How AI Empowers the FinTech Industry?

As far as the “fintech industry” is concerned we can see the rise of automation technology to empower the operations of fintech apps. Now, fintech mobile app development companies adopt automation tools to streamline end-to-end effective financial operations.

According to the report published by Brainy Insights, it can be analyzed that the global fintech market size is expected to stand at $936.51 billion by the year 2030. As per this report, the global fintech market was valued at $ 115.34 billion by the year 2021.

There are other studies as well which showcase the growth of associated elements with the Fintech industry growth. According to Statista, the transaction value in fintech can be segmented into 3 diverse categories – such as: digital capital ratio, digital payments and neobanking.

By analyzing the above transaction value a question can arise in your mind what will be the average transaction value recorded per user? The higher transaction per value by users results in generating more sales opportunities. So, research by Statista showcased that neobanking can incorporate higher average transaction value per user.

As of now, by reading these forecasted data you also want to turn your fintech idea into reality by incorporating the optimum use of artificial intelligence and machine learning. In this blog, there will be a discussion about fintech mobile app development and the use of AI in operations. If you want to know about the best chatbot frameworks then you can read our blog on the best chatbot development frameworks.

Overview of AI in Fintech Development

AI is transforming all industries with its advanced capabilities and the function of automation. Fintech institutions incorporate the use of AI and ML to help businesses to gather multiple facets of data. To get a better understanding, let’s review the example below mention example.

For example: traditionally, the process of doing “know-your-customer (KYC)” was complex and it took hours to handle the process. Without any doubt, the traditional KYC process was time-consuming and costly because banks or financial institutions need to verify data before onboarding any new customer. After the use of AI, now companies can minimize human intervention in KYC end-to-end process. It even brings down the rate of error and simultaneously enhances the level of efficiency.

At Amplework, with the fintech app development services, we also offer AI bot development services to support business operations. So, if you are interested in developing advanced AI bots to automate your business then you can connect with us for affordable AI bot development services.

What are the Advantages of AI in Fintech Development?

The foremost benefit of AI is to empower customer services because financial institutes often look for various business activities through which they can increase customer services. In such cases, AI is a great choice for companies to increase their customer retention rate.

If you’re also looking for reliable AI solutions and mobile app development services then you need a partner like Amplework. Apart from this, to know about the advantages of AI in Fintech app development are endless but we have figured out a few advantages for your understanding:

1. Increased Business Efficiency

Without any doubt, the use of AI in operations will increase business efficiency by multiple folds. For example: if any bank required 100+ employees in one branch to complete the work of 4K hours in a 5-working day then with AI the bank can deliver the same amount of output in 2.5 days.

2. Data Analysis & Personalization

Now, the trend for delivering personalized solutions is on the rise because it helps in targeting customers with their specific needs. Although, fintech companies can also use personalization functions by advanced algorithms to offer personalized financial solutions to customers.

3. Early Fraud Detection

The rise of digitalization also gives rise to fraudulent-related activities. The ultimate use of artificial intelligence and machine learning will be going to support fintech operations with early fraud detection measures.

4. Understanding of User Pattern:

Understanding user behavior is critical because it helps in understanding which kind of tech products will be more suitable for the customers. In such cases, AI is the best option to monitor their past purchasing history or past activities to figure out their pattern.

Must-Have & AI-Enabled Features for Fintech Applications to Generate More Sales

| Must-Have Features | Advanced AI Features |

| Account Management | Smart Recommendations |

| Payments and Transfers | Intelligent Virtual Assistant |

| Budgeting and Expense Tracking | Fraud Detection System |

| Investment and Wealth Management | Risk Assessment Engine |

| Financial Goal Planning | Natural Language Processing (NLP) |

| Credit and Loan Management | Voice Recognition and Command |

| Alerts and Notifications | Sentiment Analysis Module |

| Security and Fraud Prevention | Robo-Advisor Functionality |

| Personalized Financial Insights | Predictive Analytics and Insights |

| Customer Support and Chatbot Assistance | Advanced Security and Authentication |

To make your fintech app more competitive, you should definitely make efforts into figuring out innovative features which can solve customer issues. When your fintech application incorporates unique and advanced features then it automatically helps to gather competitive advantages.

Here, a question can arise in your mind: what will be the cost of adding innovative features to an application? The answer is that each feature requires a different set of coding, API integration and functionality. So, the exact cost of adding a specific feature can only be stated after knowing which feature you want to integrate.

