Leveraging Full-Stack Development for Creating Personal Finance Apps

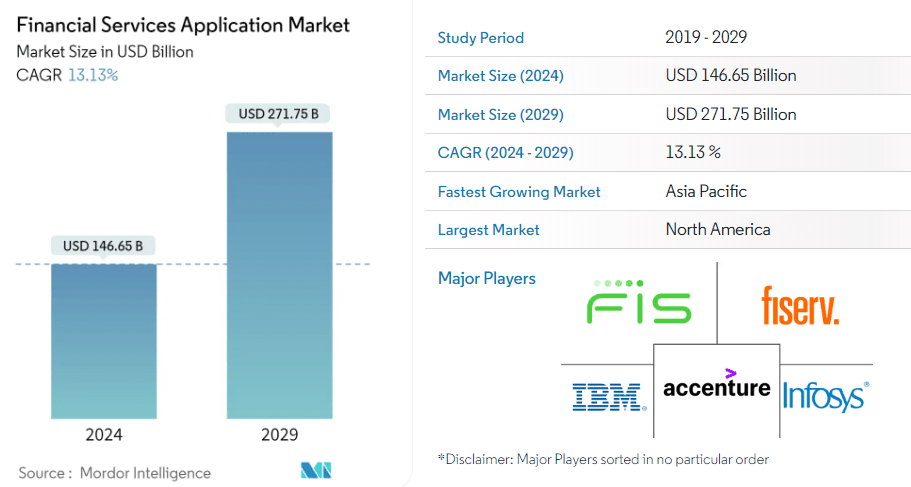

This is a basic need of current times that we make ourselves technically advanced and adapt new assets. In this context managing personal finances is considered as the best practice. Creating full stack app for personal finance project is a unique approach that results in different benefits. These advanced apps let you deal with financial complexities. Such as proper budgeting, management of savings, and performing investments. All these highlight the importance of managing finance and how personal finance management is an essential term. The personal finance management apps serve you as a valuable companion and empower users to take control of their finances. These apps can be capable of tracking your budget, expense management, and bill payment reminders. There can be a huge possibility of having a variety of personalized finance apps features. The research data by Mordor Intelligence highlights the same aspects.

As shown in the above figure, the financial services application market size is estimated at USD 146.65 billion in 2024 and is expected to reach USD 271.75 billion by 2029. While carrying a compound annual growth rate of 13.13% in the time frame of 2024 to 2029. This indicates that the development of personal finance management apps is a necessity and is expected to have higher future growth.

In the current times, fintech app solutions are capable enough to handle anything. The concept of financial technologies is introduced to provide the best fintech app solution. Integration of full-stack development techniques can lead to many advancements. This blog highlights the major benefits of adapting full-stack to build fintech apps and the development practices of these apps with a full-stack approach. So give this a quick read for gaming knowledge of creating full stack app for personal finance project.

