PayPal, Stripe, or Braintree: Which payment method is best for your mobile application?

Whether you are developing a food delivery app, taxi booking application, e-commerce mobile application or any other on-demand service application, you have to accept the digital payments for your goods & services. That is, you have to implement an electronic payment gateway which can provide a smooth customer experience. As the world is moving mobile, the customer are now preferring to do shopping on their smartphones.

It has been expected that by 2021, 54% of all e-commerce activities would be done via smartphones. Thus, it is essential to have a payment gateway which is highly secure, reliable, and comes with easy payment options. In this article, we are going to focus on the major payment providers, PayPal, Stripe, and Braintree, and will help you in making the right choice.

What is a Payment Gateway?

A payment gateway is essential for integrating payments through debit or credit card into mobile applications. It is the best practice for managing online payments. It is responsible for securely collecting the customer’s information through the payments page at the frontend of the application and then transmitting it to the related bank or payment processor for completing transactions.

What to consider while choosing a payment gateway?

There are certain factors that you need to consider while choosing a payment gateway for your mobile application:

Type of Merchant Account:

There are two types of merchant accounts: dedicated and aggregated.

Dedicated Merchant Account: In the dedicated merchant account, there is a personal account set up for maintaining the business transactions. All the funds went directly to the business bank account. There is a separate fee for each account. You should have a complete check of credit history, financial history, liabilities, etc. It is quite expensive. The transaction is fast and takes less than a day.

Aggregated Merchant Account: As the name signifies, it is a joint account which is used by many merchants. Its cost is quite less vis-à-vis dedicated merchant accounts. The funds firstly went to the aggregator and then checked. If there is no suspicious activity, then the money gets deposited to the bank account. The fee is the same for all merchants and is fixed at the provider level. It is also easy to set up and requires little verification information. The transaction can take 2-3 days.

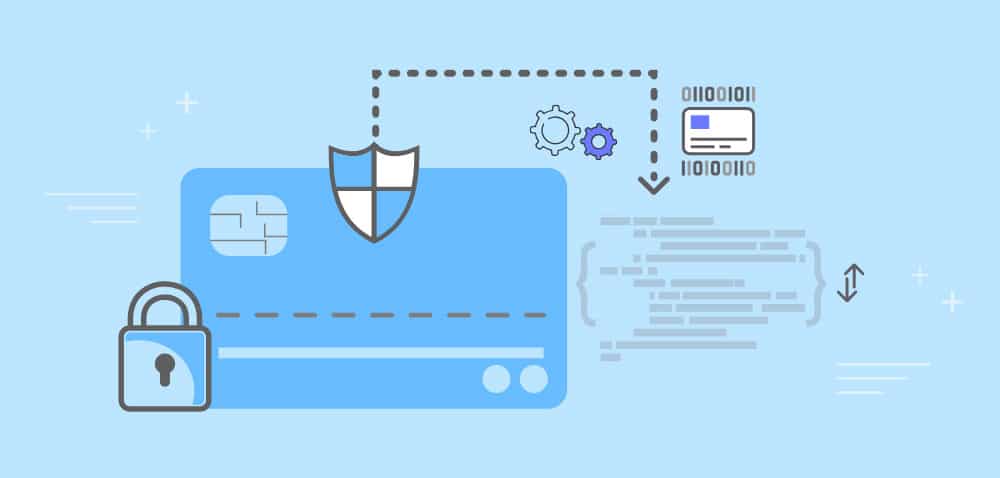

Security:

In the payments transactional activities, the customer seeks for utmost security. It involves the safety of financial information of the customers, their debit card & credit card information including numbers, name, CVV, expiration dates. All the mechanisms should be encrypted and fraud protection mechanisms should be integrated. A secure & reliable payment gateway must comply with PCI DSS.

Pricing:

After security, money also plays a significant role while choosing a payment gateway to integrate. The payment gateway companies charge a monthly fee along with the per-transaction fees. The cost depends on the features, user experiences, geographic coverage, and more. The payment methods also charge for refunds and chargeback in case of disputes.

