Benefits of Apple Card for Small Businesses

The history of the fintech system begins with the barter systems and it got continuously evolved from central banks to today’s digital banking institutions but it is still surprising us with the new marvels of its technology.

As we have gone digital, digital wallets or digital transactions have become quite common. In fact, there are many startups and small businesses who have also come forward to give their share in this innovation. And Apple which is a magnum opus and comes among the best epitome of inventions is not lagging in this tread.

To the surprise of traditional fintech players, it has also unleashed its products in the financial market as well. The products are Apple Card and Apple Pay.

Apple Pay was released in 2014 but the Apple Card is quite recent and was released in 2019. Since the day of launch, it has been a continuous debate topic about its benefits for users. Keeping that aside, it is also highly speculative to know how it can affect small businesses across the globe. More specifically, what benefits will the businesses get by integrating Apple Card and Apple Pay into their mobility solutions?

There is a fact that 90% of mobile users will start using mobile payment by the end of this year. This statistic is enough for the businesses, startups and entrepreneurs who made their investments in mobile app development to rethink more about payment gateways, Apple Credit Card integrated into Apple Pay was one of them.

Thus, check out this blog because it covers important key insights about the Apple Card specifically for small businesses.

What is an Apple Card and How Does it Work?

An Apple Card is a credit card offered by Apple Inc. It works just like any other credit card, allowing users to make purchases and pay bills, but it is integrated into the Apple ecosystem. To use an Apple Card, customers simply add it to their Apple Wallet and use it for payments with Apple Pay.

The card offers cashback rewards for purchases made through the card, and users can manage their card and see their transactions and spending patterns in the Wallet app. Apple Cards actually live in your iPhone and you can do many things with it that you couldn’t do earlier. Sounds complicated?

Let’s just simplify it for a better understanding.

There is so much hype for Apple’s Credit Card because of its excellent feature to keep track of financial health. Although you can check the transaction details and other numbers on many other credit cards, you get much more with the Apple Credit Card.

Benefits of Apple Card for small businesses

There are 4 main benefits of the Apple Card:

- Security

- No Fees at all

- Cashback Rewards

- Maps of Purchases

Let’s get key insights about major features which are present in Apple credit card for business:

A. Security

Yes, Apple business card provides several security benefits to users. It uses advanced security features to protect users’ information and ensure safe transactions. Some of these security benefits include –

- Tokenization: Apple Card uses tokenization to protect users’ information. This means that every transaction is secured by a unique, one-time code that is generated for each purchase, rather than using a traditional card number.

- Two-factor authentication: Apple Card requires two-factor authentication for sign-in and card activation, adding an extra layer of security to users’ accounts.

- Real-time notifications: Users receive real-time notifications for all purchases made with their Apple Card, allowing them to quickly identify any suspicious activity.

- No card number visible: The physical card does not have a card number printed on it, reducing the risk of fraud or theft of users’ card information.

- Purchase monitoring: Apple Card provides 24/7 purchase monitoring and fraud protection, ensuring that users are protected at all times.

Read more about: Ways to Avoid Security Issues in App Development

B. No Fees

Apple business credit card does not charge any fees for small businesses. The card is designed to provide customers with cashback rewards on purchases and a simple, straightforward way to manage their spending. There are no annual, late, or over-the-limit fees, and no penalty interest rates. However, there may be interest charges if a balance is carried from one billing period to the next.

Here, it is important to understand that Apple Cards work on this principle (it is mentioned on the official website of the company) – “Because your credit card should work for you, not against you”.

C. Maps of Purchases – Transaction Patterns

Apple Card provides real-time notifications for all purchases made with the card. Whenever a purchase is made, users receive a notification on their iPhone or iPad, allowing them to see the details of the transaction, including the merchant, the amount, and the date.

This allows users to quickly and easily track their spending and identify any unusual or suspicious activity. The business card app wallet provides a real-time notifications feature that helps to provide a secure and convenient way to manage spending and monitor transactions.