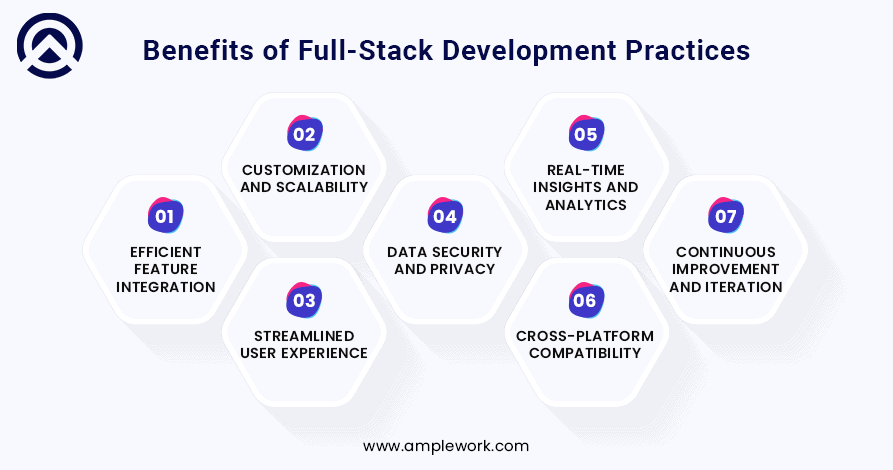

Benefits of Full-Stack Development Practices

Efficient Feature Integration

Full-stack developers excel in amalgamating diverse functionalities within personal finance applications. Such as advanced budget tracking mechanisms, intricate expense categorization systems, streamlined investment portfolio management tools, and dynamic real-time financial analytics. Their adeptness in frontend and backend technologies empowers them to craft holistic user experiences. That encompasses every crucial aspect of financial management. With a keen eye for detail and a deep understanding of user needs. These developers ensure that users can effortlessly navigate through the application while accessing robust features tailored to their financial goals. This comprehensive approach elevates the user experience, fostering greater engagement. And satisfaction with the fintech app development outcome’s performance and functionality.

Customization and Scalability

Personal finance application thrive on adaptability, necessitating customization to align with diverse user preferences and financial aspirations. Full-stack developers wield the prowess to architect scalable infrastructures, poised to seamlessly accommodate future expansions and evolving user demands. Be it the integration of bespoke budgeting functionalities or the incorporation of external financial APIs. Opting to hire full-stack web developers works on harnessing their expertise to craft personalized fintech app security solutions tailored to individual user exigencies. Through meticulous attention to detail and agile development methodologies, they ensure that the app remains flexible and responsive, adeptly catering to the dynamic needs of each user while fostering a sense of empowerment and control over their financial journey.

Streamlined User Experience

The synergy of full-stack developers, adept in frontend and backend technologies, is pivotal in crafting personal finance planning software that deliver a seamless and intuitive user experience. Their expertise spans from designing elegant user interfaces that captivate users’ attention to optimizing database performance for swift data retrieval and processing. Full-stack development orchestrates a harmonious collaboration between frontend and backend components, ensuring that every facet of the application contributes to a fluid and efficient user journey. By meticulously fine-tuning each element of the app’s architecture, these developers guarantee a cohesive user experience that fosters engagement and instills confidence in users as they navigate their financial endeavors with ease and precision.

Data Security and Privacy

Given the sensitive nature of financial data handled by personal finance apps, prioritizing data security is paramount. Full-stack web developers excel in implementing rigorous security protocols, including encryption algorithms, secure authentication methods, and stringent data validation techniques. Their proficiency ensures that user information remains safeguarded against unauthorized access or breaches. By placing a premium on data security and privacy, developers cultivate trust and confidence among users, establishing a foundation for long-term engagement with the app. Through their meticulous attention to security finance mobile app measures, full-stack developers empower users to manage their finances with peace of mind, knowing that their sensitive information is protected at every step.

Real-Time Insights and Analytics

Full-stack development facilitates the seamless integration of real-time data analytics and reporting functionalities into mobile app development Through the utilization of robust backend technologies such as Node.js or Django, developers can efficiently process substantial volumes of financial data in real-time. This empowers users with actionable insights into various aspects of their financial landscape, including spending patterns, investment performance, and overall financial well-being. By harnessing the power of real-time analytics, full-stack web developers enable users to make informed decisions promptly, thus enhancing their financial literacy and empowering them to achieve their financial goals more effectively.

Cross-Platform Compatibility

In the era of ubiquitous mobile devices and diverse operating systems, achieving cross-platform compatibility is imperative for expanding the reach of personal finance app development solutions. Opting to hire a Full-stack developer who adeptly utilizes frameworks such as React Native or Flutter to create applications that seamlessly operate on both iOS and Android platforms. By leveraging these tools, developers ensure that users across different devices and operating systems can access the app with ease, maximizing its accessibility and enhancing user engagement. This approach not only broadens the app’s audience but also streamlines development efforts, allowing for efficient maintenance and updates across multiple platforms, ultimately fostering a more inclusive and immersive user experience.

