Empowering Personal Finance Management with Large Language Models (LLMs) in Financial Services

The financial technology (Fintech) industry has experienced explosive growth over the past few years. Emerging technologies like Artificial Intelligence (AI) are at the heart of this transformation. In particular, Large Language Models (LLMs) such as GPT-3, BERT, and FinBERT are reshaping personal finance management. They especially impact the realm of investing. Large Language Models in fintech open doors for personalized financial advice and optimized investment strategies. They also create seamless user experiences tailored to each user’s unique financial goals and risk tolerance.

Managing personal finance, especially investing can be an overwhelming task for many people. From understanding market trends to determining the right investment portfolios, individuals often struggle with information overload. This is where LLMs come into play, and LLMs in fintech are simplifying complex financial concepts and offering personalized recommendations based on user data.

In this blog, we will examine how LLMs are empowering end users to take control of their personal finances, focusing specifically on investing. We will explore the key applications of LLMs in Fintech, how they are helping end users make informed investment decisions, and their future potential in shaping personal finance management.

How LLMs Are Reshaping Personal Finance Management for End Users

Large language models in fintech are transforming how people manage their finances by providing more personalized, efficient, and accessible tools for investing. Traditional financial advisors, while still valuable, are increasingly being supplemented by AI-driven solutions that allow users to make informed decisions without the high costs associated with human advisors.

1. Personalized Investment Advice

One of the most significant ways LLMs are helping individuals manage their finances is through personalized investment advice. LLMs in fintech can analyze a user’s financial situation, risk tolerance, and long-term goals to provide tailored recommendations. By parsing through large datasets of market trends, historical performance, and asset classes, these artificial intelligence models offer valuable insights. They help users choose the right investments.

According to Deloitte, AI-driven personalized financial tools can increase user engagement by up to 20%. Individuals are more likely to take action when recommendations are customized to their specific needs.

Example:-

Betterment is a leading robo-advisor platform, that utilizes AI-driven algorithms to offer users personalized investment portfolios. These portfolios are designed based on the user’s risk tolerance, financial goals, and timeline.

2. Simplifying Complex Financial Concepts

Investing can often seem complex to individuals who are not familiar with financial markets, asset classes, or portfolio management. LLMs in fintech simplify these concepts by providing clear and easy-to-understand explanations. Users can ask questions about different investment options and the risks associated with certain assets. They can also inquire how market volatility might impact their portfolio. LLMs can deliver digestible answers in real-time.

A survey by Investopedia revealed that 67% of individuals are more likely to invest when financial information is simplified and explained in layman’s terms. LLMs are making financial literacy more accessible, which, in turn, encourages more people to participate in the markets.

Example:-

NerdWallet is a platform where users can ask financial questions related to investing, personal finance, or debt management. Powered by AI models, NerdWallet provides personalized answers based on the user’s specific financial situation. This helps users make informed financial decisions without navigating complex jargon.

3. Automated Portfolio Management

Large language models in fintech are also driving advancements in automated portfolio management, allowing users to set investment goals, such as saving for retirement or a major purchase, and letting AI-powered systems manage their investments on autopilot. These systems continuously monitor the markets, rebalancing portfolios based on market movements or changes in the user’s financial goals.

Research by The Financial Times shows that robo-advisors that use AI-driven portfolio management have outperformed human-managed portfolios by 5-10% over the past five years, especially during volatile market conditions.

Example:-

Wealthfront uses LLMs to automate investment portfolios for its users. By collecting data on user preferences, market trends, and economic conditions, Wealthfront’s AI engine manages portfolios with minimal user intervention, ensuring that they are optimized for growth and risk management.

Key Applications of LLMs in Personal Finance and Investing

LLMs in fintech are transforming how end-users approach investing by providing tailored, data-driven insights and personalized tools that take the complexity out of managing investments. Below, we explore some of the most impactful applications of LLMs in personal finance, with a focus on investing.

1. Real-Time Market Analysis and Sentiment Detection

LLMs are capable of processing vast amounts of financial news, social media chatter, and market reports in real time to detect trends and sentiment. This is especially useful for individual investors who want to stay informed about market conditions and make timely decisions.

