LLMs in Insurtech: How LLMs are Transforming the Insurance Industry in 2024

The insurance industry has always been built on data. From assessing risk to processing claims, data is the lifeblood that drives decisions in insurance. However, traditional methods of handling data have often been inefficient and labor-intensive. This is where Insurance Technology, or Insurtech, comes into play, with Large Language Models (LLMs) leading the charge in transforming how insurers operate. LLMs, such as GPT-3, BERT, and domain-specific models like FinBERT, are revolutionizing insurance by automating processes, enhancing customer experience, and improving decision-making.

LLMs are highly advanced AI models trained to understand, process, and generate human-like language, making them ideal for tasks such as claims automation, customer interaction, and risk assessment. With their ability to sift through vast amounts of unstructured data, LLMs are helping insurance companies streamline operations, reduce costs, and offer more personalized products to customers. That’s why, the demand for the integration of LLMs into insurance processes is increasing. And we can say that large language models in the insurance sector have become a must nowadays.

In this blog, we will explore the transformative role of LLMs in the Insurtech sector. We will discuss key applications, the benefits for insurers and customers, challenges, and the future potential of LLMs in driving innovation across the insurance landscape. Let’s start to know.

Statistics of Large Language Models in Insurance Industry

- According to Market Research Future, the global LLM market is projected to reach $2,598 million by 2030, growing from $1,590 million in 2023, with a compound annual growth rate (CAGR) of 79.80% from 2023 to 2030.

- According to McKinsey, By 2025, it is estimated that 50% of digital work will be automated through applications utilizing LLMs.

- According to Statista, by 2025, 750 million applications will be using LLMs for various purposes, including in the insurance sector.

- According to Juniper Research, AI chatbots powered by LLMs are expected to save the insurance industry approximately $1.3 billion annually in customer support costs by 2023.

- According to the Coalition Against Insurance Fraud, LLM-driven fraud detection solutions can help insurers detect up to 30% more fraudulent claims compared to traditional methods.

- According to Accenture, 80% of customers are more likely to purchase insurance from providers that offer personalized products, which LLMs facilitate by analyzing customer data.

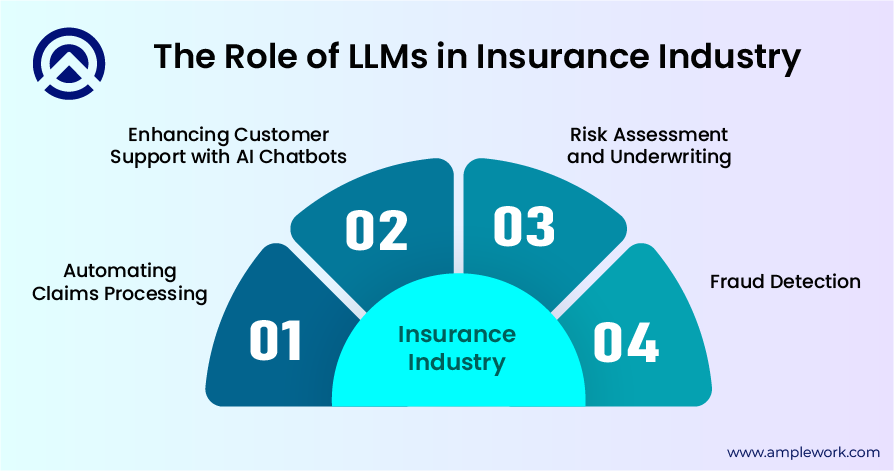

The Role of LLMs in the Insurance Industry

The insurance industry is data-intensive. A large portion of this data is unstructured. It includes policyholder information, claims reports, and regulatory documents. Traditional methods of handling this data often require significant manual intervention. LLMs change this by enabling the automation of various processes, allowing insurance companies to become more efficient and responsive.

1. Automating Claims Processing

One of the most significant applications of LLMs in insurance is automating the claims processing workflow. Claims are often riddled with paperwork, requiring detailed analysis of reports, medical documents, and policy details. LLMs in insurtech can process these documents, extracting relevant information and flagging potential issues for further review, greatly reducing the time taken to process claims.

