Developing a Next-Gen Digital Banking App: Key Insights and Strategies

As per a particular analysis by most of the research studies it’s been derived that, in the past few years we have witnessed a growth in the number of digital banking apps. Offering a hassle-free banking process to the users. We all remember the traditional banking systems. Where everyone needs to stand in longer queues and wait for their number, withdrawing or depositing the cash to and from their respective bank accounts. banking app development has made it much easier, more secure, and efficient for users. With just simple taps they can perform every banking transaction through such apps. That’s the reason why the improvisations and introduction of the latest technological advancements are continuously happening for the same.

These constant evolutions led to drastic changes in the mobile baking sector. Enhancing its operationalities and making it much easier for the users. Also with the technological evolution the cost to create a full-fledged and feature-oriented banking mobile app has already been reduced. As it doesn’t require as much human effort as in earlier times. With the help of artificial intelligence, most of the app development processes are automated. Not only AI is impacting the digital banking sector but also technologies like blockchain and IoT, are transforming the digital banking industry. This evolution also led the fintech mobile app development companies to deliver high-performance and robust fintech solutions to users at economical price ranges.

Blog Motive

With this blog, we will be deep-diving into the concept of cost, discovering how much amount a fintech business has to incur for the creation of best-in-class mobile applications. Including the features and functionalities like security features, integration of financial tools, and compliance according to the banking regulations.

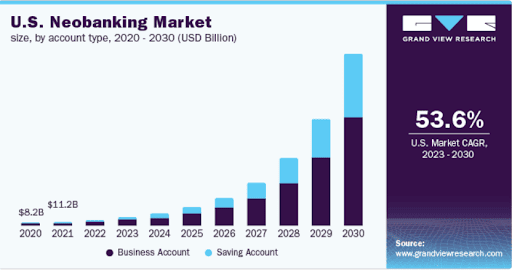

Brief Statistical Understanding of Banking Data

It is considering a research study that is geared towards the indication of the US’s market for net banking. This research report has been generated by a top research and development company that is “Grand View Research”. This research indicates that the global market use of net banking apps was valued at $66.82 billion in the year 2022 and is expected to grow with an annual growth rate of around 54.8% from the current year 2023 to 2030. That’s how it is proven that in the upcoming era, we will be witnessing huge growth in the fintech app development sector.

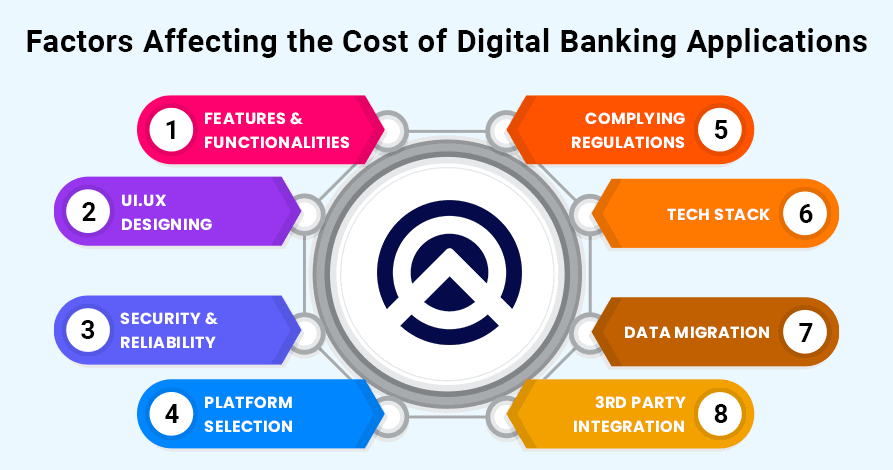

Factors Affecting the Cost of Digital Banking App Development

The finance incurred by the fintech businesses in crafting digital banking applications can be influenced by a wide range of factors. Out of such factors here we are addressing some of the key essentials that are affecting the cost. Understanding these factors can help you understand the concept of budgeting and resource allocation according to the app development requirements.

1. Features & Functionalities

The major factor that influences the cost of developing a banking app is the user’s requirements for features and functionalities. The pricing always depends on how complex are the features that you need to equip your app with. Considering the basic banking operations to advanced transaction management and budgeting tools. With these factors, you can get a rough idea of the cost of building a digital banking app.

