Understanding the Cost of Contactless Payment System Development

The era of currency notes or physical payment methodologies is now over. As digitalization is taking over different industries. Our generation is rapidly approaching the era of cashless transactions. One such industry that has transformed through the implementation of the latest tech stacks is fintech. However, this transformation has completely reshaped the payment methodologies. But for the businesses and organizations who are planning to create their own advanced system, the question of costs arises every time. As the businesses are not aware how much does it cost to build a contactless payment system that is secure, feature-rich, and future-proof as well?

Since development costs are considered one of the biggest and most important factors, its awareness is also religiously important for saving your business’s costs. Well, the fact is that the creation of cashless payment mechanisms involves a wide range of steps. Also, these steps comprise multiple factors that affect the actual cost of development. That includes integrating contactless payment technology, like RFID, NFC, and many other forms. These technologies are integrated together to form advanced contactless payment systems.

The cost of development also relies on factors such as time consumed in development, complexity, and the size of the solution. This blog serves as your pricing decoder, that unlocks all the mysteries of an effective cost to incur for crafting your preferred contactless payment solution. In this blog, we will be delving into the various cost components, exploring crucial factors like security and integrations, and providing valuable resources to help you navigate the financial landscape. By the end of this journey, you will be equipped with the knowledge and tools to transform your vision into a thriving reality, without breaking the bank.

A Few Statistical Highlights

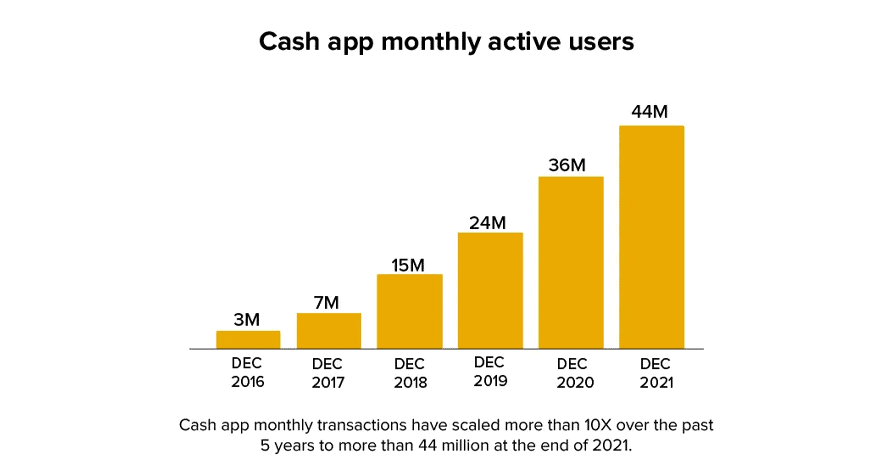

According to a detailed descriptive study conducted by a well-recognized organization that is “Business Wire”, data specifies that the value of contactless payment applications is expected to reach $10 trillion by 2027. Here are some statistical considerations of a highly used cashless transaction app that is named “cash”, through bitcoin trading the cash app has generated over $12.3 billion in revenue in the year 2021.

The cash app is at the topmost position in terms of active users as well. Whose count goes to approximately 44 million active users and the app has witnessed over 100 million downloads. Also considering the profitability ratio of the cash app which was around $ 2 billion in the year 2021. This data showcases the scope of the cashless transnational app development, especially after the rise of Covid 19 pandemic, and is still growing to the unexplored heights of the competitive edge of the fintech market.

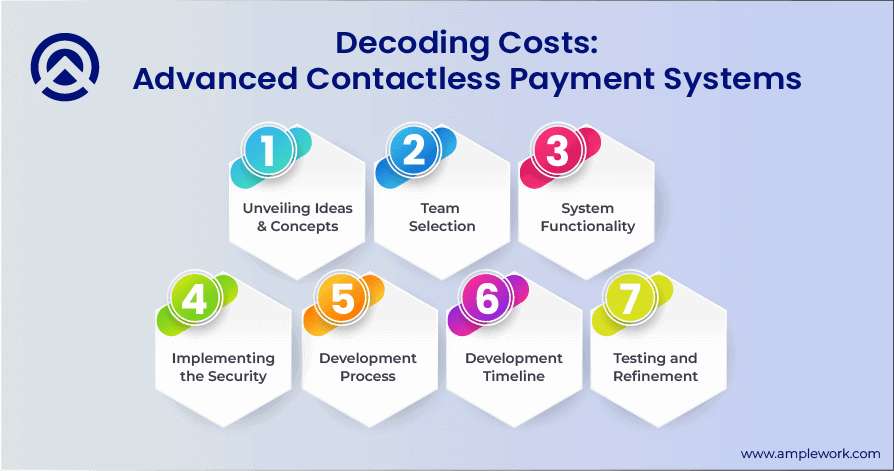

The Factors to Decode the Budgeting For Your Advanced Contactless Payment Systems

Since there’s no magic formula for identifying the budgeting for a custom payment system development it is only dependent on user-specific needs and requirements. Considering their targeted audiences and desired functionalities you need to add to it. Here’s the series of steps on how you can unlock the development cost of contactless FinTech mobile app development.