Example:

Lemonade, a well-known Insurtech company, uses AI and LLMs to automate the claims process. The company’s AI assistant, Jim, can handle claims in seconds by reviewing data and making payouts without human intervention for simple cases.

According to a study by McKinsey, insurance companies that integrate AI into their claims processes can reduce processing costs by 30% while improving customer satisfaction by up to 20%. By automating repetitive tasks, LLMs free up human agents to focus on more complex claims that require a personalized approach.

2. Enhancing Customer Support with AI Chatbots

In the insurance industry, customer support plays a crucial role in ensuring customer satisfaction. LLMs power AI-driven chatbots in the insurance industry. They provide 24/7 customer service and answer policy-related questions. They also help with claims and guide customers through the insurance purchasing process. These chatbots can handle multiple inquiries simultaneously, offering a more efficient and cost-effective alternative to traditional call centers.

Example:

Allstate uses AI chatbots to assist customers with policy inquiries, claims status updates, and payment issues. Powered by LLMs, these chatbots can understand customer queries and respond in real-time, improving customer experience.

Research by Juniper Research predicts that by 2023, AI chatbots will save insurers $1.3 billion in customer support costs annually. Chatbots powered by LLMs can handle up to 90% of simple customer interactions, allowing human agents to focus on more complex customer service issues.

3. Risk Assessment and Underwriting

Risk assessment and underwriting are core functions of insurance companies. Traditionally, these processes require underwriters to manually assess large amounts of data, including policyholder information, medical records, and actuarial tables. LLMs in insurance simplify this by automatically analyzing these datasets, identifying patterns, and predicting risk more accurately.

Example:

Zesty.ai is an Insurtech startup that uses AI models, including LLMs, to assess the risk of natural disasters affecting properties. By analyzing satellite images, weather data, and historical information, Zesty.ai helps insurers make more informed underwriting decisions.

A study by PwC found that AI-driven underwriting solutions can increase accuracy by up to 25%. This reduces the likelihood of insuring high-risk individuals or assets without proper premiums. This results in better financial outcomes for both insurers and policyholders.

4. Fraud Detection

Insurance fraud is a major issue for the insurance industry, costing companies billions of dollars each year. But, LLMs in the insurance sector, with their ability to process unstructured data, can help detect fraudulent claims by analyzing patterns in text and identifying inconsistencies that may indicate fraudulent activity.

Example:

Shift Technology provides AI-powered fraud detection solutions for insurers. By analyzing claims data, Shift’s LLMs detect anomalies and patterns that could signal potential fraud, helping insurers mitigate risk and reduce losses.

According to the Coalition Against Insurance Fraud, fraud costs the insurance industry over $80 billion annually in the U.S. alone. LLM-driven fraud detection solutions can help insurers detect up to 30% more fraudulent claims compared to traditional methods.

How Large Language Models in the Insurance Industry Poised to Improve Customer Experience?

The insurance industry is notoriously slow when it comes to claims processing and customer service. Integration of LLMs into insurance processes is changing this dynamic by speeding up processes, providing personalized advice, and enhancing customer engagement. Let’s start to know how LLMs are transforming the insurance industry.

1. Personalized Insurance Plans

Large language models in insurance enable insurers to offer personalized insurance plans by analyzing customer data, such as lifestyle, health information, and financial status. This allows insurance companies to create tailored policies that meet the specific needs of each customer.

Example:

Bima, a mobile Insurtech provider, uses AI & LLMs to offer personalized micro-insurance plans in developing markets. By analyzing user data from mobile devices, Bima can offer health and life insurance that aligns with the user’s lifestyle and financial situation.

A report by Accenture found that 80% of customers are more likely to purchase insurance from providers that offer personalized products. LLMs allow insurers to provide highly customized plans, improving customer satisfaction and increasing sales.

2. Natural Language Processing for Policy Management

Managing insurance policies often involves complex documents filled with legal jargon. LLMs simplify this process by using Natural Language Processing (NLP) to summarize policy details in plain language, helping customers better understand their coverage, exclusions, and terms. This way managing policy in the insurance sector becomes so much easier.

