Essential Considerations and Strategies for Your Fintech MVP

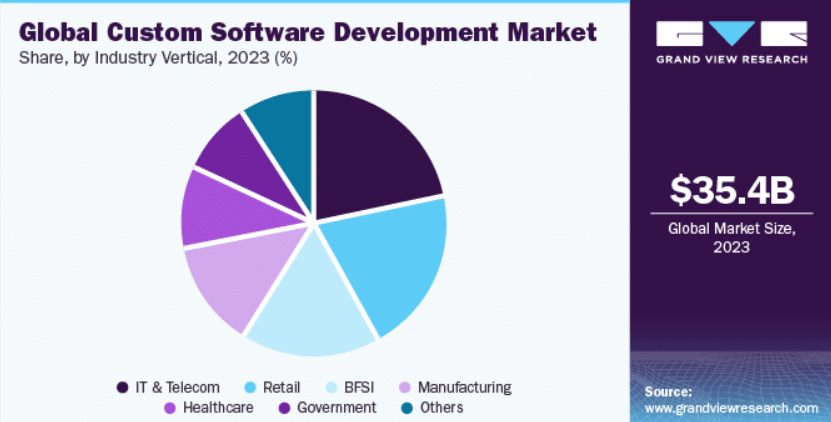

In the contemporary landscape, establishing a business no longer demands abundant resources. With the right skill sets and a modest budget, one can transform a business idea into reality. Consider envisioning a groundbreaking digital or app product capable of revolutionizing current living and working conditions. To bring such an innovative concept to life, embracing the Minimum Viable Product (MVP) approach proves transformative, offering numerous advantages for the development of fintech applications. MVPs, the initial versions of applications or digital platforms, prioritize essential functionality, leveraging cost-effective advanced technology. This approach entails core product functionality, efficient customer relationship management, regular updates, and minimized development costs. research data further underscores the significance of these aspects in the same vein. The research data by Grand View Research highlights the same aspect.

As shown in the figure above, the global software development market was valued at USD 35.4 billion in 2023. Further, this market is expected to grow at a CAGR of 22.4% within the time frame of 2023 to 2030. The integration of the MVP approach works as a threshold asset that makes sure that you start the business with effective growth. This indicates that any business idea that is willing to start from ground zero then MVP app development leads to additional business value and many other benefits. There are many contributing factors to the development of MVP-based platforms and customer feedback is considered the most important one.

Blog Highlights

No doubt MVP is the technology that can provide ease to various startups in which early customers play a major role. This blog is all about how essential considerations and strategies of the development process can enhance MVP-aided FinTech products. Highlighting the role of these strategies and considerations for successful MVP app development and step-by-step product iterations. Give this a quick read and adapt the practice of best fintech app development.

