Optimizing Financial Risk Analysis with AI Agents: Development Strategies and Tools

The financial industry operates in an environment marked by uncertainty, market volatility, and rapid technological advancement. Effective risk management is no longer an optional task, but a fundamental requirement for maintaining stability and profitability. Traditionally, financial risk analysis was performed using manual processes, heuristic models, and static statistical methods. These methods are foundational but are limited in their ability to adapt to real-time changes and analyze huge datasets.

Artificial Intelligence (AI) is a transformational force that leverages machine learning (ML), natural language processing (NLP), and predictive analytics to solve the complex challenges of risk analysis. Financial AI agents can process vast datasets and identify patterns that traditional methods miss. An AI agent in finance enables faster, data-driven decision-making, making financial institutions more agile and resilient in a dynamic environment. This is why the demand for AI agents for financial risk analysis continues to grow.

In this blog, we are going to discuss AI agent development strategies and tools tailored for financial risk analysis so that you can clear all your doubts and make informed decisions to optimize risk management in the finance industry.

Let’s have a look at the key statistics of financial risk management to know why AI agents should be built for risk analysis.

The Role of AI in Financial Risk Management: Key Statistics

AI integration in financial risk management has become a must to drive innovation and let’s have a look at the following statistics that show the power of AI in the finance industry.

- 40% of financial firms plan to invest in AI for risk management by 2025.

- AI reduces risk analysis time by up to 60%.

- Predictive analytics powered by AI achieves a 25% higher accuracy compared to traditional methods.

| Metric | Traditional Methods | AI-Driven Approaches |

| Analysis Speed | Days | Real-time |

| Risk Prediction Accuracy | ~65% | ~90% |

| Volume of Data Processed | Limited | Large-scale (Big Data) |

| Reduction in Operational Costs | 20% | 40% |

Artificial intelligence for risk management has the potential to combine data scalability with real-time analysis and which offers you a wide range of benefits. For example, predictive models use historical data and can also adapt to new information to make them more accurate, reliable, and advanced in comparison to static statistical approaches.

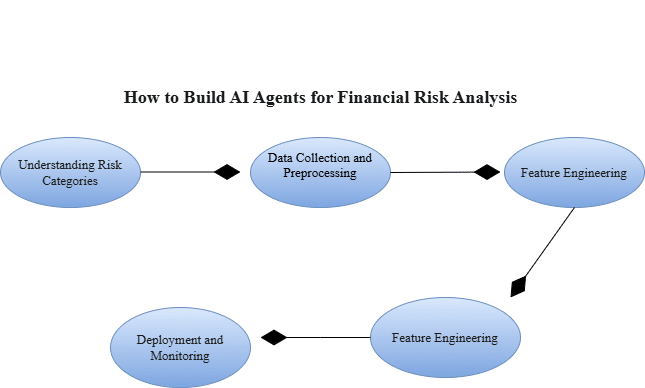

Step-by-Step Process for Building AI Agents for Financial Risk Analysis

To build AI agents for financial risk analysis you have to develop intelligent systems that can process a huge amount of financial data and identify potential risks in real time. By using machine learning algorithms, AI agents can detect patterns, predict market trends, and assess credit or fraud risks. So you have to design AI and ML models that evolve with time by adapting new data and can improve themselves over time for accurate and timely risk assessment. Here, we are going to discuss the step-by-step process of developing an AI agent for financial risk analysis so that you can clear all your doubts and make an informed decision to build an AI agent to empower your finance business.

1. Understanding Risk Categories

When you are going to build an AI agent for financial risk analysis then the first step is to know the types of risks you want to mitigate with AI solutions. Financial risk can be classified into three categories.

| Risk Type | Key Metrics | AI Approach |

| Credit Risk | Credit score, debt-to-income ratio | Classification models (Logistic Regression) |

| Market Risk | Market trends, volatility indices | Time series forecasting (LSTM) |

| Operational Risk | Fraud rates, process inefficiencies | Anomaly detection (Autoencoders) |

- Credit Risk: In this type of risk, a borrower’s ability to repay loans is accessed. AI models check credit history, transactions, and trends to predict loan defaults.

- Market Risk: When the market fluctuates, it can impact investments. AI systems monitor market trends, detect anomalies, and predict future price movements.

- Operational Risk: Risks happen because of mistakes, system issues, or fraud. AI can spot unexpected patterns in transaction data and help prevent further trouble.

By understanding and choosing the specific categories, developers can tailor AI agents to address unique business challenges effectively.