Apple Card Benefits for Small Businesses

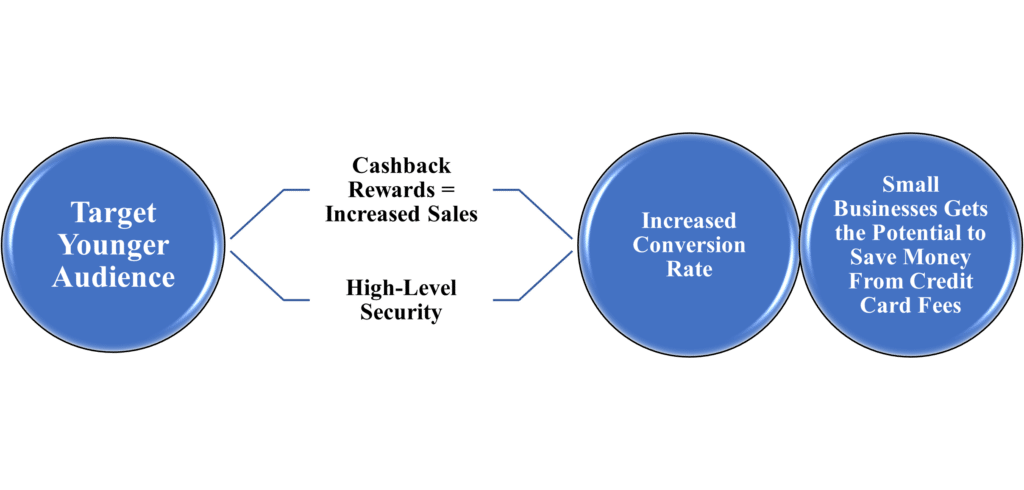

Small Businesses Get the Potential to Save Money From Credit Card Fees

Small businesses can take advantage of the potential to save money by using Apple Cards for their financial transactions. Apple Card offers cash-back rewards for purchases made through the card, helping businesses save money on their operational expenses.

Additionally, the card features no annual, late, or international fees, providing savings compared to traditional credit cards. With features such as the ability to track and categorize expenses and access to 24/7 support, small businesses can make informed financial decisions and better manage their funds.

By utilizing Apple Card, small businesses can streamline their financial operations and increase their savings. So, it is a perfect time to enhance your business growth with the utilization of a digital business card apple wallet.

Moreover, you can hire iOS developers for developing mobile applications that are compatible with the iOS platform.

High-Level Security

Apple Card offers small businesses a secure and reliable way to manage their finances. It utilizes industry-standard security measures such as tokenization, which replaces a card number with a unique digital code for every transaction, helping to protect against fraud and data breaches.

The card also features biometric authentication through Face ID or Touch ID for added protection. Additionally, Apple Card provides real-time alerts for purchases made with the card, allowing small businesses to quickly identify any suspicious activity. With its emphasis on security, Apple Card offers small businesses peace of mind and protection of their financial assets.

Apple credit card for small business offers a higher level of security and protection to safeguard the interest of the customers.

How to convert an iOS app into Android or vice-versa?

Target Younger Audience

Small businesses can attract younger audiences by utilizing the features and technology offered by Apple Cards. The card’s user-friendly design and integration with Apple Pay make it appealing to a younger demographic who are increasingly relying on technology for financial transactions.

By accepting Apple Cards as a form of payment, businesses can demonstrate their commitment to innovation and appeal to tech-savvy consumers. Additionally, Apple Card’s cash-back rewards program can incentivize younger audiences to choose the card for their purchases, driving repeat business.

By embracing technology and incorporating Apple Card, small businesses can effectively target a younger, tech-savvy audience.

Cashback Rewards = Increased Sales

Apple Card’s cash rewards program can drive increased sales for small businesses by incentivizing customers to choose the card for their purchases. The card offers higher cash rewards for purchases made at participating businesses, providing a financial incentive for customers to choose the card.

This not only increases the volume of sales for small businesses but also helps to attract new customers who may not have considered the business before. Additionally, by accepting Apple card for business as a form of payment, small businesses can demonstrate their commitment to innovation and appeal to tech-savvy consumers who are looking for seamless and rewarding payment experiences.

By offering higher cash rewards, the Apple card business can play a significant role in driving increased sales for small businesses.

Increased Conversion Rate

Small businesses can benefit from increased conversion rates by accepting Apple Card as a form of payment. Apple wallet business card offers a user-friendly and seamless payment experience that can reduce friction at checkout, making it easier for customers to complete transactions.

The card’s integration with Apple Pay also provides added convenience, as customers can make purchases with a single touch or glance. These features can result in higher conversion rates as customers are more likely to complete purchases when the process is quick and convenient.