A study by PwC found that 75% of investors believe that real-time data and sentiment analysis can improve their investment decisions. LLMs enable this by analyzing both quantitative and qualitative data to provide timely, actionable insights.

Example:-

Robinhood has integrated AI-driven tools that provide users with real-time market updates and sentiment analysis. By parsing news articles and social media posts, Robinhood gives users insights into how the market is reacting to specific stocks, enabling them to make informed investment decisions.

FinBERT, a financial-specific language model, is trained on financial data to analyze news articles and social media posts for sentiment related to particular stocks or market events.

2. Managing Risk and Volatility

Investing comes with inherent risks, particularly in volatile markets. LLMs can help end users manage these risks by continuously analyzing market data and providing recommendations on how to adjust their portfolios. For example, during periods of high volatility, large language models in fintech may recommend shifting investments into safer assets, such as bonds or stable value funds, to protect against significant losses.

According to BlackRock, AI-powered risk management tools can reduce portfolio volatility by up to 30%, especially during periods of market turbulence. LLMs’ ability to constantly assess market conditions helps protect user investments from large-scale losses.

Example:-

Ally Invest uses AI models to analyze market volatility and automatically adjust users’ portfolios based on their risk tolerance. This allows users to benefit from algorithmic risk management without needing to constantly monitor the markets.

3. Personalized Investment Portfolios

LLMs in fintech have also made it easier for individual investors to create and maintain personalized investment portfolios. By analyzing user data such as age, financial goals, income level, and risk tolerance LLMs recommend asset allocations that are optimized for growth while aligning with the individual’s specific needs.

A study by Morningstar showed that personalized investment portfolios generated by AI can deliver a 2-3% higher return compared to traditional, non-personalized portfolios. LLMs in fintech help optimize asset allocation by taking into account a user’s unique financial situation.

Example:-

Fidelity uses AI models, including LLMs, to offer personalized portfolio recommendations. By collecting data on the user’s financial profile, Fidelity’s AI engine creates custom investment strategies that align with the individual’s long-term goals.

4. Automating Savings and Investment Strategies

LLMs in fintech are increasingly being used to help users automate their savings and investment strategies. By analyzing cash flow data and spending patterns, LLMs can determine how much a user can afford to save or invest each month, automating transfers to investment accounts or savings plans. This hands-off approach ensures that users stay on track with their financial goals, even if they aren’t actively managing their finances daily.

A report by JPMorgan Chase found that users who automate their savings and investments tend to save 30% more compared to those who manage their savings manually. LLMs streamline this process, helping users reach their financial goals faster.

Example:-

Acorns is an app that uses AI-driven models to round up users’ purchases to the nearest dollar and automatically invest the spare change in personalized portfolios. The system’s use of LLMs ensures that users are continuously investing small amounts without needing to take manual action.

5. AI-Powered Financial Education and Planning

One of the most important aspects of managing personal finance is education. Many individuals shy away from investing due to a lack of knowledge or fear of making poor financial decisions. LLMs, however, are being used to bridge the gap by offering personalized financial education and planning tools that empower users to take control of their finances.

By analyzing a user’s current financial situation, goals, and risk tolerance, LLMs in fintech can provide tailored advice and educational content. This can range from explaining basic investing concepts, such as the difference between stocks and bonds, to offering more advanced strategies for optimizing investment portfolios.

A survey by Bankrate found that 44% of Americans avoid investing due to a lack of understanding about financial markets. By offering tailored educational resources, LLMs can demystify investing and empower individuals to make informed financial decisions, leading to increased participation in the markets.

Example:-

Robo-advisors like Ellevest use AI-driven tools to offer personalized financial education alongside investment management. By catering to the specific financial literacy levels of their users, platforms like Ellevest help individuals build confidence in managing their finances.

