Fintech Business Model: How to Start a Successful Fintech Business

The rapid growth of technology also supported the growth of Fintech industries. Now, consumers can make quick payments through their mobile wallets to another wallet in an effective way. The growth of fin-tech industries not only enhances job opportunities but it also gives a boost to general audiences to connect with digital payments.

As per the market report of Allied Market Research, the fintech business will grow at a CAGR of 20.3% from 2021 to 2030. This report also implies that the global fintech technologies market is expected to reach at $698.48 billion.

Although, as per the report of Brimco 2023 – our world will going to experience some fascinating figures in the fintech industry. This report stated that by the year 2026, the global digital payments market will reach $11.29 trillion by 2026. Artificial intelligence (AI) and machine learning (ML) will be going to showcase their impact on fintech business models.

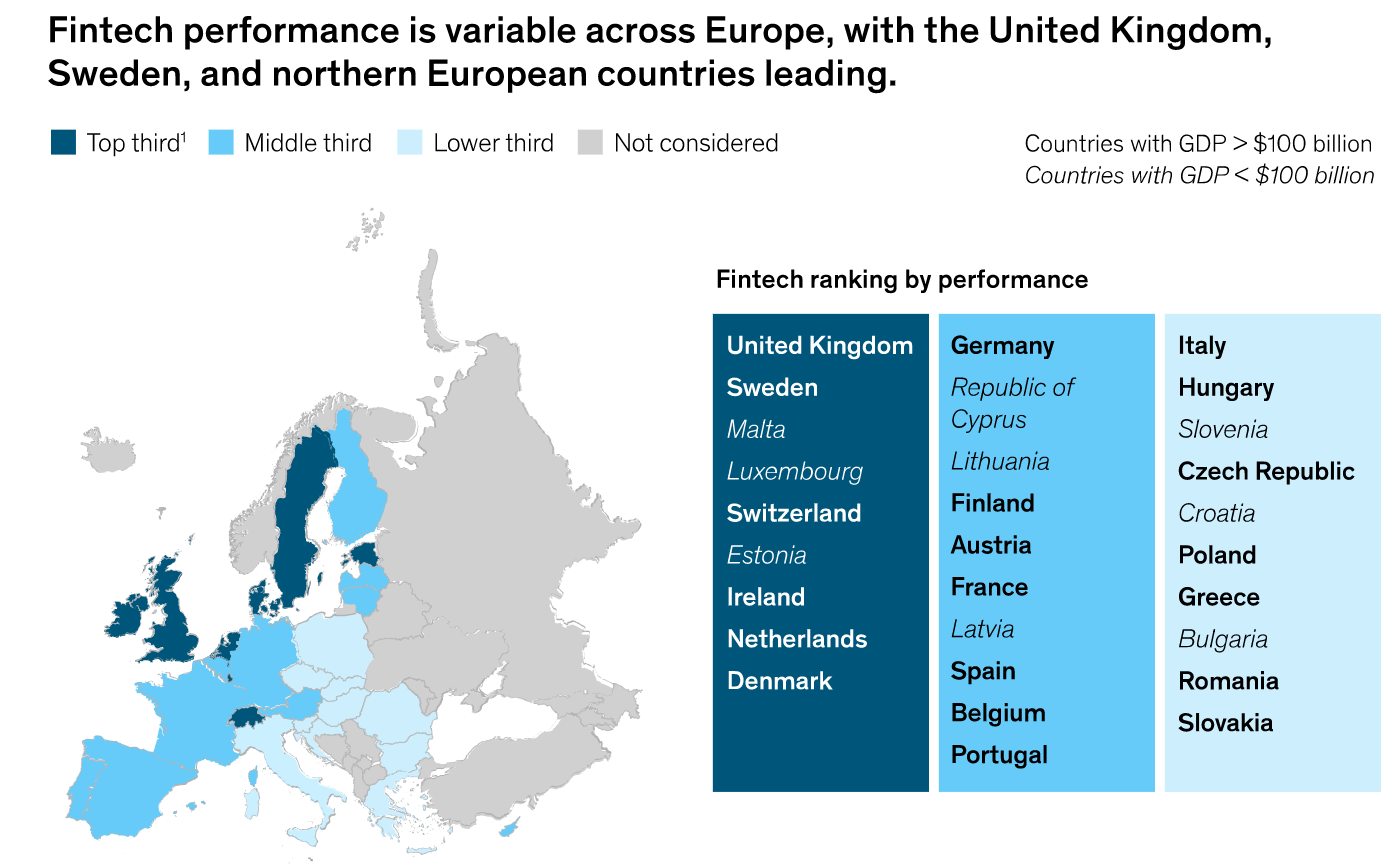

As Robo-Advisors are expected to manage a wealth of $2.8 trillion by 2023. In the year 2022, McKinsey officially introduced a report about the top-performing countries by their fintech ranking performance.