2. UI/UX Designing

The next major factor on which the cost is levied is the design of the user interface. If you need a digital fintech app with a simple and basic design then, it will cost you slightly lower. However, if you need an advanced design for user interaction then the cost for the same will be a bit higher. Since designing is the main element of the fintech app development process.

3. Security & Reliability

The next factor on which cost is dependent is security. The digital banking app requires security to let its users transact without any fear of cyber threats. Implementing multi-layered security mechanisms can cost you more money., crafting a mobile app with a single-layered security structure can let you incur a lesser amount. When it comes to digital banking apps security is one such feature that can’t be compromised.

4. Platform Selection

The platform you select for the development of the backend, frontend, and database is also the major factor influencing the cost. When you are choosing open-source mobile app development platforms the cost to create a digital banking platform will be a bit lower than that of the paid platforms.

5. Complying Regulations

Processing a banking app development with all the financial rules and regulations can be a bit costlier for you. As it requires a complete understandability of the same. The cost may include legal consultations, documentation, and feature implementation, according to the actual regulatory requirements of the finance sector, enhancing the app’s reliability.

6. Tech Stack

Selecting the advanced tech stack that includes a high-end understanding of coding and frameworks affects the costs. Since some of the technologies require higher fee incursions for licensing, they also require specialized knowledge involving human resources making the mobile banking app a bit costlier than usual. Whereas some technologies are lower on their licensing fee influences limited costs.

7. Data Migration

Whenever you need to migrate the data from your current digital banking app which is a must. Integrating such a wide range of user data requires a lot of effort. That’s the reason why this factor can be the key reason, influencing the overall cost of digital banking mobile application development. Migrating data from your existing app can sometimes become a challenge for fintech app developers with higher chances of data deletion. For which they have to take several backups for the same data files. This consumes a lot of time and effort.

8. 3rd Party Integration

Integrating the legacy system and 3rd party APIs during banking app development leads to enhancing the performance and reliability of the application. Integrating your digital banking app can also attract higher costs, depending on the level of 3rd party APIs or whether you need to integrate the payment gateway or technological integration like AI and machine learning or IoT.

Related Blog: Leveraging Full-Stack Development for Creating Personal Finance Apps

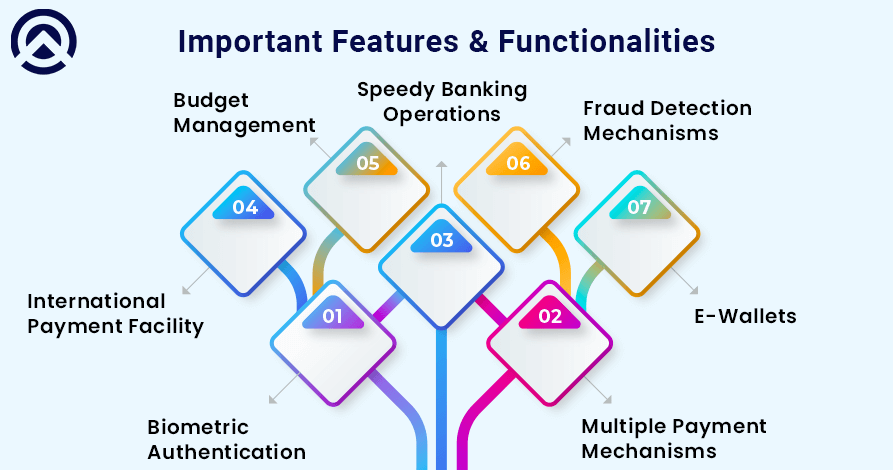

Here’s Some Features and Functionalities that a Digital Banking App Must Have

The digital banking apps developed by mobile app development companies these days are like the mines of features and functionalities. However, here we will be going to discuss the list of necessary features that a digital banking app must comprise.

1. Biometric authentication

It is a security mechanism that offers great benefits to banking apps. Biometric authentication is one of the key security measures that a digital banking mobile app must have. These authentication mechanisms are used to ensure that the account holders or owners can have access to their accounts. It leads to the avoidance of unauthorized access to the mobile app and enhances the account’s security. There is a wide range of authentications like fingerprint, facial, and voice recognition. Also, you can set PIN authentication for the same.

