Navigating Security Risks in Mobile Banking Apps

You feel good when everything you project gets completed with different technical advancements. But have you ever thought that these advancements can equally damage your confidential data. Similarly, cybersecurity is treated as one of the major challenges in the growth of mobile banking app development. There are many innovative solutions when it comes to personal finance management. In the current times, mobile banking apps are emerging as the most valuable internal asset for consumers. This technique offers several advantages like speedy transactions and an accessible and convenient banking process. This increase of fintech mobile app use denotes that we must take care of security awareness and proactive security measures. The research data by the Cyber Threat Intelligence Report highlights the same aspects.

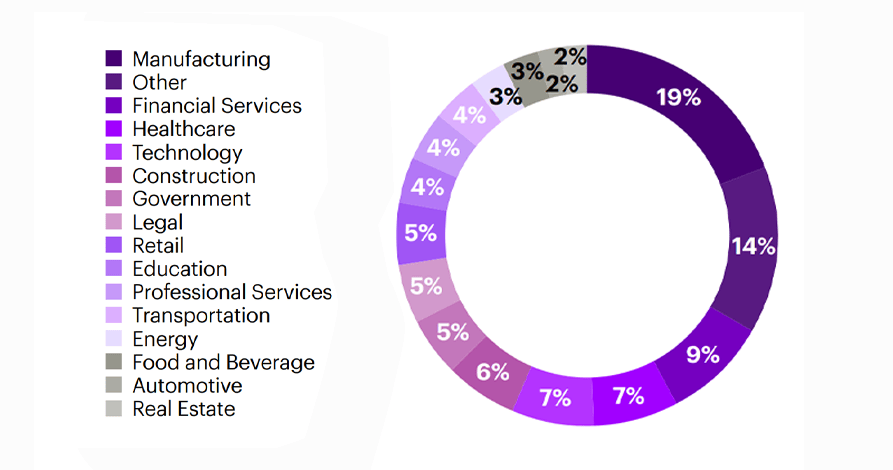

According to the above figure, 45% of economic contributors were affected by ransomware and extortion threats in 2021. In which majorly the industrial sectors like manufacturing, financial services, healthcare, and technical became the most targeted industries for the same. This indicated that the financial sector needs to take care of the mobile application development privacy sector. From these cyber threats, any organization or individual can face different losses. These are financial losses, loss of confidential information or data, loss of user trust, reduction in the market image of any organization, productivity losses, data breaches, and potential legal fines or lawsuits.

Blog Highlights

This blog will present helpful data in a meaningful way. From reading this, one can understand the severity of cybersecurity threats within the mobile banking sector. The major highlights of this are the major mobile banking app security issues and remedies to prevent such issues from being in the field of the financial sector. Give this a quick read to acquire knowledge before opting for fintech mobile app development practice.

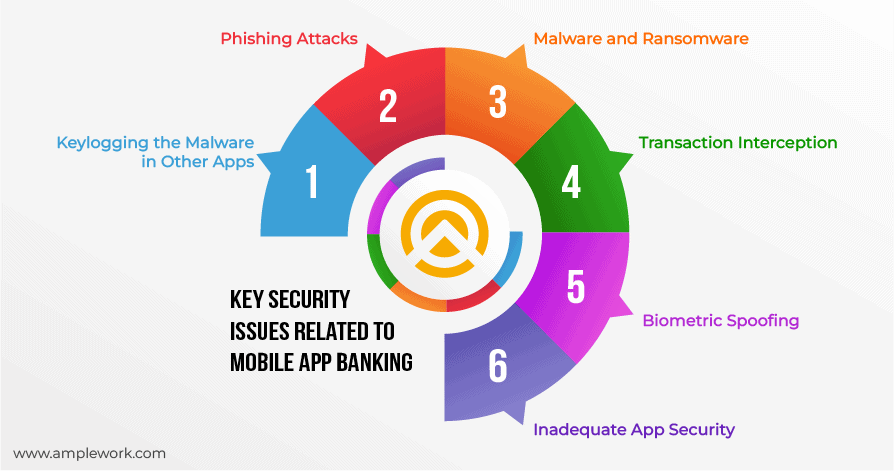

Key Security Issues Related to Mobile App Banking

1. Keylogging the Malware in Other Apps

One additional worry identified by cybersecurity experts involves the emergence of “keylogging.” This refers to malicious software concealed within ostensibly benign applications. This malware can record keystrokes as users input their login details on mobile banking apps, subsequently transmitting this sensitive information to the malicious actor. Furthermore, such malware may facilitate “overlaying” attacks, where it superimposes extra fields onto the authentic login page, tricking users into entering their username, password, or other confidential data. If users unknowingly input their credentials into these deceptive fields, the attacker can effortlessly steal their data.