1. Unveiling Ideas & Concepts

Before you proceed further into the journey associated with cost calculations, just get a start by identifying the actual needs and requirements of your desired system. For this, you need to research both the targeted audiences and competitors in the market. After which you need to identify the best tech stack for integrating the security, robustness, and efficiency of your mobile applications. Considering all such factors you can get a brief idea about the cost.

2. Team Selection

Assembling the top-notch developers or outsourcing the project to a best-in-class mobile app development services. That comprises of developers, UI/UX designers, QA testers, and project managers. However, a major factor in their salaries and benefits for in-house recruitment options, considering their expertise and location. But when you hire any custom mobile app development services company then it can be much cheaper than that of an in-house one for you.

3. System Functionality

Adding robust functionalities to the system through Biometric authentication, multi-currency support, loyalty programs, and other advanced features that enhance the development time and cost. Also, Tailoring the system according to the industry-specific needs of your business to process custom fintech app development can require additional development effort and can raise costs.

4. Implementing the Security

Implementing the Fort Knox level security is necessary for any of the contactless payment apps. Initializing from data encryption to multi-factor authentication, security measures are always non-negotiable as it is the backbone of your business, which helps build the trust of your clients towards your brand. For the same, you need to consult with security experts to assess risks and implement appropriate solutions, that contribute to the added costs. But these costs are necessary as well. Meeting specific industry or regional regulations necessitates additional work and potentially specialized expertise which is a major factor that affects the cost to build a fintech app.

5. Development Process

Considering and finalizing the contactless payment app is also a necessary factor that attracts the cost. Implementing the agile development approach may be more flexible and iterative. Also, it can potentially affect the cost compared to the traditional waterfall development approaches. Which requires a stepwise development mechanism and is lengthier for both the developers and testers.

6. Development Timeline

According to the project’s size and complexity the longer the development time the greater the resource allocation is that increases the overall development costs. This timeline comprises the overall time to complete the project starting from designing to development, testing, and finalizing it. Also, the feedback loops sometimes can extend the timeline but can improve the user experience saving further costs.

7. Testing

Implementing comprehensive testing mechanisms to test and identify all the bugs and errors in your mobile application is necessary. Rigorous testing ensures functionality, security and compliance. Allocate ample time and resources for comprehensive testing across various scenarios, uncovering and fixing bugs before the launch of contactless payment systems.

Related Blog:- Full-Stack Development for Creating Personal Finance Apps

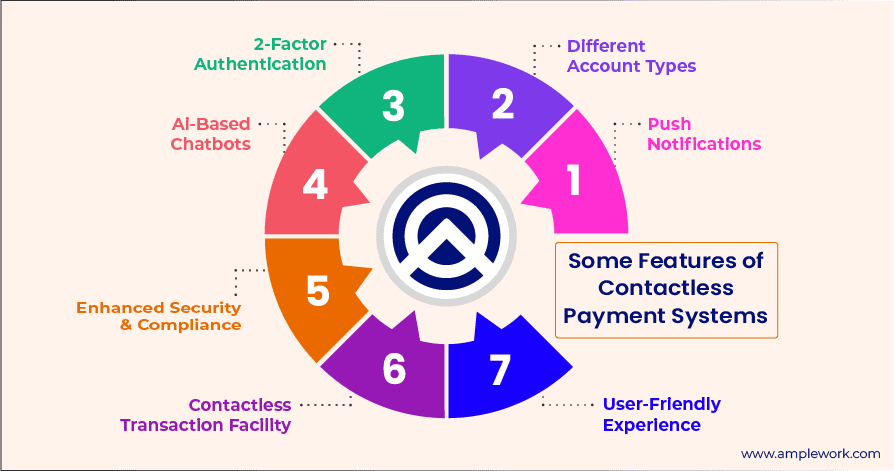

Some Advanced Features That an Advanced Contactless Payment App Must Have

We all are aware that individuals and businesses are expecting a lot from such contactless payment fintech app solutions. So, if you want to craft an advanced contactless payment mobile application then here are a set of features that this app must comprise:

1. Push Notifications

It is considered a great feature that is considered the best mechanism for keeping your targeted audiences about the latest features, special offers, and other required updates about your contactless payment fintech app solution. This functionality ensures that your users always remain engaged with your app, avoiding the risk of app switch.