Continuous Improvement and Iteration

Full-stack development cultivates a culture of perpetual refinement and iteration, enabling developers to swiftly incorporate user feedback and iterate on app features. Through the adoption of agile development methodologies and the utilization of both frontend and backend technologies, developers can efficiently prototype, test, and enhance new functionalities. This iterative approach ensures that the app remains dynamic and responsive to evolving user needs and trends in the fast-paced personal finance landscape. By embracing continuous improvement, full-stack developers uphold the app’s relevance and competitiveness, fostering sustained user engagement and satisfaction as the application evolves to meet the ever-changing demands of its users.

Key Strategies for Full-Stack Personalized Finance Apps

User-Centric Approach

To further enhance user satisfaction and engagement, it’s crucial to prioritize usability and accessibility throughout the fintech app development process. Conduct usability testing to ensure that the app’s interface is intuitive and easy to navigate for users of all skill levels. Implement accessibility features to accommodate users with disabilities, ensuring inclusivity and compliance with accessibility standards. Additionally, consider incorporating gamification elements or reward systems to incentivize user engagement and foster a sense of achievement. By integrating these strategies alongside a user-centric approach, you can create personal finance software that not only meets the functional needs of your audience but also delivers a compelling and enjoyable user experience, driving long-term usage and loyalty.

Comprehensive Feature Set

In addition to offering a comprehensive set of features, personalized finance apps should also prioritize customization and flexibility. Empower users to tailor the app to their specific financial goals and preferences by allowing them to customize categories, set individualized budget limits, and adjust settings to suit their unique needs. Furthermore, leverage machine learning algorithms to provide intelligent insights and recommendations based on users’ spending patterns and financial goals. By offering a highly customizable and intelligent platform, you can enhance user engagement and satisfaction, empowering individuals to take control of their financial future with confidence and ease.

Scalable Architecture

To further enhance scalability and adaptability, consider implementing a microservices architecture, allowing for independent deployment and scaling of different components. Additionally, prioritize modular development to facilitate easy updates and modifications without disrupting the entire system. Implement automated testing and continuous integration practices to maintain code quality and ensure stability throughout the mobile app development process. By embracing these architectural best practices, you can future-proof the app and ensure that it remains agile and responsive to evolving user needs and market dynamics. This proactive approach not only minimizes technical debt but also fosters innovation and sustainable growth in the long run.

Data Security and Privacy

In addition to implementing robust security measures, regularly conduct security audits and penetration testing to identify and address vulnerabilities proactively. Provide transparent information to users about how their data is collected, stored, and used, and offer options for users to control their privacy settings. Furthermore, establish protocols for incident response and data breach notification to mitigate the impact of potential security incidents. By prioritizing data security and privacy at every stage of development and operation, you can instill confidence in users and build a reputation for trustworthiness and reliability. This commitment to protecting user data not only ensures compliance with regulatory requirements but also fosters long-term user loyalty and satisfaction.

Personalization and Customization

Additionally, provides users with interactive tools and educational resources to enhance their financial literacy and decision-making capabilities. Offer features such as interactive budgeting calculators, investment simulators, and educational articles or tutorials on financial topics. Encourage users to track their progress toward their financial goals and celebrate milestones to foster a sense of accomplishment and motivation. By empowering users to take control of their financial journey and providing them with the tools and knowledge they need to succeed, you can cultivate a loyal user base and drive long-term engagement with your app.

Seamless Integration and Connectivity

Moreover, prioritize data security and privacy in these integrations by implementing secure authentication protocols and encryption mechanisms to protect users’ sensitive financial information during data exchanges. Regularly audit and monitor these integrations to identify and address any potential issues related to security finance mobile app vulnerabilities or compliance issues. Additionally, provides users with granular control over their data-sharing preferences and permissions, allowing them to manage which accounts or information they want to integrate with the app. By prioritizing both functionality and security in external integrations, you can enhance users’ confidence in your app and create a robust and trusted financial ecosystem that meets their diverse needs.