User Experience:

User experience during payment is highly important for conversions. There are high chances that if the payment method is cumbersome on a mobile app, the customers will abandon their carts. In fact, in 2017 a “too long and complicated process” was among the top three reasons for cart abandonment. Hence, you must include payment methods which are user-friendly. It should include all the trending payment methods which are getting used by customers such as debit cards, credit cards, Amazon Pay, UPI, (in India), other local payment methods etc.

Paypal vs. Stripe vs. Braintree:

These three payment methods are amongst the most integrated payment methods in e-commerce applications, with Paypal most. Using these payment methods you would be able to receive payments through Visa, Mastercard, American Express, JCB, along with local services like Apple Pay, Google Pay. While these payment methods have many familiarities but also have certain differences too. We will discuss both.

Paypal:

Beginning with the world’s most recognizable payment system, Paypal was once a subsidiary of eBay. After 20 years of its foundation, this payment gateway has been used by 227 million accounts and completed 7.6 billion transactions. It has gained the trust of 17 million merchants with clients like eBay, Walmart, Netflix, and Best Buy.

If you are a startup or a small vendor then this payment method must be the first choice for you as it takes from all merchants into a single aggregate account. You can get the approval process in Paypal within 3-5 days. It gets integrated into almost any platform. It supports 24 currencies and has 200+ merchant locations. You can also terminate using it anytime without any charge. Its payout is in 1-4 days however, if you require instant transfer you can get it for $0.25.

There are 3 different plans in Paypal:

Payments Standard: It is the basic gateway which you can easily set up within just 15 minutes. The gateway redirects buyers to PayPal’s website freeing you from the majority of PCI DSS requirements. However, this might cost you some conversions due to the interrupted flow.

Express Checkout: If you are already accepting online payments and looking for other options then this can be a prominent choice. There would be a secure window overlaying your site on which the customers can enter their card details. After the complete transaction, the gateway redirects the users to your app. PCI requirements and fees are similar to PayPal Standard.

Payments Pro: Unlike other methods, this plan will stick your customers to your site. It is a quite smooth and customizable experience. You’ll have to handle PCI compliance yourself but transparent redirection makes the task a bit easier.

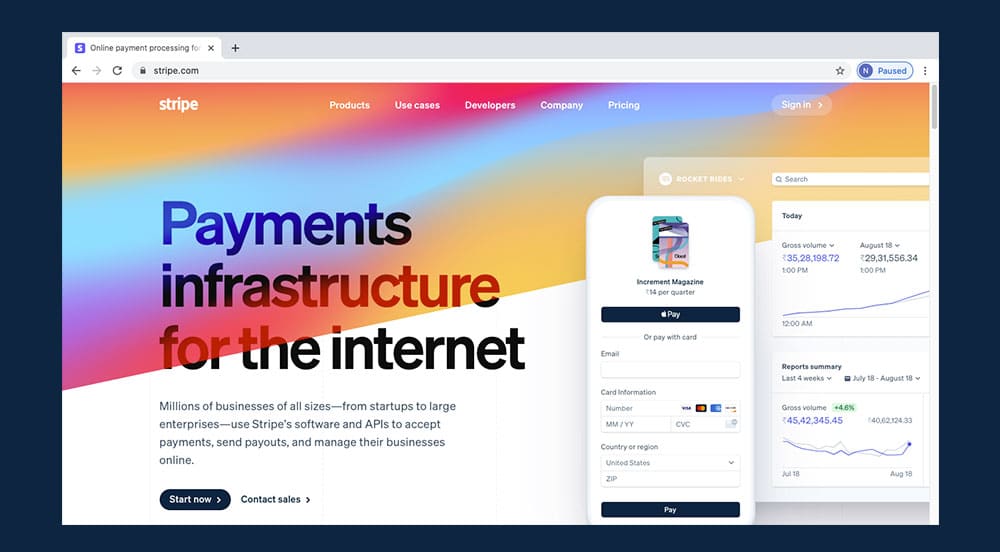

Stripe:

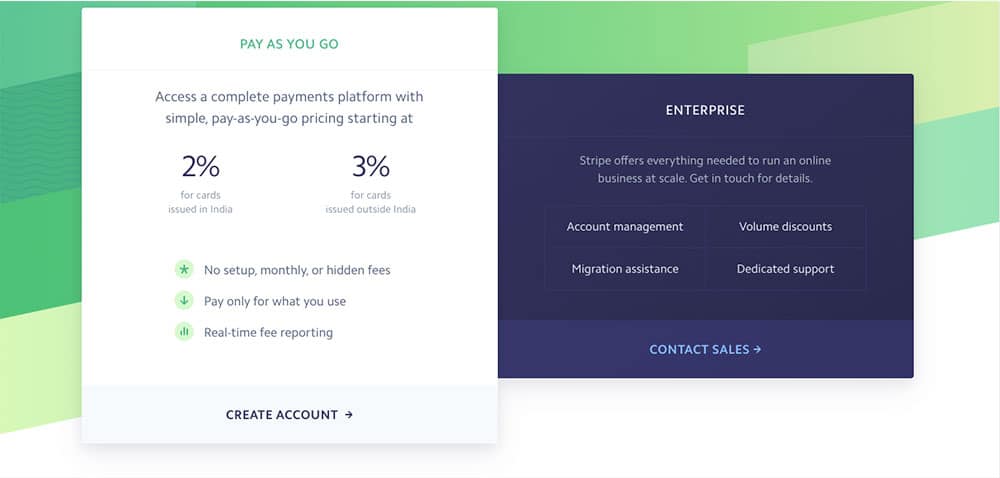

Stripe was the first payment gateway with well-designed APIs. It is one of the most trusted payment platforms with a valuation of more than $9 billion. In 2015, 27% of the Americans used it for a transaction. Some of its major clients are Pinterest, Target, Blue Apron, WARBY PARKER, etc. It can integrate with many platforms including Magento, Shopify, WooCommerce, BigCommerce, etc. It supports 135+ currencies and has 25 merchant locations. Stripe accepts a wide range of payments including most of the US debit & credit cards, American Express, Visa, Mastercard, and also China’s Alipay. Alike, Paypal, you can also stop using Stripe whenever you wish with no charge. Its payout time varies like 2 days for US & Australia, 4 for New Zealand. However, for an instant deposit, there is a 1% fee.

Braintree:

Founded in 2007, Braintree was highly focused to bring an outstanding customer experience for the payment industry. Paypal bought the Braintree for $800 million in 2013. Since then, it has become an important major player in the market. However, it is for dedicated merchant accounts. It comes with a similar UI as of PayPal. Some of its major clients are Uber, Airbnb, Marketplacer, Casper etc. It supports 130 currencies and 45+ merchant locations. It accepts all major credit cards including PayPal. The payout time is 2-5 days with international merchants having different policies.

Now that we have read about all three payment methods, you can easily compare them through this table…

| Payment Platform | Stripe | Braintree | Paypal |

| Monthly Fees | No | No | $30 per month (Payments Pro Plan) |

| Transaction Fees | $0.30 + 2.9% | 0.30 + 2.9% | $0.30 + 2.9% |

| Currency Conversion | 2% | 1% | 1-4% |

| Chargeback fees | $15 | $15 | $20 |

| Payment methods | Visa, MasterCard, AMEX, etc. | MasterCard, Visa, AMEX, etc. | MasterCard, Visa, AMEX, etc. |

| Availability | 25 countries | 46 countries | 200+ countries |

| Refund Policy | Transaction fees returns for issued refund | Transaction fees returns for issued refund | Partial transaction fees for issued refund |

| Payout Time | 7 days | 2-5 days | 1-4 days |

| Offers | Discounts for mass volume clients | No fees for less than $50,000 | Discounts for mass volume clients |

Read more: How to make money even through Free Apps?

Wrapping Up

Well, there is no clear cut answer that which payment method would be best to integrate while your next mobile application development. You can choose as per the fees structure, location, volume and other metrics. At Amplework, we are having expertise in integrating payment methods in your mobile application with an enhancing customer experience.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228