2. Different Account Types

The contactless payment fintech app offers its users the feasibility of both businesses and individuals. As it is equipped with a feature for creating multiple accounts for both businesses and individuals. The separate account types can offer them the ability to transact differently be it a merchant or a payer, it comprises both ends.

3. 2-Factor Authentication

Like every fintech application, the money application must comprise security measures to protect all the transactions performed by users. Because of this, it requires the 2-factor authentication functionality that authenticates the transaction through multiple factors, initially with a login pin and after that through another validation pin for the transaction. It also comprises of features like OTPs, pattern verification, pin verification, and biometric authentication systems, depending on your requirements.

4. Ai-Based Chatbots

We all are aware that the contactless payment system must have the functionality of 24×7 assistance for all its users. To solve all the payment-related or other queries and problems of users you can integrate an AI-based chatbot into your payment solution. These automated chatbots can help users resolve all their queries, thus saving customer support expenses. It also helps businesses improve the overall user experience of their contactless payment app.

Related blog: ERP AI Chatbots: Revolutionizing Business Processes in 2024

5. Enhanced Security & Compliance

Protecting user information with industry-standard encryption protocols and also utilizing security mechanisms like facial and fingerprint authentication for secure access and transactions. Also implementing the mechanism to facilitate regular security audits to address the vulnerabilities and keep your app protected against evolving cyber threats. To effectively build the trust of your targeted audiences you need to ensure adherence to relevant financial and data privacy regulations like PCI DSS or GDPR compliance standards.

6. Contactless Transaction Facility

Integrating a wide range of contactless payment mechanisms like digital wallets and QR-based payment services is a necessary aspect of such apps. You need to ask your hired fintech app developer to streamline the payment process so that the users can facilitate transactions with minimal taps on their smartphone screens. Making it fast and secure by prioritizing speed without compromising security, by implementing the necessary security protocols and standards.

7. User-Friendly Experience

Implementing an easier registration process makes it easy for users to register and activate their accounts quickly. Offering the users with personalized data insights such as spend analytics, transaction history, and other custom settings for delivering them a tailored experience. You can also add on multilingual support to cater to a wide range of audiences by offering your app in various languages.

Related blog: Mitigating Fraud and Security Risks in Online Payment Systems

Identifying the Actual Cost of Building a Contactless Payments App

The actual cost unfortunately depends on the specific nature of your project as there are a lot of customizations and complex features and functionalities that are needed by you. That’s the reason there is a wide range of factors that you have to consider while crafting a contactless custom fintech app development:

1. Complexity

- Simple System (limited features, single platform): $25,000 – $50,000

- Medium Complexity System (additional features, multiple platforms): $50,000 – $150,000

- Advanced System (highly complex features, multi-platform integration): $150,000 – $300,000+

2. Additional Factors

- Integrations: $5,000 – $20,000 per complex integration (financial institutions, loyalty programs).

- Security Features: $5,000 – $35,000+ depending on complexity and required compliance.

- Development Team: Hourly rates from $30 – $200+ depending on experience and location.

- Project Management: $5,000 – $12,000+

- Testing and QA: $5,000 – $10,000+

- Marketing and Deployment: $5,000 – $15,000+

3. App Type

- Web Apps: $12,000 to $40,000

- Cross-Platform Apps: $20,000 to $40,000

- Multi-Platform or Native Apps: $50,000 to $95,000

- Hybrid Applications: $10,000 to $150,000

Final Words

Crafting an advanced contactless payment system is an exciting journey that requires essential financial planning that is crucial for achieving success. However, there is not any sort of fixed answer for the same. For identifying the actual costs you should carefully consider your specific needs, targeted audiences, and desired features. Considering all cush aspects you can create a realistic budget that propels your vision forward. You can do the same by utilizing the allocated resources sleek expert advice and embrace flexibility through the overall development process. Always remember that the code to a cost-effective system lies in meticulous planning, informed decision-making, and a touch of adaptability.

Amplework, your preferred fintech app development company crafts contactless payment apps that exceed your expectations. Through our custom mobile app development services, our experts create bespoke solutions using a cutting-edge tech stack, focusing on seamless collaboration. To unlock new efficiencies for your business, empower clients, and thrive in the digital age. So what you are waiting for is to partner with Amplework to transform your real fintech mobile app development journey.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228