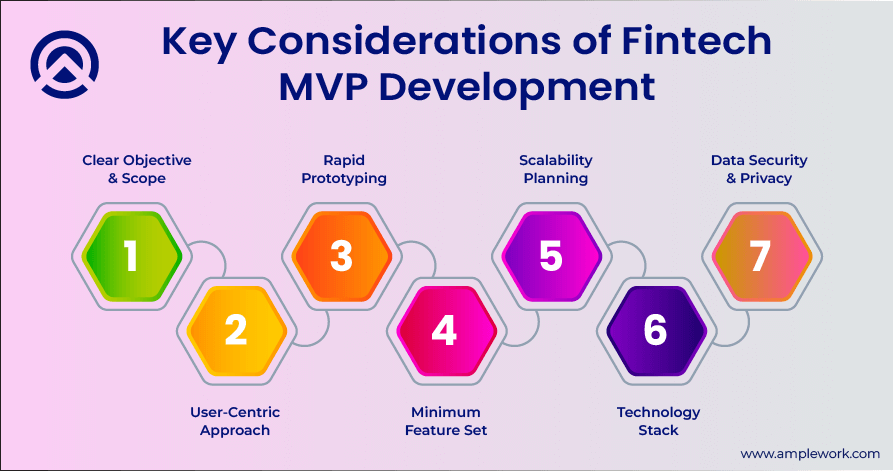

Key Considerations of Fintech MVP Development

1. Clear Objective & Scope

Before initiating Minimum Viable Product (MVP) development, meticulous planning is paramount. Define concise objectives and a well-structured scope, articulating the precise problem your fintech MVP addresses and the essential features it incorporates. This strategic clarity not only mitigates the risk of scope creep but also concentrates development efforts on core functionalities. Undertake thorough market analysis and user persona creation to align your product with market needs. Prioritize features judiciously, emphasizing those that deliver maximum value. Explicitly outline the scope to prevent feature bloat, facilitating an efficient allocation of resources. Establish measurable Key Performance Indicators (KPIs) to gauge success and guide ongoing improvements.

2. User-Centric Approach

Centering the user in fintech MVP development is pivotal. Immerse yourself in understanding the target audience. Delve into their pain points and craft MVP features tailored to their needs. Embed regular user feedback and testing seamlessly into the development cycle, forming a continuous loop of refinement based on authentic user experiences. This user-centric approach ensures that the MVP resonates with the intended audience, enhancing usability and satisfaction. Prioritize user empathy in design thinking, anticipating and addressing user concerns throughout the development journey. By consistently incorporating user perspectives, you foster a dynamic development process that aligns the fintech MVP closely with user expectations, fostering product success.

3. Rapid Prototyping

Fintech MVP development is synonymous with agility and efficiency. Employ rapid prototyping techniques to swiftly generate and test rudimentary versions of your product. This iterative methodology establishes swift feedback loops, facilitating the early detection of flaws and timely adjustments. By prioritizing speed, you accelerate the learning curve, ensuring that your product evolves rapidly in response to user insights. Embrace a culture of continuous improvement, where each iteration builds on the lessons learned from the previous ones. This dynamic and responsive approach not only expedites the development cycle but also enhances the adaptability of your fintech MVP, aligning it more closely with evolving market demands.

4. Minimum Feature Set

The crux of a fintech MVP lies in its simplicity. Pinpoint the minimum set of features essential to tackle the core problem at hand. Resist the allure of incorporating unnecessary bells and whistles. The objective is to furnish a functional product that fulfills its primary purpose with the least possible development effort. By adhering to this minimalist philosophy, you streamline the development process, ensuring that resources are allocated judiciously. This focused approach not only expedites time-to-market but also allows for a quicker and more targeted response to user feedback, fostering an iterative cycle of improvement with a foundation rooted in simplicity.

5. Scalability Planning

While emphasizing a minimal feature set, it’s crucial to factor in the scalability of your product. Strategically plan for future growth and be ready to scale the fintech MVP in response to escalating user demands. This foresight not only accommodates the evolving needs of your user base but also ensures a seamless transition to a fully-featured product once validation and market acceptance are achieved. Balancing simplicity with scalability safeguards against potential bottlenecks and allows your fintech MVP to evolve organically, adapting to increased usage and expanding market opportunities. This forward-thinking approach lays a robust foundation for sustained success beyond the initial fintech MVP software development phase.

6. Technology Stack

Selecting an apt technology stack is pivotal for aligning with development goals and future scalability plans. Opt for technologies that facilitate swift development cycles and seamless integration of new features. Prioritize factors like maintainability, scalability, and the availability of skilled developers within your chosen stack. This strategic tech selection not only expedites the fintech MVP development process but also positions your product for long-term success. The chosen stack should serve as a robust foundation, supporting the evolution of your product as it grows. By anticipating future needs and aligning technology choices accordingly, you enhance the agility and adaptability of your development endeavors.