Example:

Metromile, a pay-per-mile auto insurer, uses LLMs to provide customers with easy-to-understand summaries of their policies, making it simpler for policyholders to review their coverage and terms.

According to Forrester, 60% of consumers struggle to understand their insurance policies. By using LLMs to simplify policy language, insurers can improve customer understanding and reduce the number of disputes related to policy terms.

3. AI-Driven Customer Engagement

Large language models in the insurance sector are also enhancing customer engagement by offering personalized content and recommendations based on individual customer profiles. By analyzing customer behavior, preferences, and interactions, LLMs can suggest new policies, discounts, or coverage options that align with the customer’s evolving needs.

Example:

Hippo Insurance uses AI to analyze customer data and send personalized recommendations, including policy updates, discounts, and reminders for coverage adjustments based on life events like buying a new home or having a child.

Research by Deloitte shows that personalized customer engagement can lead to a 20-25% increase in policy renewals, as customers are more likely to stay with insurers that offer relevant, tailored recommendations.

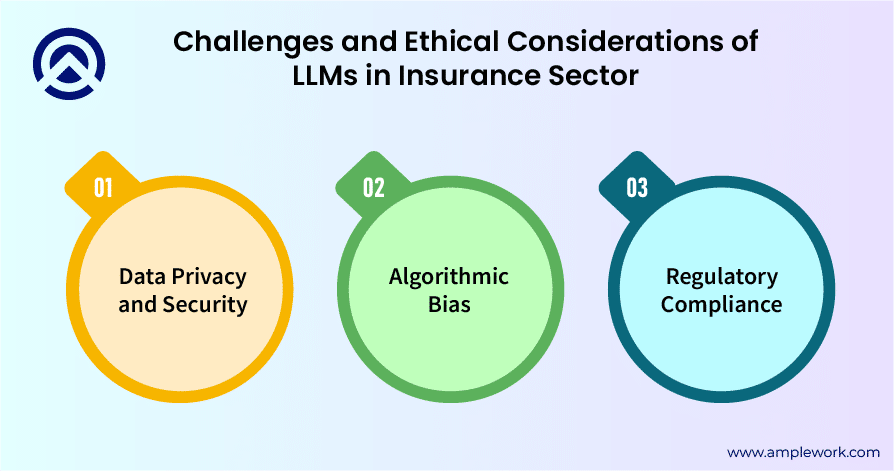

Challenges and Ethical Considerations of LLMs in Insurance Sector

While LLMs bring immense potential to the Insurtech industry, they also introduce challenges and ethical considerations that must be addressed, including data privacy, algorithmic bias, and regulatory compliance.

1. Data Privacy and Security

Insurance companies handle highly sensitive personal data, making data privacy a top priority. The use of LLMs in Insurtech requires processing vast amounts of data, raising concerns about how this data is collected, stored, and used.

Solution:

Insurance companies must adopt robust data encryption methods and comply with privacy regulations like GDPR and CCPA. LLMs should also be trained using privacy-preserving techniques such as federated learning, where models are trained on decentralized data without accessing raw information.

2. Algorithmic Bias

LLMs in the insurance industry are only as good as the data they are trained on. If the data used to train LLMs is biased, the resulting models can exhibit algorithmic bias. In the insurance industry, LLMs could lead to unfair treatment of certain demographic groups, with higher premiums or denials based on biased data.

Solution:

To mitigate bias, Insurtech companies need to ensure that LLMs are trained on diverse datasets that reflect various customer profiles and backgrounds. Additionally, regular audits of LLMs are essential to detect and correct any biases that may emerge. Insurtech firms should also adopt fairness-aware algorithms, such as adversarial debiasing, to improve model equity.

Example of Use:

Zest AI, an AI company specializing in underwriting models, actively works on reducing bias in financial services. Their algorithms are designed to ensure that credit decisions, insurance underwriting, and pricing models are free from discriminatory outcomes.

