Mitigating Fraud and Security Risks in Online Payment Systems

Just imagine a scenario where you are making an online payment transaction, and your payment system is not that secure and efficient. The chances of witnessing online fraud increase. Which leads to swiping and cleaning all the savings from your bank account. As technology keeps on transforming with time, optimizing the way we manage the inflows and outflows of the funds. The security risks also keep on evolving daily. Most of such risks are faced by users of fintech solutions. With the rapid growth in the fintech sector, the number of mobile payment solutions has gradually increased. According to proficient research data derived by Statista states that as of May 2023, only 11,651 fintech businesses were functioning in the USA. Around 5100 in the Asian region and approximately 9700 fintech businesses were functioning in Europe, the Middle East, and the African region.

The rapid growth in the fintech businesses has led to the gradual enhancement of the fintech app development sector. That’s the reason behind the occurrence of such fraudulent practices and security risks. In this blog, we will be discussing the potential security threats and fraudulent practices in online payment solutions. With the mechanisms to prevent or mitigate such risks and threats from your system.

Some Statistical Considerations

With the rapid growth of the fintech industry in the previous years the number of mobile banking users is also increasing daily. According to the data discovery completed by Statista, a platform that offers you research outcomes on different aspects. According to their research consideration, the number of mobile banking users is expected to increase to approximately 217 million users by the year 2025. It was recorded around 197 million at the end of year 2021. The reason behind this growth is, that online payment mobile application development leads to convenient and efficient means to transact over different places.

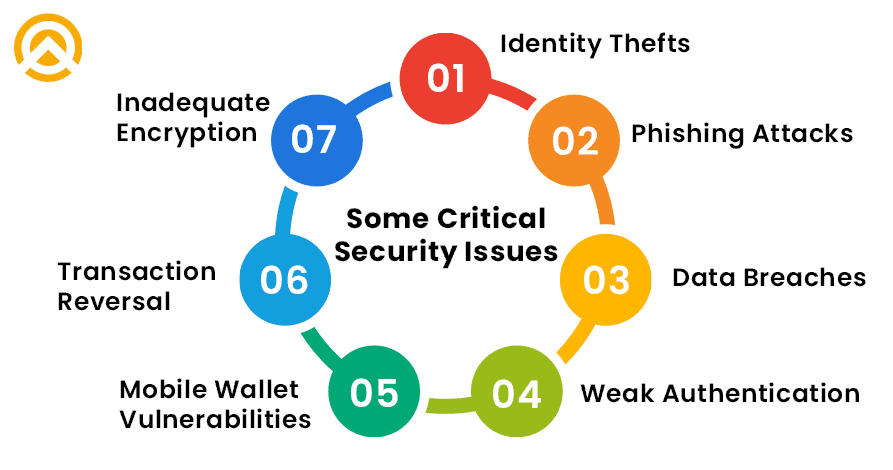

List of Critical Issues of Fraud With Online Payment Systems

Addressing some of the critical issues related to fraudulent practices and security risks to online payment systems, requires a comprehensive approach, using the latest technologies user awareness and continuous monitoring can act as the defense mechanism for such issues. Here’s a list of some serious security issues and insider threats that lead to serious damage to both individuals and payment gateway development organizations.

1. Identity Thefts:

The major cause of this threat is unauthorized access to the personal information of the users who have not prevented the same. This unauthorized access can lead to identity theft, allowing the fraudsters to make unpermissible transactions on behalf of the users. Such thefts can make you suffer huge losses while you are making online payments using an unsecured payment mechanism.

2. Phishing Attacks:

Fraudsters often create deceptive e-mails, messages, or web pages in such a way that they look just like a real payment page. It is done mainly to trick the users so that they can reveal their sensitive and confidential information like IDs and passwords or credit card or bank account details. These details can be further used by hackers to wipe off your bank account with ease.

3. Data Breaches:

Most of the payment gateways are equipped with different vulnerabilities that are responsible for compromising the payment system’s database. Resulting in the theft of large amounts of user data. After which the attackers expose such data of different individuals to further process potential fraudulent practices with those individuals. It not only causes the users to suffer huge financial losses but also compromises the payment business’s reputation in the market.

4. Weak Authentication:

Inadequate authentication mechanisms like weak or discoverable passwords in your accounts, or when the users have not implemented multi-factor authentication over their online payment platforms. Allows unauthorized users to easily access your account, resulting in the wiping up of your savings. Weak authentication can make your payment account prone to data breaches and security issues.