7. Data Security & Privacy

In the embryonic stages of your MVP, safeguarding data security and privacy is non-negotiable. Integrate robust security measures to fortify user data protection and guarantee adherence to pertinent regulations. Prioritizing these aspects from the outset is not just a compliance necessity but a strategic move to establish trust can be a fundamental pillar for long-term success. User confidence in the confidentiality and integrity of their data is paramount for adoption and sustained engagement with your product. Through the incorporation of advanced encryption, authentication protocols, and privacy-focused practices, you not only meet regulatory standards but also signal a commitment to user trust, cultivating a strong and resilient foundation for your product’s enduring success.

Also Read: A/B Testing for MVPs: Data-driven Decisions for Product Success

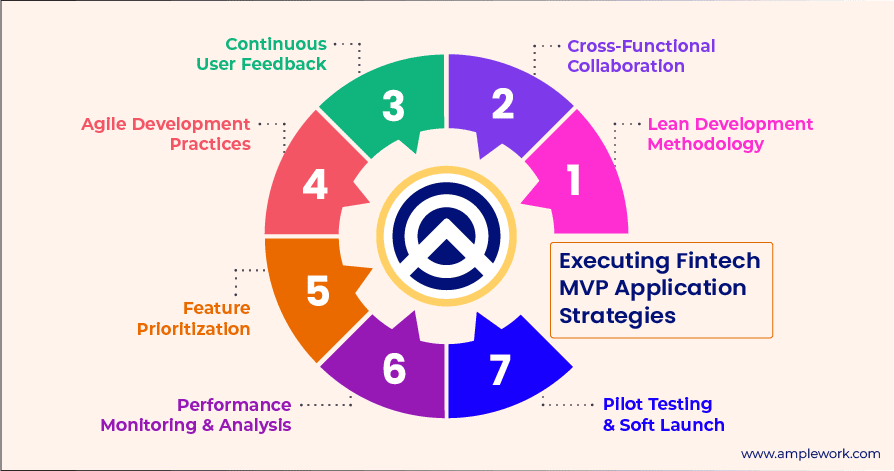

Implementing Strategies of Fintech MVP Applications

1. Lean Development Methodology

Embracing a lean development approach is pivotal for the success of your fintech MVP. Prioritize efficiency by trimming away unnecessary steps, honing in on the essentials, and expeditiously delivering value. Wholeheartedly embrace the build-measure-learn cycle, fostering a culture of rapid iteration. This approach empowers your team to swiftly respond to user feedback and adapt to dynamic market changes. By prioritizing speed and constant refinement, you not only accelerate the product development lifecycle but also enhance your product’s responsiveness to user needs. A lean mindset enables your team to optimize resources, minimize waste, and maximize the impact of each development cycle, steering your fintech MVP towards heightened efficiency and enduring success.

2. Cross-Functional Collaboration

Cultivating collaboration among cross-functional teams developers, designers, and product managers is paramount for the triumph of your fintech MVP. Advocate for open communication and instill a sense of shared ownership in the success of the project. This collaborative ethos ensures a holistic perspective, drawing on the diverse expertise of each team member and fostering a synergy that leads to more well-rounded solutions. By breaking down silos and encouraging interdisciplinary collaboration, you create an environment where ideas flow seamlessly, innovation thrives, and the collective intelligence of the team converges to produce a more comprehensive and refined Minimum Viable Product. This collaborative approach lays the groundwork for a successful, integrated, and harmonious development journey.

3. Continuous User Feedback

Actively soliciting and integrating user feedback is a linchpin of successful FinTech MVP development. Employ tools and processes that streamline regular user testing, ensuring a continuous flow of valuable insights. This iterative feedback loop proves invaluable for honing features, ironing out usability issues, and aligning the product precisely with user expectations. By maintaining a responsive approach to user input throughout the development journey, you not only enhance the overall user experience but also demonstrate a commitment to meeting and exceeding user needs. This user-centric strategy ensures that your Minimum Viable Product evolves dynamically, incorporating real-world insights and consistently aligning with the ever-evolving expectations of your user base.