Additionally, the card’s cash-back rewards program can incentivize customers to choose Apple Card for their purchases, leading to higher conversion rates and increased sales. By offering a streamlined and rewarding payment experience, Apple Card can help small businesses drive increased conversion rates.

Although, for higher conversion rates it is necessary to work on UI/UX part during the mobile app development process. For higher conversation, your application needs to be completely user-friendly.

Mobile Applications leveraging Apple Card

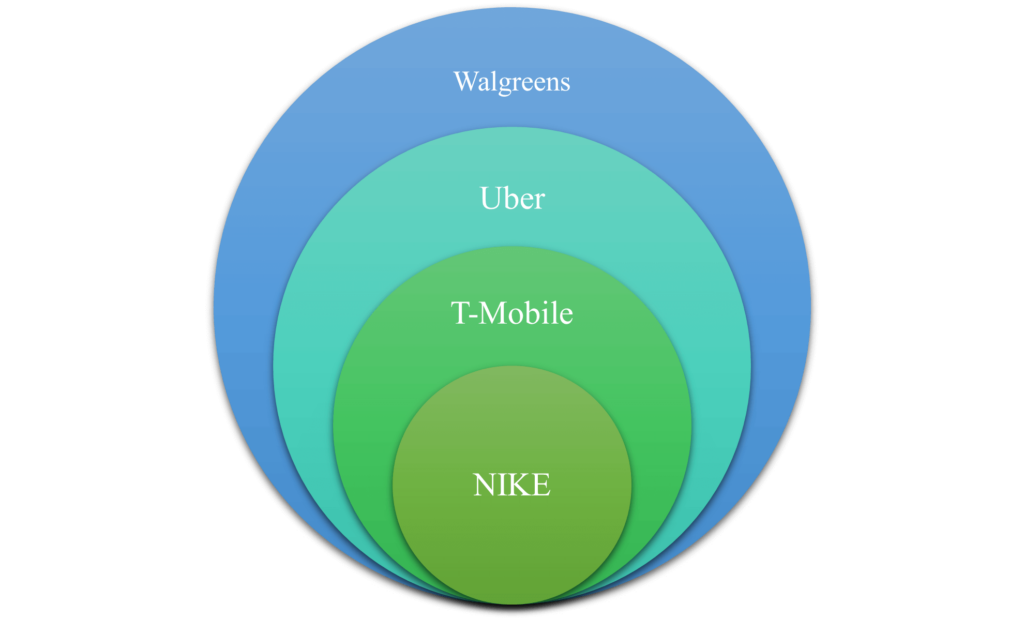

Nike

Apple Card into their mobile app, allowing customers to easily make purchases and access cash rewards. By offering a seamless payment experience and incentivizing purchases through cash rewards, Nike can drive increased sales and attract more customers.

Additionally, the integration of Apple Card into the Nike app provides valuable data insights and helps to personalize the customer experience. By leveraging the technology of Apple Card, small businesses such as Nike can drive innovation, improve customer satisfaction, and drive growth.

T-Mobile

T-Mobile is another example of a small business that can leverage the technology of Apple Card to enhance the customer experience and drive sales. By integrating Apple Card into their mobile app, T-Mobile can offer customers a seamless and convenient payment experience.

Uber

Uber is a small business that can leverage the technology of Apple Card to enhance the customer experience and drive sales. By integrating Apple Card into their mobile app, Uber can offer customers a seamless and convenient payment experience. This can increase conversion rates and drive sales as customers are more likely to complete transactions when the process is quick and effortless.

Walgreens

Conversion rates and drive sales as customers are more likely to complete transactions when the process is quick and effortless. Additionally, the card’s cash-back rewards program can incentivize customers to choose Walgreens and Apple Card for their purchases, leading to higher conversion rates and increased sales.

Walgreens can also benefit from valuable data insights and the ability to personalize the customer experience. By leveraging the technology of Apple Card, Walgreens can drive innovation, improve customer satisfaction, and drive growth.

Read more: Fintech Business Model: How to Start a Successful Fintech Business

The Final Words

Apple Pay is like a premium method of payment with high security and exciting cashback. If you integrate this payment gateway into your existing site or iOS or Android mobile app, you can definitely reach us. We, at Amplework, the best mobile application development company is having expertise in meeting such requirements related to mobile apps. We can develop both iOS and Android mobile apps from scratch, convert an iOS app into Android or vice versa and much more. Let us know your requirements and we will definitely turn them into reality.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228