According to the official report published by Findexable – the top 5 countries that effectively drive fintech innovation forward are Switzerland, Lithuania, the USA, the UK and Singapore.

Steps to Begin the Successful Fintech Business

Starting a successful Fintech model requires extensive research and planning. To diminish your struggle, we have prepared certain key steps that will help you to give digital wings to your idea in an effective way:

Step 1: Brainstorming to observe potential existing issues

First, you need to conduct the brainstorming of ideas to figure out about the existing issues that people are facing. Now, you need to crucially analyze how your fintech operations can ease those challenges in the market.

For example: now different types of fintech companies provide the option to pay through a QR code and scanner. However, this idea might be started when an entrepreneur noticed that people are able to pay in “cash mode” only at small retail shops. Or, an entrepreneur might be noticed that people only had limited options to pay money (credit card & net banking). As a result, entrepreneurs come up with an idea for making mobile payments to pay money through QR codes.

In this way, you also need to conduct a brainstorming of ideas to figure out potential issues that can be rectified through your fintech product. For example: if you are “targeting small businesses” then search for the best fintech for small businesses and create a useful fintech product for them.

Read More: Best Strategies to Get First 1 Million Downloads for Your App

Step 2: Market segmentation – define your targeted audiences

In the next step, you need to define your targeted audiences. Now, here a question arises what is the best way to identify the targeted audiences? To answer this question, we like to add a brief discussion about our own strategy that we use to identify our targeted audiences.

To identify the targeted audience, we conduct a detailed market segmentation. In this approach, we make a detailed analysis by distinguishing our targeted audiences on the bases of their location, income segment, age, education, behavior, lifestyle, etc.

Important Note: if you’re an MBA graduate with a specialization in Marketing then must be aware of the concept of “marketing segmentation”. So, with marketing segmentation, you need to judge your audiences on the basis of their demographic variables as well as psychological variable. However, if you’re not aware of this strategy then you can take use of our above mention strategy.

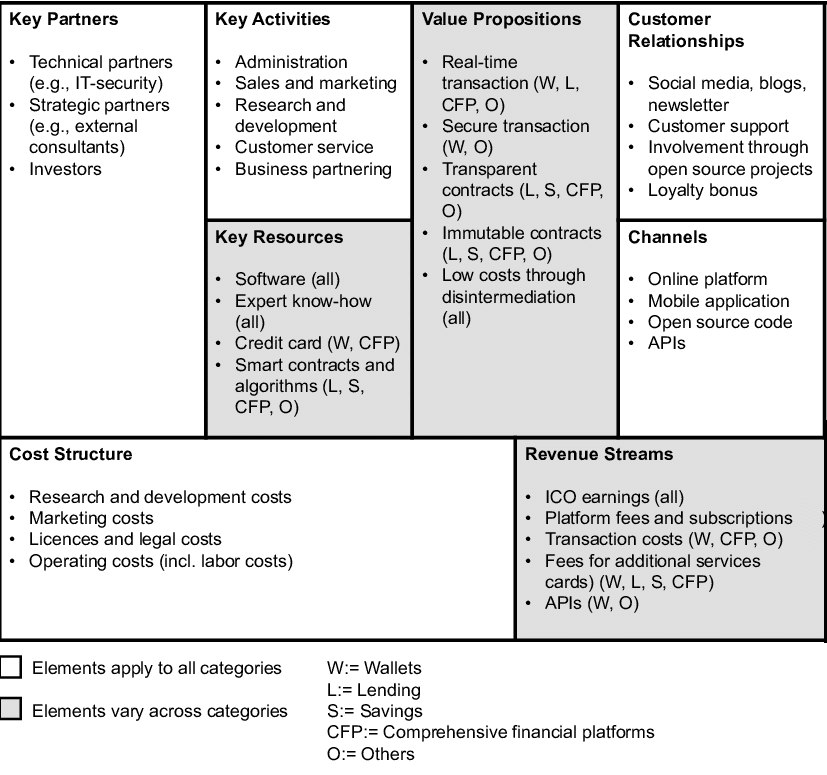

Step 3: Use business model canvas

Now, you need to incorporate the 9 foremost elements of the business model canvas. You need to make sure about these criteria:

- A. Key Partners.

- B. Key Activities.

- C. Key Resources.

- D. Cost Structure.

- E. Value Proposition.

- F. Revenue Streams.

- G. Customer Relationships.

- H. Channels.

- I. Customer Segments.

The use of a business model canvas will help companies to get a widespread snapshot of every aspect of their business. So, for fintech solutions, you can use business model canvas and you can even connect with us to fetch out results.