Agile Development and Iterative Improvement

Fostering a collaborative environment within the development team, encouraging open communication and feedback sharing to facilitate efficient iteration cycles. Utilize project management tools and techniques such as sprints and kanban boards to streamline workflow and prioritize tasks effectively. Moreover, establish a culture of continuous learning and improvement, encouraging team members to stay updated on emerging financial technologies or fintech apps and best practices for a full stack app for personal finance project. By embracing agile methodologies holistically, you can not only deliver high-quality features and enhancements iteratively but also foster a culture of innovation and adaptability within your development team.

Key Trends Shaping the Future of Fintech App Development

As new technologies change financial services, fintech app development is changing too. Here we will discuss the main trends affecting the direction of fintech applications.

Artificial Intelligence and Machine Learning Integration

Artificial intelligence and machine learning are transforming finance apps by providing intelligent automation, predictive analytics, and tailored suggestions. These technologies enable apps to evaluate user activity, improve spending patterns, and detect fraudulent actions in real-time.

Blockchain Technology for Enhanced Security

Blockchain plays an important role in the development of fintech apps by increasing transparency, security, and confidence in financial transactions. Blockchain enables peer-to-peer secure transactions, reducing the risk of fraud and encouraging accountability throughout the system.

Biometric Authentication for Seamless User Experience

Increasingly, biometric authentication such as face recognition or even fingerprint scanning is being incorporated into fintech applications. The technology increases security because it gives users a secure, easy method of verification while transacting more smoothly and safely.

Open Banking and API Integrations

Open banking is driving the future of fintech apps through the exposure of a bank’s services to third-party developers via APIs. This means that innovative financial products that can serve the needs of a user will eventually be developed, improving financial inclusion and service offerings.

Real-Time Payments and Instant Transactions

Consumers want real-time transactions and faster payment solutions, which are forcing fintech apps to adopt instant payment systems. Technologies such as blockchain, along with faster clearing and settlement systems, are enabling seamless, near-instantaneous financial transactions for users.

Also More:- Mobile App Development Outsourcing

Why Choose Amplework for Your Fintech App Development?

Amplework combines knowledge and new ideas to create financial technology applications. Amplework has a team of skilled full-stack developers with years of experience creating safe, high-performance fintech solutions that are customized for both businesses and their users. Our company leverages the use of AI, blockchain, and other advanced technologies, creating applications not only to standard industry expectations but also to provide advantages in competitiveness. Whether it’s strong security or seamless payment system integration, the Amplework focus is to bring innovation as well as reliability to apps.

Partnering with a trusted solution provider, dedicated to your success, Amplework will stand for the successful delivery of fintech app development services. Taking the customer-centric approach, understanding all the needs and requirements of a business, and crafting apps that increase user experience with the utmost levels of security and performance in their use. Our team ensures your app will scale, adapt, and win the fast-changing game of fintech.

Conclusion

In full-stack development, technology integration revolutionizes the creation of personal finance apps, blending front-end finesse with robust back-end systems. Yet, ensuring stringent data protection is paramount. These fintech app security solutions provide a suite of tools tailored to navigate the unique challenges of this domain. The rising demand for secure automation drives developers and institutions to prioritize process fortification. Despite initial challenges, pioneers have positioned themselves at the forefront of this transformation, making intelligent solutions more accessible.

Amplework, a leader in full-stack development with over 5+ years of experience, stands out for its innovation and reliability. By surpassing client expectations, we’ve earned a reputation for trustworthiness. Upholding the highest standards of security, we’ve supported various tech entities in achieving significant milestones. Explore our website to discover our exceptional full-stack development services. Partner with Amplework for a transformative journey mastering front-end design and fortifying back-end systems with unparalleled reliability.

Read more: Criteria for Choosing the Best Full-Stack Development Agency for Your Business

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228