However, to provide you with an understanding of the cost of adding AI-enabled features we’re presenting a tabular presentation for you:

| Advanced AI Feature | Average Cost Estimate (USD) |

| Smart Recommendations | $10,000 – $30,000 |

| Intelligent Virtual Assistant | $20,000 – $50,000 |

| Fraud Detection System | $30,000 – $60,000 |

| Risk Assessment Engine | $25,000 – $50,000 |

| Natural Language Processing (NLP) | $15,000 – $40,000 |

| Voice Recognition and Command | $10,000 – $30,000 |

| Sentiment Analysis Module | $10,000 – $25,000 |

| Robo-Advisor Functionality | $20,000 – $50,000 |

| Predictive Analytics and Insights | $25,000 – $60,000 |

| Advanced Security and Authentication | $15,000 – $40,000 |

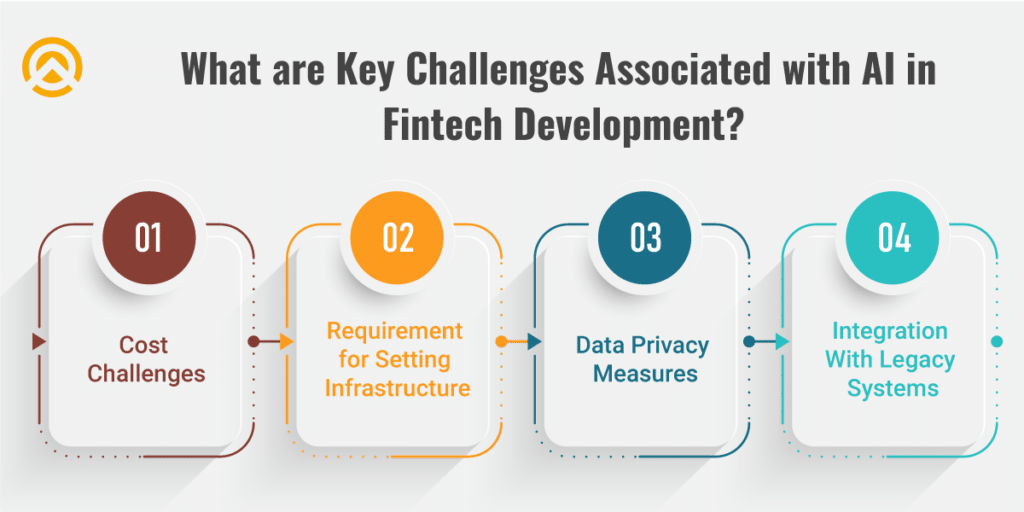

What are Key Challenges Associated with AI in Fintech Development?

1. Cost Challenges

The development of AI into fintech requires a lot of cost for handling operations. If you choose to build your own in-house team then it will enhance the cost. As a cost-effective measure, you should choose remote services for an affordable solution.

2. Requirement for Setting Infrastructure

For the development of AI, you need smart labs + profound IT infrastructure to handle operations. So, if you’re not willing to set up any kind of infrastructure for AI development then you should choose to go with remote services. There are many IT companies that offer 30 mins free consultations to clients.

3. Data Privacy Measures

AI in fintech is all about managing data and validating them. So, the rise of digitalization also raises the probability of fraudulent activities. In such a case, it can raise concerns for data privacy measures. Thus, your business needs to implement profound data protection and firewalls to completely restrict any kind of unauthorized user entry.

4. Integration With Legacy Systems

In fintech operations, AI is a new concept and as-of-now we cannot completely outperform traditional practices of handling fintech operations. So, in such cases, it can arise a challenge to integrate AI with traditional systems to handle operations.