2. Multiple Payment Mechanisms

The digital banking app must be equipped with multiple payment mechanisms like P2P, ACH, and A2A payments. Offering the users a choice of payment mechanism according to their needs and requirements. These payment mechanisms allow the clients to send and receive the payments according to their transactional requirements. These transactional mechanisms also allow them to perform speedy payment transactions with complete security and reliability.

3. Speedy Banking Operations

The Android banking app development might comprise delivering robust digital banking applications to the users. Allowing them to transact easily and speedily without getting stuck with the process. The financial mobile apps consist of a wider set of banking operations starting from account opening to budget planning and transaction management. So it must deliver the users with a swift transactional experience.

4. International Payment Facility

Remember the time when you were used to standing in longer queues for cross-border transactions? In the current scenario, the game has changed with the evolution of digital banking apps. An international payment facility is a must that every fintech app should have. It can be the time-saving and best opportunity for both the businesses and individuals, that are processing cross-border payments daily.

5. Budget Management

A highly preferred feature for users of digital banking applications is budget management. This feature offers total assistance to the account holders, providing them with a complete understanding of core financials and budget management. Providing you a complete analytics of your expenditures and savings. The main goal of this feature is to add value to the user’s transactions, encouraging them to save their money and generate higher returns.

6. Fraud Detection Mechanisms

This is a must-have feature that a banking app should be equipped with. This fraud detection and avoidance feature notifies the users of the different types of security issues like attacks, malware, and fraudulent practices detection. This helps the users to automatically detect whether the transactions they are doing are safe or not with the warning alerts.

7. E-Wallets

These are the key elements that a digital banking and finance app must comprise. Offering the feature to send or receive payments to the users is necessary these days. These e-wallets linked to your bank accounts offer a seamless and hassle-free transaction experience to the users. Allowing them to easily send or receive payments to and from multiple sources with security features.

Related Blog: Security in Mobile Banking Apps: Factors and Advantages

Cost of Developing a Banking App

While you are up to identify the actual banking app development cost. It is necessary to understand the criteria or factors that affect the cost of mobile app development. The major factor on which the cost is dependent is the complexity of the fintech apps. It depends totally on the user’s requirements. The app comprises basic complexity and will cost you approximately $35,000 to $ 50,000. As it will be consuming approximately 3-6 months.

Coming on to the moderately complex mobile app that will cost you around $ 55,000 to $80,000, depending on the features, functionalities, and tech stack that you opt for. It will consume approximately 6-7 Months depending on the needs. Finally, the one with advanced features and higher complexity will cost you approximately $ 85,000 to $2,00,000 again depending on the same criteria.

| Mobile App Type | Approximate Cost | Time Consumption |

| Basic | $35,000 – $50,000 | 3-6 Months |

| Moderate | $55,000 – $80,000 | 6-7 Months |

| Advanced | $85,000 – $2,00,000 | 8-12 Months or more |

The cost also depends on the regional area from where you are up to hire a fintech app developer. Relying on a factor that whether you have hired a full-time in-house developer for the same which will cost you more than that of outsourcing the project. When you choose the hourly developer, its prices rely on geographical differentiation. When you hire mobile app developers from the US, UK, or France they will charge you approximately $95-$100 per hour. If you hire developers from Australia, Europe, and Asian Region then it will cost you an average of $45-$60 per hour.

| Geographical Area | Per Hour Price |

| USA, UK, and France | $95 – $100 |

| Australia, Europe, and Asia | $45 – $60 |

| UAE and the Middle East | $60 – $65 |

Concluding

In this blog, we have offered you a detailed idea of how Digital banking mobile apps are affecting the lives of individuals, allowing them to perform hassle-free and secure transactions. The cost of developing digital banking mobile apps can be influenced by a wide range of factors. Understanding such factors is crucial for discovering the accurate budget and resource allocation. You should consider such factors during the planning phase of the digital banking application, helping in creating the proper budget and development timeline for the same.

Amplework Software, a well-renowned mobile app development company in USA, delivers you with a wide range of banking app development services at economical prices. We have already served a wide range of clients with their desired mobile app development services. We possess a team of experienced and skilled developers, functioning on a user-centric approach, from clearly understanding your business goals and requirements to developing and delivering best-in-class and feature-rich solutions. So if you have an idea about any sort of fintech app development then share it with us. Here we shape your innovations into real-world solutions.

Also Read:- Advanced Language Learning App

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228