How to Build a Minimum Viable Product for Personal Finance Management

Over the past few years, personal finance mobile app development services have witnessed steady growth prospects. Mainly after the rise of the COVID-19 pandemic when the lockdown was imposed by the government globally. This is the major reason why almost every individual has relied on personal finance solutions to fulfill all their personal finance-related needs and requirements. So even in an emergency, there is no need to wait or stand in ATM queues whenever the fund is required. Managing personal finances efficiently is crucial for achieving financial well-being for individuals. Whether you are saving for a dream vacation, planning for retirement, or just aiming to stay on top of monthly expenses, having a reliable Personal Finance Management (PFM) tool can make a difference.

So before diving into the development of a PFM tool, the businesses must grasp the concept of an MVP. A Minimum Viable Product is considered a minimal version of a product that includes only the essential features needed to address the core problem or pain point. By focusing on a simplified version, developers can gather valuable feedback, real-time insights, and a deep understanding of the latest trends. Making you understand, whether your product is performing well in the market or not at the earlier stages. Developing an MVP for the personal finance management tool saves both the time and money of the businesses, providing them with the perfect ideology about the performance of their products and services.

Blog Motive

This blog embarks you on an exciting journey, spreading light on the process of constructing a Minimum Viable Product (MVP) for a PFM tool. Whether you are embarking on a quest for fiscal discipline, aiming to achieve long-term financial goals, or simply seeking clarity, about the monthly or daily based financial expenses. All thanks to personal finance management software development companies, that are crafting robust finance management solutions for the same.

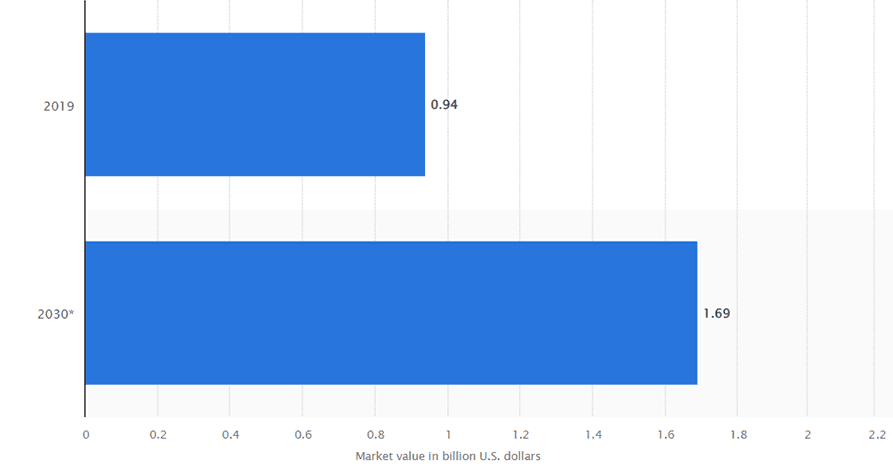

A Few Statistical Reflections

According to a statistical consideration provided by “Statista” a well-known research and statistics organization. Provides us with a research report that classifies the growth rate of the personal finance software market. As per the report, in the year 2019, the global personal finance software market was evaluated at approximately 0.94 billion US dollars. According to the growth levels, a prediction of growth has also been made in the same report that clearly states, the increase in the growth levels of the personal finance solution market till the end of the year 2030. According to the report the market forecast is expected to increase to approx 1.69 billion USD by the end of the year 2030. Which is the most important fact to be considered by the business world.

How Personal Finance Management Tools Put a Positive Impact on Individuals

A personal finance management system comprises a wide range of features and functionalities making finance management an effective and hassle-free process. Since these tools are feature-rich and robust, helping individuals effectively manage their finances, budgeting, accounting, and expense tracking, providing you with detailed insights into the same. Not only that, but instead it also provides you with different investment schemes and tax advice according to your expenses. That’s the major reason why personal finance management solutions play an important role in the lives of individuals, helping them effectively manage their finances. It is a platform that effectively helps you transform your budgeting mechanisms, making you save more by reducing all the unrequired expenses.

Significance of Crafting Personal Finance Management MVP for Businesses

According to research conducted by “CBInsights” which clearly states that more than 38% of startups fail because of their limited financial resources. Also, there are other reasons for the same like the businesses are not completely aware of the user’s requirements and current trends. Higher competitiveness, and many others. These are the major reasons impacting the failure of the product in the market. MVP is one of the best possible solutions for the addressed issue, as it comprises minimal features and functionalities that are necessary for solving the problems faced by individuals.