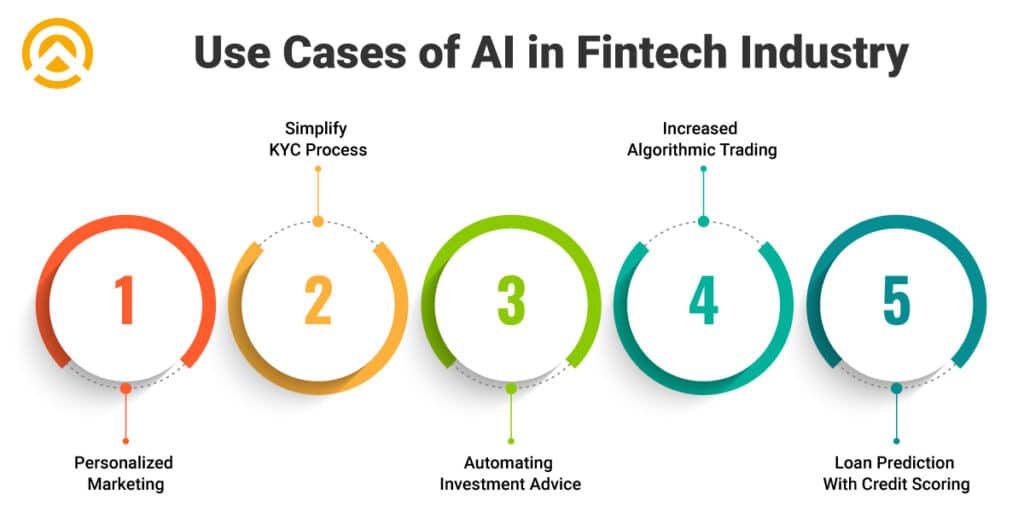

Use Cases of AI in Fintech Industry

1. Personalized Marketing

Fintech institutions are experiencing 3x & 5x revenue growth by offering personalized marketing to their companies. Although, the companies are required to make sure that their operations are

2. Simplify KYC Process

The use of AI in Fintech can result in simplifying the KYC process. As, instead of manual uploading of documents by the bank employees. The customers can directly upload the documents through the portal.

3. Automating Investment Advice

In reality, not all people are financially literate and many people make basic financial mistakes that cost them a loss of thousands of dollars. In such a case, the use of AI can help them with automated investment advice. Although, if you have an idea then you can make use of MVP Development services.

4. Increased Algorithmic Trading

According to Coherent Market Insights, the global algorithmic trading market was valued at $10,346.6 million in 2018. Although, it is expected that this market will reach $25,257 million by the year 2027.

5. Loan Prediction With Credit Scoring

By simplifying the loan approval process, financial app development enterprises may reduce worker labor, increase approval speed, and boost accuracy. For instance, AI in Fintech can evaluate borrowers’ risk of loan default by examining their employment history, economic status, and other information. As a result, there can be a reduced likelihood of losses and fintech application development companies can aid in improving the decision-making process of loans.

How Financial Institutions Can Transform Customer Interaction with AI?

1. Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants can handle customer inquiries and provide personalized assistance 24/7. These intelligent bots can understand natural language and context, allowing customers to ask questions, get account information, receive product recommendations, and even initiate transactions through conversational interfaces.

2. Natural Language Processing (NLP) for Document Processing

Financial institutions handle numerous documents, such as loan applications, insurance claims, and account statements. AI-powered NLP systems can automatically extract relevant information, classify documents, and streamline document processing workflows, reducing manual effort and improving efficiency.

3. Voice and Speech Recognition

Voice recognition technology allows customers to interact with their financial institutions using voice commands. This includes tasks like account inquiries, fund transfers, and bill payments. Speech recognition can also be used for call center interactions, enabling automated call routing and analysis for improved customer service.

4. Sentiment Analysis

AI can analyze customer feedback, social media posts, and other textual data to understand customer sentiment and identify areas for improvement. This helps financial institutions address customer concerns, enhance their products and services, and deliver a better customer experience.

5. Robo-Advisors

AI-powered robo-advisors can provide automated investment advice based on customer goals, risk tolerance, and market conditions. These digital advisors can optimize investment portfolios, rebalance assets, and provide ongoing monitoring and recommendations, making investing more accessible and affordable for customers.

Overall, by leveraging AI technologies, financial institutions can enhance customer interaction by providing personalized, efficient, and convenient services while ensuring security and compliance.

Almost all people who are connected to the tech universe are aware of revolutionary AI tools known as Chat GPT. This tool “Chat GPT” is a part of Artificial Intelligence & Machine Learning (ML). According to industry experts, AI technology will be impacted by industries in diverse measures.

The Final Words

Amplework is known as the most affordable fintech app development company in the market. We’re known for delivering various business operations with tech-driven solutions through our result-oriented services related to full-stack Development, MVP Development, App Maintenance & many more.

So, if you’re looking for a reliable and affordable partner for transforming your fintech app idea into reality then you should take our 30 mins free consultation. Our prowess developers will be going to present a key business solution to elevate your probability of success in the market.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228