Challenges and Ethical Considerations in Implementing LLMs for Personal Finance

While LLMs offer immense potential to simplify personal finance management, particularly in investing, they also come with challenges and ethical considerations that need to be addressed. Some of these challenges include data privacy, algorithmic bias, and ensuring transparency in AI-driven financial advice.

1. Data Privacy and Security

For LLMs to provide personalized financial advice, they must analyze vast amounts of personal data, including spending habits, income, and investment portfolios. This raises significant concerns about data privacy and security, especially in an era where data breaches are becoming increasingly common. To overcome this issue, you can take the help of a fintech app development services provider.

To address these concerns, Fintech companies must implement strict security protocols, such as encryption and secure data storage, to protect user information. Moreover, using privacy-preserving technologies like federated learning—where LLMs are trained on decentralized data—can help minimize the risk of data exposure.

Example:-

Google’s TensorFlow Federated framework allows for the development of AI models that can learn from decentralized data, ensuring user privacy is maintained without compromising the accuracy of the model.

2. Algorithmic Bias and Fairness

Another challenge facing LLMs in personal finance is the issue of algorithmic bias. Since LLMs are trained on historical data, there is a risk that they may inherit biases present in that data. For example, investment models might disproportionately favor certain demographics or financial products based on historical trends, leading to unequal outcomes for different user groups.

To mitigate bias, Fintech companies must ensure that LLMs are trained on diverse datasets and continuously audited for fairness. This includes applying techniques such as adversarial debiasing to identify and correct biases in the models’ recommendations.

Example:-

Zest AI uses AI models designed with fairness in mind, ensuring that financial products such as loans and credit are offered equitably to all demographics.

3. Transparency and User Trust

As LLMs take on a larger role in managing personal finances, ensuring transparency is crucial. Users must understand how their financial data is being used and how investment recommendations are generated. A lack of transparency can lead to mistrust and hesitancy in adopting AI-driven financial tools.

Fintech platforms should prioritize explainability in their AI models, providing users with clear insights into why specific investment recommendations are made. This can be achieved through explainable AI (XAI) techniques that help users understand the logic behind AI-driven decisions.

Example:-

Klarna, a leading Fintech company, provides users with detailed breakdowns of how their financial data is used to recommend personalized financial products and services, fostering greater trust in their platform.

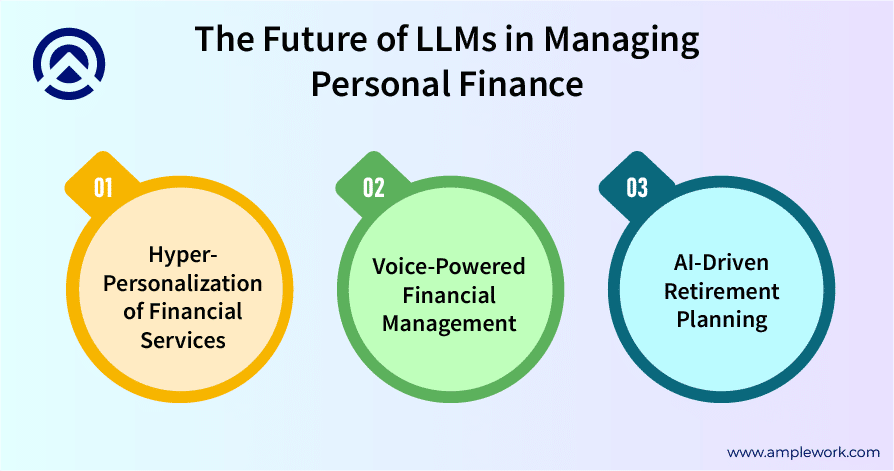

The Future of LLMs in Managing Personal Finance

As LLMs continue to evolve, their role in personal finance management, particularly in investing, will become even more impactful. Several emerging trends suggest that LLMs will not only provide more personalized financial services but will also reshape how individuals engage with their finances.

1. Hyper-Personalization of Financial Services

The future of LLM in Fintech is centered around hyper-personalization. As AI models become more advanced, they will be able to offer highly individualized financial advice, taking into account not just a user’s financial situation, but also their life events, preferences, and long-term goals. This level of personalization will help users make more informed decisions, where personalized investment strategies and savings plans will be a key differentiator for fintech platforms.