MVPs for personal finance management tools help individuals validate their ideology with a sense of practicality. Creating MVP involves limited risks and is a budget-friendly experience for businesses. So if they need to evaluate their idea in the market to discover its success probability then MVP is a must for them. With MVPs, you can rapidly launch the solutions with a faster time to market. They are resulting in faster feedback and gaining insights about the latest market trends.

Different Types of Personal Finance Management Solutions

The personal finance management solutions are of two different types. One with a major feature and the other comprises just a limited number of simple features. Both the types are described below.

1. The One with limited features & functionalities

The apps are simply used to keep track of your income and expenditures. Such apps help you generally manage your financial inflows and outflows of your financial aspects, and facilitate functioning on the manual inputs entered by the users. These solutions are featured with limited mobile app development features and functionalities. These mobile apps comprise limited or zero risk factors as there is no need to add your confidential details to these.

2. Advanced Personal Finance Apps

The complex finance mobile applications are equipped with advanced features and functionalities, allowing users to add up all their bank accounts and other financial sources. These solutions are highly secure and efficient, automatically managing the inflows and outflows of the individual’s finances, providing the users with real-time transactional updates, and controlling their expenditures.

Also Read: MVP Advancement: Evolving Your Product Based on User Feedback and Market Demand

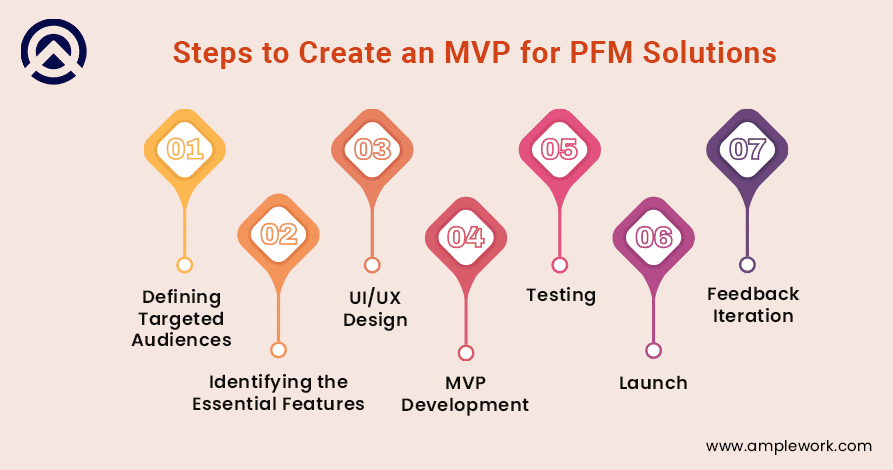

How to Build an MVP for Personal Finance Management Solutions

Crafting an MVP in finance management tool for individuals involves creating a basic version of the product, equipped with only a set of essential features and functionalities, meeting the needs and requirements of your targeted audiences. Here is a list of steps to help you build an MVP for your personal finance management tools.

1. Defining Targeted Audiences

Identifying the specific demographical data about your targeted users is one of the necessary aspects of the MVP development process. You must understand the general problems faced by the users in managing their finances. Defining the targeted audiences leads to a clear understanding of the latest trends and their specific requirements, ensuring the success of your actual product.

2. Identifying the Essential Features

Start focusing on the essential features and functionalities that you need to add to your MVP, addressing the pain points of your targeted audiences. These core features include expense management and tracking, budget management, and income tracking with automated real-time financial reporting. These features can be added according to the desired goal of your MVPs. To identify the necessary features you must also get in touch with the MVP product development consultants.

3. UI/UX Design

Fintech app solutions require an intuitive user interface design allowing the users to easily navigate through the mobile app, accessing every feature and functionality for the same. Design plays a major role in creating user trust, making the finance management tasks much easier and hassle-free.

4. MVP Development

After you have identified the best possible measures. These are development platforms to craft an MVP for personal finance management tools. The next phase is to start the coding process. That is carried out by the fintech app developers, who process with the coding standards. Making the necessary features functional for the individuals. Resulting in the creation of robust personal finance management mobile apps.

5. Testing

Comprehensively testing every aspect and functioning of MVPs is a must. For the identification of the major bugs and errors that were mistakenly impounded by the fintech app developers. Identifying such errors and making improvisations and necessary changes are necessary. Ensuring the smooth functioning of the mobile app, that’s what the testing process comprises.

6. Launch

When you are done with the testing and the application is ready and approved by the developers. Now you can easily go with the launching process for the same. For the same, you can utilize a perfect launch plan, introducing your MVP to target audiences. Also, you can implement marketing measures for the promotion of your MVP in your target market, making the users aware of your app.