3. Regulatory Compliance

The insurance industry is heavily regulated, and the introduction of AI technologies like LLMs must align with local and international laws. Regulations such as GDPR in Europe and HIPAA in the U.S. govern how customer data can be collected, stored, and used, particularly in industries like health and life insurance. Failure to comply with these regulations could result in significant penalties and damage to a company’s reputation.

Solution:

Insurance companies must ensure that their AI models and data-handling practices comply with applicable regulations. This involves conducting regular audits, implementing secure data storage practices, and maintaining transparency with customers regarding how their data is used.

Example:

Lemonade has implemented privacy-preserving AI practices that comply with GDPR. Their LLMs are designed to handle personal data securely, ensuring that customer information is used responsibly.

Also Read: LLMs in Healthcare: Empowering Healthcare IT System

The Future of LLMs in Insurtech

As LLMs evolve, their impact on the insurance industry will deepen, driving more innovation and transforming how insurers interact with their customers, manage risk, and optimize operations. Here are some of the key trends we can expect to see in the future of LLMs in Insurance sector:

1. Hyper-Personalized Insurance Products

In the future, insurance LLMs will enable insurers to offer even more hyper-personalized insurance products, adjusting coverage dynamically based on real-time data. For example, LLMs could analyze data from wearable devices to offer personalized health insurance plans, adjusting premiums based on an individual’s lifestyle and habits.

Example:

Oscar Health is an innovative Insurtech firm that already uses AI and data from wearable devices to personalize health insurance coverage, offering plans that reward customers for healthy behavior.

A study by Deloitte revealed that 44% of insurance customers are willing to share data from wearable devices if it results in more personalized and cost-effective policies. Insurtech LLMs will play a crucial role in analyzing this data and tailoring products to individual needs.

2. Real-Time Claims Settlement

As LLMs become more sophisticated, we can expect to see real-time claims settlement become the norm. In the future, LLMs in Insurtech will process claims as they are submitted, analyzing documents, assessing damage, and making payouts almost instantly. This will drastically reduce the time customers spend waiting for claims to be resolved.

Example:

Root Insurance uses AI to offer immediate claims processing for car insurance claims. The company uses data from telematics devices in customers’ cars to assess damage and settle claims quickly.

According to McKinsey, real-time claims settlement could reduce processing costs by 50% and improve customer satisfaction by over 20%, as customers no longer have to wait weeks for payouts.

3. AI-Driven Risk Management

Risk management will see further advancements as LLMs are integrated with other AI technologies like machine learning and predictive analytics. Insurers will be able to anticipate risks in real time and adjust premiums, coverage, or exclusions accordingly. For instance, property insurers could use AI models to monitor weather patterns and adjust flood or wildfire coverage based on real-time risk levels.

Example:

Cape Analytics is an AI company that uses machine learning and satellite imagery to assess property risk for insurers. Their AI models predict how natural disasters could impact properties and help insurers adjust policies proactively.

A report by PwC predicts that AI-driven risk management could reduce insurance fraud by 30% and improve risk forecasting accuracy by up to 25%, leading to more stable and predictable premiums for consumers.

4. Autonomous Insurance Advisory

With advancements in LLMs and conversational AI, the future could see the rise of autonomous insurance advisors like virtual agents powered entirely by AI that guide customers through the insurance process, from selecting the best policies to managing claims and coverage. These advisors would have access to a customer’s entire insurance history, financial data, and preferences, allowing for a completely tailored advisory experience.

Example:

Insurify, a digital insurance marketplace, uses AI to recommend the best policies to users based on their preferences and needs. In the future, Insurify’s AI could evolve into a fully autonomous insurance advisor that manages all aspects of a customer’s insurance lifecycle.

A Capgemini study found that 60% of customers would be comfortable interacting with an AI-powered insurance advisor, especially if it led to more personalized and timely services.