According to Accenture, 91% of consumers are more likely to shop with brands that offer personalized experiences. This trend is expected to extend to financial services, where personalized investment strategies and savings plans will be a key differentiator for Fintech platforms.

2. Voice-Powered Financial Management

With the rise of voice assistants like Alexa and Google Assistant, LLMs will increasingly be integrated into voice-powered financial management tools. This will allow users to manage their investments, check account balances, and receive financial advice simply by speaking to their devices. Voice-powered investing will make financial management more accessible and intuitive, especially for users who are less familiar with traditional financial tools.

Example:-

Wealthsimple is developing voice-powered financial management tools that allow users to ask for real-time updates on their investment portfolios, set savings goals, and receive financial advice through voice commands.

3. AI-Driven Retirement Planning

LLMs will play an increasingly important role in helping users plan for retirement. By analyzing long-term financial goals, income, and lifestyle preferences, LLMs can create personalized retirement plans that ensure users save enough to meet their retirement needs. These AI-driven plans will adjust in real-time based on changes in market conditions, employment, and spending habits, helping users stay on track.

Example:-

Vanguard is integrating AI models to offer personalized retirement planning tools that help users maximize their retirement savings while minimizing risk.

You might also want to look at: How LLMs are Transforming the Insurance Industry in 2024

How Amplework Software Can Help You Harness the Power of LLMs in Personal Finance

As LLMs become a vital tool for managing personal finance, businesses in the Fintech space need to ensure they are leveraging this technology to its full potential. Amplework Software is a leading mobile app development company that is at the forefront of AI development, offering comprehensive LLM solutions tailored to the Fintech industry. Our services range from developing custom LLM models to integrating AI-driven tools into existing financial platforms.

Amplework Software’s Services for Fintech

- Custom LLM Development for Personal Finance Applications

Our team specializes in building custom LLM models designed to meet the specific needs of Fintech companies. Whether it’s developing AI tools for investment management, retirement planning, or real-time market analysis, Amplework’s models are tailored to provide actionable insights and personalized advice to end users.

- AI-Powered Personalization and Hyper-Personalization

Amplework helps Fintech companies develop AI solutions for startups that deliver hyper-personalized financial experiences. By analyzing user data and financial goals, we create LLM-powered platforms that offer tailored investment strategies, personalized portfolios, and automated savings plans.

- Data Privacy and Ethical AI

We prioritize the ethical use of AI, ensuring that all our models are built with fairness and transparency in mind. Our solutions are compliant with industry regulations, such as GDPR and CCPA, ensuring that user data is handled with the highest levels of privacy and security.

- Integration with Existing Financial Systems

Amplework provides seamless integration services, allowing Fintech app development companies to incorporate LLM-driven tools into their existing platforms without disruption. Our team works closely with clients to ensure that AI solutions enhance user experience while maintaining the integrity of their financial systems.

To empower your customers to manage their investments with confidence and ease, share your idea with Amplework, and they will offer you tailored solutions to enhance personal finance management by harnessing the power of LLMs.

Final Words

Large Language Models (LLMs) in fintech are transforming the way individuals manage their personal finances, especially when it comes to investing. By providing personalized investment advice, simplifying financial concepts, and automating savings strategies, LLMs are helping end users make more informed decisions and achieve their financial goals with greater ease. However, with great potential comes the need to address challenges such as data privacy, algorithmic bias, and transparency.

As a leading AI development company, we offer you the best fintech software solutions that take your idea to the next level and you get your desired results. Our experienced team of developers is well-versed in all kinds of tech stacks and trends, and they enrich your idea with top-notch specifications so that it can stay ahead of the curve. Contact us any time to give shape to your fintech idea.

Frequently Asked Questions (FAQs)

How do large language models help payment businesses?