Step 4: Build a team

Now, you need a team of developers to give shape to your digital visions. In this step, you need to make an extensive list to make sure how much developers and team strength you require for appropriate results.

| Role | Number of Team Members |

| Business Analysts | 1-2 |

| Developers | 1-10+ |

| Designers | 1-2 |

| Data Analysts | 1-2 |

| Security Experts | 2-4 |

| Marketing Experts | 1-2 |

Step 5: Build an MVP

Building a Minimum Viable Product (MVP) is a key step in developing a successful product or service, whether it’s in the tech industry or not. An MVP is the most basic version of a product that can be released to the market to test its viability and gain feedback from customers. The purpose of an MVP is to validate the assumptions about the product idea and test its feasibility before investing significant resources into its development.

Step 6: Launch your fintech product in the market

Once, your MVP is completed analyze the results in the real-time market. On the bases of the market results, you need to launch your product. Although, in this stage, it is important that you first conduct extensive pattern analysis to figure out specific use cases. Then on the bases of the MVP results, you can launch your product in the market for results.

In reality, it is a fact that now many companies are actively looking to test their ideas in the real-market scenario by developing appropriate MVPs. So, if you should also focus on MVP development before launching the product in the market. On the bases of the MVP results, you can make a judgment on whether you need to add a certain level of features in your product or you need to eliminate them. Although, we provide affordable MVP solutions in USA that provide you with a key competitive advantage.

Step 7: Analysis of the data to figure out specific behavioral patterns

Once your product is launched then you need to again focus on the process for analyzing results. As the process of analyzing results (time-to-time at frequent intervals) will help you to figure out about your consumer’s demands and requirements.

In the fintech industry, the demand of consumers evolves quickly thus it is important that your audiences are getting personalized solutions. In this case, you need to evaluate the data after launching the project. With the help of your data analytics and data scientists, you can identify reliable patterns.

7 Monetization Strategies for Fintech Applications

Once you developed your fintech product or service then there are various monetization strategies that you can use to create wealth. We are presenting top monetization methods that you can use for generating income from your fintech application or website:

#1: Transaction Fees

If you’re running a payment gateway then you can ask your audiences for paying minor transaction fees for completing the transaction. In this way, you can make an additional income stream. However, it is important that your payment gateway should be completely secure and your consumers should trust your payment gateway window.

Although, ecommerce marketplace app development can also generate transaction fees for you. We can develop a platform for you with proper APIs and security patches to make it highly secure and optimized.

Read More: 101 Top Mobile App Ideas 2023 for Startups

#2: Subscription Fees

Fintech companies can charge subscription fees by offering premium features or services to their customers. These premium features can include access to exclusive content, personalized financial advice, advanced budgeting tools, and other value-added services that go beyond the basic features of the product.

#3: Interchange Fees

Interchange fees are fees charged to merchants for accepting credit or debit card transactions. Fintech startups can earn a portion of the interchange fee by acting as a payment processor or intermediary between the merchant and the card issuer. This monetization strategy is particularly useful for fintech startups that offer point-of-sale solutions or merchant services.

#4: Loan Interest Income

If your fintech application is providing loans, you can earn interest income on the loans. Fintech startups can either act as a lender or partner with traditional lenders to provide loans to their users. This monetization strategy is particularly useful for fintech startups that offer personal loans, small business loans, or peer-to-peer lending services.

#5: Partnership & Integration Fees

Fintech startups can earn revenue by partnering with other companies or integrating their products or services with other platforms. For example, a fintech startup could partner with a traditional bank to offer its users access to the bank’s services. Alternatively, a fintech startup could integrate its product or service with a popular e-commerce platform to expand its reach.

This monetization strategy is particularly useful for fintech startups that offer APIs or SDKs for integration. Although, to develop a platform with advanced APIs and secure solutions you can hire full stack developers in USA.

#6: Trading Fees

If your fintech application is providing trading services, you can earn revenue by charging trading fees. Trading fees are charged to users each time they buy or sell securities through the fintech application. This monetization strategy is particularly useful for fintech startups that offer robo-advisory or online brokerage services.

#7: Advisory Fees

Fintech startups can earn revenue by offering advisory services to their users. Advisory fees are charged to users for financial advice, investment recommendations, or other consulting services. This monetization strategy is particularly useful for fintech startups that offer financial planning or investment management services.

Conclusion

In conclusion, starting a successful fintech business requires careful planning, market research, and a strong understanding of the industry. It’s important to identify a unique value proposition and target audience, as well as to build a solid team with expertise in technology and finance. Fintech startups also need to navigate complex regulatory frameworks and establish trust with users to succeed.

At Amplework, our developers incorporate prowess into developing fintech business solutions for companies. We are known in the market for developing highly secure and optimized business solutions. So, connect with our developers to experience result-oriented performance.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228