2. Phishing Attacks

One significant security risks in mobile banking app issues is the prevalence of phishing attacks. In these instances, malicious entities employ deceptive tactics to trick users into divulging sensitive information, such as login credentials. If successful, these attacks can lead to unauthorized access to accounts, potentially resulting in financial losses and the compromise of personal information. To mitigate this risk, it is crucial to educate users on recognizing phishing attempts and to implement secure communication channels within the mobile app to ensure the confidentiality of sensitive data.

3. Malware and Ransomware

Mobile devices are susceptible to malware and ransomware attacks, posing a substantial security risk in mobile banking apps. Malicious software can compromise the integrity of the app, leading to unauthorized access, data theft, and even financial extortion through ransomware. To address this risk, users should be encouraged to install reputable antivirus and anti-malware software on their devices. Additionally, mobile app developers must regularly update and patch the business banking mobile app to proactively address security vulnerabilities and protect against evolving cyber threats.

4. Transaction Interception

The risk of Man-in-the-Middle (MitM) attacks presents a serious threat to mobile banking app security. In MitM attacks, adversaries intercept and manipulate transactions between the mobile app and the banking server. This can result in unauthorized access to sensitive transaction data, potentially leading to financial fraud. To mitigate this security risks in mobile banking, it is crucial to implement robust encryption protocols, such as Transport Layer Security (TLS), to secure data in transit. Regularly updating security measures is essential to counteract evolving attack methods and maintain the confidentiality of financial transactions.

5. Biometric Spoofing

Biometric authentication methods, such as fingerprints or facial recognition, introduce the risk of spoofing. In these cases, attackers may attempt to deceive the system by using fake biometric data. If successful, this could lead to unauthorized access to the mobile banking app. To address this security risks in mobile banking, it is imperative to enhance biometric security with additional authentication layers. Regularly updating biometric templates and algorithms is essential to stay ahead of potential spoofing techniques and ensure the effectiveness of biometric authentication methods.

6. Inadequate App Security

Weaknesses in the security infrastructure of the fintech app development process itself pose a considerable security risk in mobile banking. If exploited, these vulnerabilities can lead to unauthorized access, data breaches, and potential manipulation of financial transactions. To mitigate this risk, regular security audits, penetration testing, and the implementation of secure coding practices are essential. These measures help fortify the mobile banking app against potential threats, ensuring the overall security and trustworthiness of the application.

Read more: The Visual Edge: Data Visualization’s Impact on Financial Technologies

Preventive Measures of Security Risks in Mobile Banking

Adapting KYC & KYB Principles

Engaging in practices such as Know Your Customers (KYC) and Know Your Business (KYB) plays a crucial role in securing diverse financial transactions by validating counterparties’ details. Essentially, both these methodologies form a system incorporating a series of third-party services to precisely analyze user data. This systematic approach empowers financial organizations to execute secure transactions involving private or business funds. As a result, early detection of security risks in mobile banking issues and fraud occurs, preventing substantial losses for both the bank and the consumer. Implementing these practices is facilitated by integrating risk management engines into digital banking software or applications.

Secure Distribution and Secure Enrollment

Securing the development of applications designed for banking operations is essential to ensure an authentic process. Directing customer activities through this secure channel contributes to minimizing security risks in mobile banking. The recommended approach involves prominently featuring the application links on app stores and official websites. This measure is effective in safeguarding banking customers from potential exposure to fraudulent websites. Additionally, implementing continuous checks on the application’s integrity from the bank’s backend, coupled with monitoring the health of devices, adds an extra layer of security.