Large language models (LLMs), such as GPT-4, BERT, and Roberta are making a significant impact in the fintech industry. They have revolutionized the fintech industry, and now, the payment business has become more efficient for end-users. Here are some of the key impacts that you get when you integrate LLMs into the payment business-

- Customer support

- Fraud detection and prevention

- Risk assessment

- Financial advice

- Efficient Onboarding

- Automated compliance and regulatory reporting

- Natural language processing (NLP) for data analysis

- Advanced Financial Advice

What are the key challenges in handling financial data?

Handling financial data is not an easy task because accessing relevant and high-quality financial data is important for the efficacy of finance large language models. Here is a list of the key challenges that occur while handling financial data.

- High training costs

- High temporal sensitivity

- High dynamism

- High-quality data requirement

- Low signal-to-noise ratio (SNR)

- Proprietary model limitations

What are finance large language models (LLMs)?

LLMs are trained on large amounts of data and can understand, generate, and interact with human language, and have become a powerful tool for the financial industry. LLMs are bringing value to the fintech industry. Financial LLMs are AI systems that use NLP (Natural language processing) and ML (Machine Learning) to analyze financial data and help with decision-making. Apart from the decision making, they can do a variety of tasks such as:

- Financial analysis

- Portfolio management

- Customer interactions

- Loan services

- Risk assessment

- Market analysis

- Trading strategies

What are the key elements of financial LLMs?

Financial Large Language Models (LLMs) are tailored to understand and process financial data, making them crucial for various financial applications like trading, risk management, fraud detection, and customer service. Here are the key elements of financial LLMs:

- Data Handling and Preprocessing

- Domain-Specific Knowledge

- Natural Language Understanding

- Quantitative Models and Predictive Analytics

- Integration with Financial Systems

- Risk and Compliance Management

- Human-Machine Collaboration

How much time does it take to train a financial LLM from scratch?

The time to train LLMs in finance depends on its size and quantity of data. It can take some days to weeks. To know the exact time according to your project, you can discuss your project with Amplework.

Why Amplework is the first choice to develop a fintech application?

Amplework is a leading AI-based mobile app development company that uses AI tools and other technologies to build your app. This way, you get innovative software solutions in a limited time. The traditional development process takes 3 to 5 months to build a fintech app. But, Amplework can offer advanced software solutions within 1 to 2 months by using custom generative AI solution. This way, you make a fast market entry and also save your development cost.

What are the prominent LLMs in financial services?

Here is the list of the popular large language models in financial services-

- GPT-4

- BERT

- FinBERT

- Bloom

- T5

- RoBERTa

How are large language models in banking revolutionizing customer service and risk management?

Large language models (LLMs) in banking are significantly transforming both customer service and risk management. By utilizing advanced natural language processing capabilities, LLMs enable banks to provide personalized and efficient customer support, automate inquiries, and enhance user experience through chatbots and virtual assistants. These models also analyze vast amounts of data, helping banks identify potential risks, detect fraudulent activities, and comply with regulatory requirements. Overall, LLMs are streamlining operations, improving decision-making, and driving innovation in banking services. That’s why the demand for large language models in financial services is increasing.

How to develop a large language model for finance?

Building a large language model (LLM) tailored for the finance industry involves leveraging vast financial datasets and advanced machine learning techniques. It’s crucial to fine-tune pre-existing models to handle domain-specific tasks, such as market predictions, fraud detection, and sentiment analysis while ensuring compliance and data security. Here is the step-by-step development process of developing a large language model for finance.

- Data Collection & Preprocessing

- Model Selection

- Fine-Tuning for Financial Tasks

- Model Evaluation & Testing

- Scalability & Infrastructure

- Compliance & Security

- Deployment & Monitoring

- Ethical Considerations

By following these steps, you can build an LLM that is capable of addressing a wide range of financial tasks, from market analysis and investment advice to risk management and customer service.

Why is a large language model used in finance?

Large language models (LLMs) are increasingly used in finance due to their ability to analyze vast amounts of data, extract insights, and make informed predictions. Here’s why they are valuable in the finance industry:

- Enhanced Decision-Making

- Risk Management

- Automation of Tasks

- Sentiment Analysis

- Customer Service

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228