Also Read: The Role of Large Language Models in Fintech Services

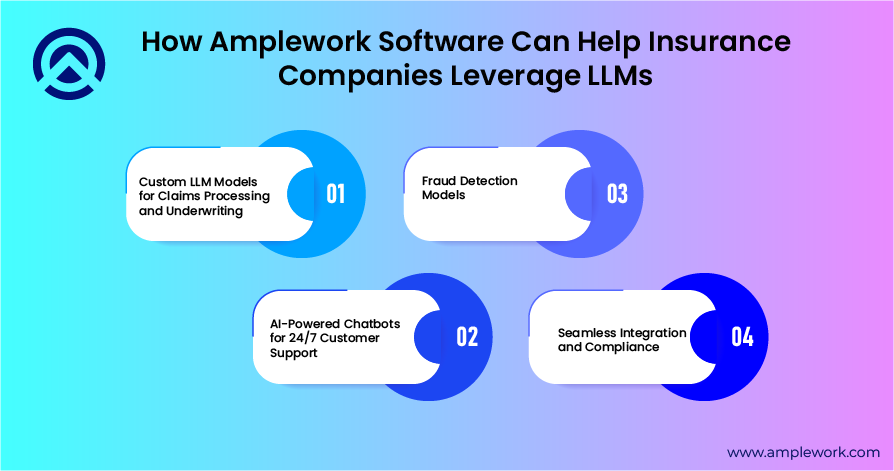

How Amplework Software Can Help Insurance Companies Leverage LLMs

As Large language models continue to transform the insurance industry, insurance companies must stay ahead of the curve by adopting AI-driven solutions that enhance operational efficiency, improve customer satisfaction, and reduce costs. To overcome these challenges and issues, Amplework Software is the best option.

Amplework Software is a popular AI app development company that specializes in developing custom LLM solutions for the insurance sector. Our expertise in AI-driven technologies allows us to create models that automate claims processing, enhance customer service, improve risk assessment, and personalize insurance products. Whether you’re looking to integrate chatbots, automate fraud detection, or optimize underwriting processes in the insurance industry, Amplework has the best tools and expertise to help you succeed.

Our LLM Development Services for Insurance industries Include:

1. Custom LLM Models for Claims Processing and Underwriting

Amplework Software can develop tailored LLM solutions for insurance companies that automate your claims processing and underwriting workflows, reducing processing times and improving accuracy.

2. AI-Powered Chatbots for 24/7 Customer Support

Our AI-driven chatbots are designed to provide real-time customer support, handling inquiries, claims status updates, and policy information with ease.

3. Fraud Detection Models

Amplework Software builds LLM-powered fraud detection systems for the Insurance sector that analyze claims data to identify potential fraudulent activity, reducing losses for insurers.

4. Seamless Integration and Compliance

We ensure that all AI models developed by Amplework comply with industry regulations like GDPR and CCPA, while also integrating seamlessly into your existing systems.

Also Read: Addressing Complete Guide on AI Models and Its Working Methodology

Unlock the Full Potential of Large Language Models in the Insurance Sector with Amplework Software

With the power of LLMs, Insurance companies can offer hyper-personalized insurance products, automate manual processes, and create more engaging customer experiences. At Amplework Software, we provide the expertise and tools you need to stay competitive in this rapidly evolving landscape. To harness the power of LLMs in the insurance sector, contact us anytime.

Final Words

Large Language Models are revolutionizing the insurance industry by automating claims processing, enhancing customer support, improving risk assessment, and personalizing insurance products. As Insurtech continues to evolve, LLMs will play an increasingly important role in driving innovation and efficiency. However, implementing LLMs comes with its own set of challenges, including ensuring data privacy, mitigating algorithmic bias, and complying with regulatory requirements.

With the help of Amplework Software, Insurtech businesses can overcome these challenges and unlock the full potential of LLMs. From fraud detection to real-time claims settlement and autonomous advisory, Amplework’s AI-driven solutions ensure that insurance companies can offer seamless, personalized, and secure services to their customers.

Frequently Asked Questions (FAQs)

How are large language models transforming the insurance industry?

Here is the list of the key applications of LLMs in the insurance sector so that you can learn how LLMs play a vital role in transforming the Insurtech industry. Let’s have a look at them-

- Streamline Customer Service

- Claims Processing

- Price Optimization

- Insurance Underwriting

- Insurance Products Recommendations

- Effective Intranet Search

- Developing New Data Strategies

- Customer Retention

- Data Security

- Lapse Management & Training

- Insurance Software Testing

- Virtual Assistants

What are the use cases of AI & LLMs in the Insurance industry?