Forming Department for Fraud Prevention

Given the research data highlighted in the opening section of this blog, it becomes evident that the significance of banking fraud detection matches the anticipated growth in mobile banking services. Establishing a dedicated fraud detection department can bring about numerous secure enhancements, reassuring customers of the safety of their financial transactions. These specialized departments possess the capability to identify fraud by employing methods such as distinguishing various IP addresses over a specific time frame and taking necessary actions against suspicious activities. To meet their objectives, these departments may need to utilize specific tools designed to effectively detect and address fraudulent activities.

Authentication with Security Measures

The process commences by initiating user authentication, incorporating advanced multi-factor authentication techniques, including biometric protection, certificate pinning, and the use of secrets. Following this step, the protocols for achieving banking-grade security and protection against tampering come into play. These practices involve backend procedures specifically crafted to generate, host, and oversee certificates, preventing unauthorized access by third parties. It’s essential for the mobile application development environment to inherently possess crypto-agility as a default condition to seamlessly accommodate these security measures.

Technique of Secure Data Encryption and Data Storage System

The creation of mobile applications necessitates the fulfillment of specific conditions to result in an application tailored to meet desired requirements. Accomplishing this goal is a task well-suited for an experienced fintech app development company. To enhance the security of these banking applications, organizations opt for the incorporation of industry-proven and government-approved cryptographic algorithms, modes, and libraries. Fintech app developers are required to adhere to these prescribed practices, focusing on ensuring secure cipher code configurations and the establishment of a secure setup for block modes. Additionally, developers can enhance security by encrypting private data with a managed key during transfer and in a resting state, thereby ensuring data integrity and confidentiality.

Mobile Application Design Aided Security

Ensuring a secure banking transaction is contingent upon the design techniques employed in the mobile app. Designing mobile applications requires a systematic integration of security measures throughout the iterative process. Within this design framework, mobile banking or fintech app developers often embrace three significant approaches. The initial approach, known as application hardening, focuses on safeguarding the application against reverse engineering. This involves employing various techniques such as native code obfuscation, anti-debug measures, data obfuscation, root and jailbreak detection, emulator detection, and anti-temper strategies. The second approach for effective mobile app design is referred to as active mechanisms for application self-defense.

These security mechanisms are designed to make the mobile app adaptable to diverse cyber attacks in a layered manner. Practices under this approach include Runtime Application Self Protection (RASP), device fingerprinting, public key infrastructure (PKI), and auto-update functionalities. The third approach to secure app design is centered on secure storage and execution, working to fortify the storage and execution of banking operations through protective practices. These practices encompass Key Encryption Keys (KEKs), obfuscation, hardware security modules, smart cards with EMV chips, trusted platform modules, trusted execution environments, user input/authentication, secure enclave, and keyStore implementations.

Communication with Enhanced Security

Ensuring secure communication is integral to achieving a safe FinTech mobile app development transaction. The communication process between the application and the backend server must be safeguarded as a fundamental requirement. During data transmission, the server must guarantee exclusive communication with the intended system. This involves implementing various mechanisms, including protection for access tokens and cookies, encrypted transport protection, and HTTPS tunneling. Additionally, supplementary mechanisms are necessary to authenticate both the mobile device and the backend system to enhance overall communication security.

Also Read: Cyber Threats in 2024: Latest Statistics and Best Practices for Businesses

Conclusive Outlines

In the realm of mobile banking applications, ensuring the security of your hard-earned money is of utmost importance. Robust protection for your financial data is a necessity when engaging with these apps, which are designed to cater to a wide range of banking needs. The growing demand for secure financial transactions has prompted forward-thinking developers and financial institutions to prioritize the protection of your financial assets. While facing initial challenges in this field, many have successfully positioned themselves as pioneers in developing secure mobile banking apps. In today’s dynamic financial landscape, the widespread adoption of intelligent digital solutions has become more accessible, empowering both consumers and financial institutions to seamlessly adapt to the evolving demands of modern banking while guaranteeing the safety of financial transactions.

Amplework, a leading app development entity with over 5+ years of immersive experience, understands the critical significance of security risks in mobile banking apps. Our dedicated team consistently surpasses client expectations, earning a reputation for reliability and trustworthiness. We have achieved noteworthy milestones by supporting various organizations, all while adhering to the highest security standards. Explore our website to uncover the exceptional mobile banking app development services we offer. Choose to partner with Amplework for a transformative journey towards ensuring the robust security of your financial assets in the world of mobile banking apps.

Also Read:- Security Risks in Online Payment Systems

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228