4. Agile Development Practices

Integrating agile development practices is essential to amplify flexibility and responsiveness in MVP development. Deconstruct the development process into manageable sprints, each geared towards producing tangible results. This iterative and incremental approach serves as a dynamic framework, enabling rapid adjustments based on evolving requirements and emerging insights. By adopting agility, your team gains the capacity to swiftly adapt to changing circumstances, ensuring the product remains finely attuned to evolving objectives and user expectations. This systematic approach not only heightens responsiveness but also cultivates a culture of continuous enhancement, empowering the team to iterate quickly and furnish a more polished, user-focused Minimum Viable Product.

Also Read:- Launching an MVP for Startups

5. Feature Prioritization

Prioritizing features based on their impact on solving the core problem is paramount. Identify the minimum feature set essential for the fintech MVP to deliver substantial value to users. This strategic approach ensures that development efforts concentrate on indispensable functionalities, mitigating the risk of unnecessary complexity. By honing in on the key elements that directly address the identified problem, you streamline the mobile development process, optimize resource allocation, and expedite time-to-market. This methodical prioritization not only enhances the efficiency of fintech MVP development but also underscores a commitment to delivering a product that resonates with users by focusing on what truly matters to them.

6. Performance Monitoring & Analysis

Integrating robust performance monitoring and analytics tools is crucial for tracking user engagement, feature usage, and other pertinent metrics in your FinTech MVP. Analyzing this data yields valuable insights into user behavior, empowering data-driven decisions for future feature enhancements and the overarching product strategy. By leveraging these tools, you not only gain a comprehensive understanding of how users interact with your product but also uncover areas for improvement and innovation. This data-driven approach enhances the precision of decision-making, allowing your team to iteratively refine the fintech MVP, aligning it more closely with user preferences and market demands for sustained success.

7. Pilot Testing & Soft Launch

Contemplate the prospect of conducting pilot tests or a soft launch for your fintech MVP with a limited audience. This strategic approach enables the collection of real-world feedback in a controlled environment, facilitating the identification of potential issues and making necessary adjustments before a broader release. A pilot test acts as a preemptive measure, allowing your team to validate the product in an authentic market scenario. This controlled exposure not only helps in fine-tuning the user experience but also minimizes the impact of unforeseen challenges during the full-scale launch, ensuring a more seamless and successful introduction of your fintech MVP to the broader audience.

Read more: Prototype vs MVP vs PoC (Proof of Concept): What to Choose?

Conclusive Outlines

The incorporation of your first FinTech MVP signifies a pivotal step in navigating the landscape of financial technology, bringing forth essential considerations and strategies for success. It becomes paramount to ensure robust protection for your financial data as you embark on the development of this MVP. These strategies provide a diverse array of comprehensive tools specifically designed to meet the unique needs of the FinTech industry. The growing demand for secure and efficient financial solutions has motivated forward-thinking FinTech developers and financial institutions to prioritize the security and advancement of their processes. Despite initial challenges faced in this domain, many have successfully positioned themselves as trailblazers in FinTech MVP development. In today’s dynamic FinTech landscape, the creation of your first MVP has become increasingly accessible.

Related Blog:- How to align test automation with Agile and DevOps?

Amplework emerges as a leader in the realm of FinTech development, boasting over 5+ years of immersive experience. We possess the capability to develop and recognize the critical importance of MVP innovation in revolutionizing financial technology. Our dedicated team consistently exceeds client expectations, establishing a reputation for reliability and trustworthiness. Having achieved significant milestones by supporting various FinTech entities, we adhere to the highest standards of security and innovation. Explore our website to uncover the exceptional MVP development services we offer in the FinTech sector. Partner with Amplework to embark on a transformative journey in the realm of your first FinTech MVP: Essential Considerations and Strategies.

Also Read:- Dating App Development with MVP

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228