AI and LLMs are innovatively transforming the insurance sector beyond your imagination. Integration of LLMs into insurance processes has made it more advanced. It has enhanced general operations by automating them. Here are the use cases of LLMs in Insurtech.

- Efficiency Customer Support

- Claim Fraud Detection and Prevention

- Insurance Pricing and Underwriting

- Accelerated Claims and Processing

- Claims Reserve Optimization

- Personalized Recommendations

- Prediction of Customer Churn

Why choose Amplework to integrate LLMs into the insurance business?

Amplework is a leading mobile app development services provider that has the best team of developers who are well-versed in all the latest technologies and trends. To empower your insurance business, they enrich your business platform with customized LLMs so that you can achieve your business goals easily. They use AI-powered tools to give a perfect shape to your business, and this way, they can offer your desired services in less time, and you save both time and money.

What is the role of large language models in insurance companies?

Large language models in insurance are revolutionizing the industry by enhancing efficiency, improving customer service, and enabling data-driven decision-making. These advanced models streamline claims processing, automate customer support, and bolster fraud detection efforts. By analyzing vast amounts of unstructured data, large language models in insurance also help with risk assessment and underwriting, enabling more accurate and personalized services.

- Claims Processing Automation

- Customer Support

- Fraud Detection

- Risk Assessment and Underwriting

- Personalized Marketing

- Document Review and Compliance

How is NLP transforming customer service in the insurance industry?

NLP in the insurance industry is transforming customer service by enabling more efficient, personalized, and accessible interactions. Through automation and data analysis, insurance companies are enhancing customer experiences, making services faster and more responsive.

- Personalized Communication

- 24/7 Support with AI Chatbots

- Automating Claims Filing

- Sentiment Analysis for Better Service

- Multilingual Support

What are the benefits of using NLP in the insurance industry for claims processing?

NLP in claims processing offers significant benefits by greatly enhancing efficiency, improving accuracy, and boosting customer satisfaction. By leveraging advanced natural language processing techniques, insurance companies can automate and streamline many aspects of the claims process, resulting in faster, more reliable, and cost-effective services. Here’s how:

- Faster Claims Processing

- Improved Accuracy

- Automated Categorization and Prioritization

- Fraud Detection

- Enhanced Customer Experience

What are the challenges of implementing NLP in the insurance industry?

Challenges of implementing NLP in the insurance industry include several technical and operational hurdles. Here’s a look at the key obstacles:

- Data Quality and Availability

- Complex Terminology

- Integration with Legacy Systems

- Data Privacy and Compliance

- Training and Adaptation

- Cost of Implementation

How can NLP in the insurance industry assist in improving customer experience and engagement?

NLP in the insurance industry plays a crucial role in improving customer experience and engagement by enabling faster, more personalized interactions. Here’s how it makes a difference:

- Personalized Communication

- Efficient Customer Support

- Proactive Assistance

- 24/7 Availability

- Multilingual Support

- Streamlined Claims Process

By integrating NLP into customer interactions, insurance companies can create a more efficient, personalized, and responsive service, leading to stronger customer loyalty and improved engagement.

How is LLM driving automation in the insurance industry?

LLM in the insurance industry is driving automation by streamlining key processes, enhancing operational efficiency, and improving customer experience. Here’s how:

- Automated Claims Processing

- Policy Underwriting Automation

- Customer Service Automation

- Fraud Detection

- Document Processing and Compliance

By integrating LLM technology, insurance companies are automating repetitive tasks, reducing operational costs, and improving accuracy, leading to a more efficient and customer-centric industry.

What are the benefits of using LLM for automating document processing in insurance?

Using LLM for automating document processing in insurance offers several key benefits that enhance efficiency, accuracy, and overall performance. Here’s how:

- Speed and Efficiency

- Accuracy and Consistency

- Cost Savings

- Enhanced Customer Experience

- Scalability

- Compliance and Risk Mitigation

- Natural Language Understanding

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228