7. Feedback Iteration

Creating user feedback channels for getting real-time insights about the actual requirements of the users. With this, you can easily get and analyze the user’s feedback for your applications, making the necessary changes for the same. You can also prioritize the features according to the user’s needs and preferences.

Related Blog: Personal Finance App Development: Costs, Key Features and Factors to Consider

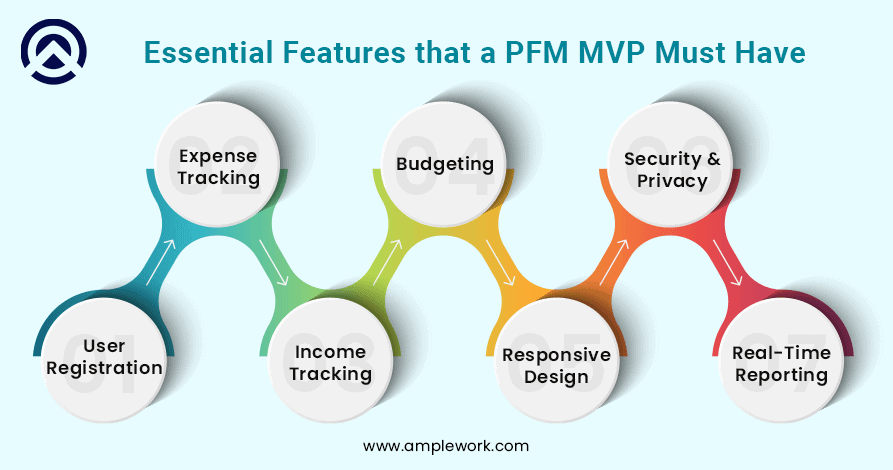

Essential Features Than an MVP for Personal Finance Management Tools Must Have

1. User Registration

Allow the users to set up their accounts while facilitating MVP Software Development. Making them set their profile according to their preferred terms. This feature allows the registered users to add their personal information about their incomes, expenditures, savings, and other financial preferences and future planning. You must provide them with a feature of profile personalization according to their preferences and needs as well.

2. Expense Tracking

Providing a simple interface that automatically detects the outflows of the finances from the user’s accounts is a must. With this feature, you can allow the users to set the recurring expenses for enhancing expense monitoring.

3. Income Tracking

Implementing the feature to track the inflows of the finances that is the income of the individuals allows them to effectively identify the actual sources where they are generating the incomes on a daily, monthly, or yearly basis. Tracking the actual income leads the solutions to provide the users with real-time insights about their actual gains and losses.

4. Budgeting

In custom fintech app development, implementation of the feature that helps the users in effective budgeting. Helps them save their money with efficiency. With this feature, they can easily set up limits on their expenditures. Providing them with alerts or notifications whenever any individual exceeds their spending limits. This helps them in saving their money which was incurred in unnecessary aspects.

5. Responsive Design

Ensure that the MVP mobile app for personal finance management should be responsive enough. Making it easily accessible for the users even when they access the app from different devices having different screen sizes.

6. Security and Privacy

We all understand that implementing the security layers is a must for personal finance management solutions. Adding the extra layers of security to your mobile app makes it more secure against various security threats, preventing the user’s personal information from unauthorized access or data breaches.

7. Real-time Reporting

Providing the users with simple reports, offering the users insights about their spending and saving patterns. This offers them a great idea about the aspects, whether they are saving the money or spending it all. You should use charts and graphs for the same that are easily understandable for the individuals instead of generating theoretical or textual reports.

Also Read: Revolutionizing Finance: Complete Guide For Fintech App Development

Conclusion

With this blog, we have understood that the goal of an MVP is to simply validate the concept of your product. With a minimal number of core features and improvisations based on user-generated feedback and the latest trends. MVP development can help your business enhance your personal finance management tools. To meet the latest evolving needs and requirements of the users. We have made you aware of the must-have features that a personal finance app might comprise. Building the MVP can be a difficult task for individuals unaware of the same. We also have provided you with the essential step-wise process to create a robust MVP for personal finance business solutions.

With the help of a Reliable and well-known MVP app development company in USA, that is Amplework. The MVP Software Development, process can be much smoother and hassle-free. We possess a team of talented and expert developers who offer you a range of MVP development services according to your specific industry. Our experts work closely with your organization. Understanding your future goals and perspectives to craft a custom MVP solution. That best fits your specific business requirements. So what you are waiting for, we are here to create feature-rich and advanced MVPs for your business solutions at an affordable price range.

Read More:- Investment Required for Virtual Reality

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228