5. Mobile Wallet Vulnerabilities:

Data security vulnerabilities in mobile payment apps and digital wallets can lead to serious security issues. These vulnerabilities provide easier access to unauthorized users, allowing them to access your payment details or enabling them to manipulate your transactions, shifting them to their payment mechanisms.

6. Online Transaction Reversal Fraud:

Fraudsters exploit or discover loopholes in your payment systems and their transaction procedures. Resulting in the reversal of the legitimate transactions made by the users or they can also conduct transactional chargebacks without letting the individuals informed about the same.

7. Inadequate Encryption Mechanism:

Deploying inefficient and inadequate encryption mechanisms to online payment systems results in insufficient encryption of data during its transmission and storage in the database. It leads to the exposure of sensitive information to unauthorized users so that they can access it to practice fraudulent events with your payment systems.

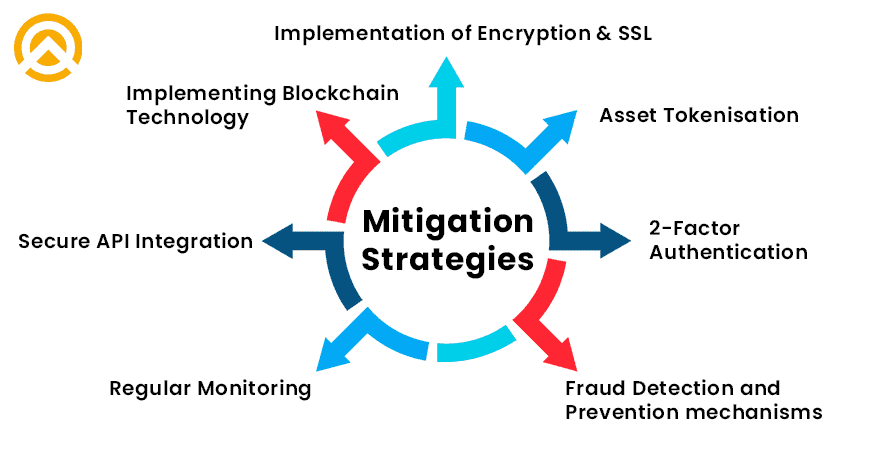

Measures to Mitigate Fraud & Security Risks in Online Payment Systems

1. Implementation of Encryption & SSL:

Implementing the secure socket layers or strong encryption mechanisms for online payment and security in web technology ensures that data can be easily transmitted through the user’s browser and payment systems are highly secure and efficient. Preventing unauthorized access to sensitive information about the payment mechanisms like credit cards, online banking IDs, passwords, etc.

2. Tokenisation:

Using the tokenization mechanism to replace sensitive data, for instance, replacing card details with unique tokens can save your data from potential data breaches. It prevents the stolen data from getting decoded and accessed without the corresponding tokens that you have created.

3. Multi-Factor Authentication:

Implementing the multi-factor authentication feature while online payment mobile app development enables its users to authenticate themselves using different factors such as email or message. This typically involves combining something like a password with a unique code for the verification of their identity, enabling them to transact over multiple platforms.

4. Implementing Fraud Detection & Prevention mechanisms:

You should deploy advanced fraud detection and prevention mechanisms to your online payment systems. Also, you can make these practices automated by implementing artificial intelligence technology solutions for the same. AI and machine learning algorithms for advanced fraud detection automatically identify the different threats and fraudulent practices. Offering you with the mitigation mechanisms for their prevention.

5. Regular Monitoring:

You should conduct regular security audits to identify the vulnerabilities and address them promptly. Keep all software, including payment system software, up-to-date with the latest security patches. Practicing software maintenance and support for continuously updating your application leads to the complete security of your payment mobile app. Also, you can implement artificial intelligence technologies for the automation of the same process.

6. Secure API Integration:

Implementing third-party services or add-ons to online payment and security in web technology ensures that your online payment systems follow all the necessary security industry standards. Make the user’s trust by showcasing that you have implemented third-party security mechanisms with the payment systems, making them more secure and efficient to use.

7. Implementing Blockchain Technology:

Implementing blockchain technology for security in online payment systems enhances its security. Since it is considered a decentralized ledger that offers a secure platform for online transactions. It is capable enough to make data accessibility and alteration difficult for the users so that they aren’t able to make any sort of modifications to it. Implementing blockchain can be done by professional blockchain app developers which enables your business to offer your clients a secure and efficient mechanism.

Also Read: Navigating Security Risks in Mobile Banking Apps

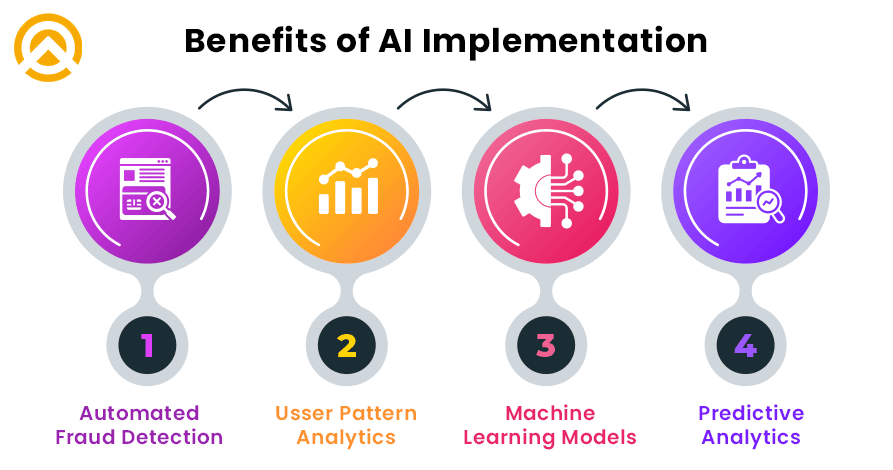

How Implementing AI can be a Game Changer For Securing Online Payment Systems

Integrating artificial intelligence technology solutions in mobile app development leads to an enhancement in the ability to detect, prevent, and defend users from several types of online frauds, ultimately providing users with a more secure and trustworthy payment experience. Here’s how the implementation of artificial intelligence can be a game changer.

1. Automated Fraud Detection:

Artificial intelligence and machine learning algorithms are capable enough to analyze the amounts and patterns of transactions in real-time, for identifying the anomalies associated with the activities performed by the fraudsters. Providing an alert message to the users for quick detection and prevention of online transactions.

2. Usser Pattern Analytics:

Artificial intelligence can leverage behavioral biometrics for the detection and analysis of the user’s transaction patterns. Such as user inputs and interaction behaviors, delivering them with an additional layer of authentication making it much more complex for unauthorized users to practice the fraudulent activities with the users of online payment solutions.

3. Machine Learning Models:

Utilizing the machine learning models while processing the mobile application development enables automated learning and adapting the latest fraud patterns with online payment systems. While continuous learning, these modules can keep on improving the understanding of their patterns and accuracy in identifying and preventing your online payment systems with such potential threats.

4. Predictive Analytics:

AI-powered algorithms are capable enough to predict the different possibilities of threat occurrence and fraudulent practices performed by unauthorized users. Just because these systems are capable enough to detect, analyze, and understand the behavioral patterns of the transactions. Based on the transaction history and location data of the users. Helps in marking the potentially fraudulent transactions and preventing the individuals from the same before their occurrence.

Read more: The Rise of Neo-Banks: How They’re Shaping the Future of Finance

Concluding It

Implementing security measures in online payment systems leads to the early detection and prevention of fraud and security risks with online payment systems. The security issues need serious attention and prevention mechanisms with immediate effect, to ensure a seamless and secure transaction mechanism for the individuals.

Amplework Software a prominent mobile app development company in USA, offers you secure and reliable online payment systems. Our team of mobile app developers possesses complete expertise. In implementing and integrating your online payment solutions with the latest technologies like Artificial Intelligence and blockchain technology for security enhancements. Our commitment to excellence and on-time project delivery always makes your fintech business stand ahead of the competitive curve in the market. Also, we offer you a wide range of affordable solutions that can be the best fit for your business. So if you are looking for a secure, reliable, and robust online payment solution just raise a query with us.

You May Also Read:- Front-End Design with Backend Systems

FAQ’s

What are the major security risks associated with online payment systems?

The common problems or security risks that are associated with online payment systems include identity theft, phishing, data breaches, vulnerable online payment systems, and many others making the users suffer from huge financial risks and fraudulent practices.

How crucial is cyber security for Fintech Systems?

It is crucial for ensuring the safety and security of the user’s information and the financial as well as transactional data. Preventing them from the frauds and security threats that can cause major financial losses to them.

How Much Does a Secure Online Payment System Costs?

A secure online payment system is chargeable according to the user’s requirements of the features and functionalities that they need to implement. However, an online payment system with simple security can cost you $90,000 to $1,00,000. An advanced payment system with robust security mechanisms can range between $1,15,000 to $2,00,000.

What security measures should you take to mitigate such security risks with online payment systems?

The security aspects that you need to implement for the prevention of such security risks are as follows:

- Authentication & Authorization

- Encryption

- Asset Tokenization

- Implementing AI-based Fraud Detection Mechanisms

- Regular Monitoring

- Secure API integration

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228