2. Data Collection and Preprocessing

The success of any AI agent or AI solution depends on the data that you offer. In financial industries, a huge amount of structured and unstructured data is generated, and to train your AI agent you have to give it relevant and refined data so you can get reliable and accurate outcomes. So, always pay attention while collecting data.

| Task | Tools/Technologies |

| Data Sources | APIs (Bloomberg, Quand), CRMs |

| Data Cleaning | Python (pandas, numpy) |

| ETL Pipelines | Apache Airflow, AWS Glue |

- Data Sources: Trustworthy data can be obtained from financial APIs (e.g., Bloomberg, Quandl), CRMs, and even web scraping for economic indicators.

- Data Cleaning: Handling missing values, removing duplicates, and filtering outliers are important steps in data preparation. Poor data quality can impact results, so careful and thorough pre-processing is essential to ensure unbiased and reliable models.

- Data Integration: AI systems are based on integrated datasets. Tools like Apache NiFi or Talend are used to integrate multiple data streams, ensuring consistency and accuracy.

For example, credit risk models may need to collect data from loan portfolios, customer profiles, and market trends. Normalization and scaling are the pre-processing steps that are used to ensure that the data is suitable for ML algorithms.

3. Feature Engineering

Feature engineering is the art of transforming raw data into meaningful inputs that improve AI model performance. Some commonly engineered features in financial risk analysis include:

| Feature Name | Purpose | Formula/Approach |

| Debt-to-Income Ratio | Assess credit risk | Total-Debt / Total-Income |

| Volatility Index | Market trend prediction | Derived from market data |

| Fraud Detection Rate | Identify operational risks | Classification outputs |

- Debt-to-Income Ratio: This ratio helps evaluate credit risk by showing how much of a person’s salary goes toward paying off debts.

- Volatility Index (VIX): This index is used to predict price fluctuations and assess market risk and for that real-time data is derived from the market.

- Transaction Frequency Patterns: Helpful in identifying unusual activities for fraud detection.

Automated tools like Feature tools can accelerate this process by generating features from relational datasets. However, domain expertise is critical to ensure that these features are relevant and informative.

4. Model Development for Financial Risk Analysis

When creating AI tools for financial risk analysis, choosing the right model is very important. The best model depends on the type of risk being analyzed. Here’s an overview of common models and popular ones that developers can customize and improve for their needs:

a. Classification Models

Ideal for tasks like fraud detection, loan approval, or credit scoring, classification models categorize data based on predefined criteria. Some popular existing models for financial classification tasks include:

- Logistic Regression: A basic but effective model for binary classification tasks, such as detecting fraud or determining loan approval.

- Random Forest: A robust group learning model that can be used for credit scoring and risk classification.

- Gradient Boosting Machines (GBM): This model is really helpful for financial data that have complex relationships and non-linear patterns.

Developers can improve these models based on financial datasets, such as transaction history, customer profiles, or past loan performance.

b. Time Series Models

Time series models are essential for market risk prediction, especially in predicting stock prices, currency fluctuations, or bond yields. Some popular models include:

- Long Short-Term Memory (LSTM): An advanced type of neural network called a recurrent neural network (RNN) is good at making predictions based on sequences. For example, it can predict future stock prices by looking at past data.

- ARIMA (Auto-Regressive Integrated Moving Average): It’s a classic method used to predict future trends based on past data, like predicting stock market changes, interest rates, or prices of goods.

For market risk analysis, best AI developers can train LSTM models on historical stock prices and enhance them with additional technical indicators like moving averages, Bollinger Bands, or relative strength indices (RSI) for improved accuracy.

c. Clustering Models

Clustering models are really helpful for organizing financial data, like grouping customers by risk, analyzing different market segments, or spotting new financial trends. Some of the main clustering models include:

- K-Means Clustering: This model is commonly used to group customers by factors like their credit score, spending history, and personal details, helping businesses categorize them into low, medium, or high-risk groups. It helps companies better understand their customers and manage risk.

- DBSCAN (Density-Based Spatial Clustering of Applications with Noise): It helps spot unusual behavior or trends in customer actions or loan performance.

For market risk analysis, for instance, developers might use an AI agent for financial data analysis to train an LSTM model on historical stock prices, incorporating technical indicators like moving averages and relative strength indices (RSIs) to enhance predictive accuracy.

Environment and Server Configuration for AI Model Integration

To get the best results when using these models for financial risk analysis, developers need a strong computing setup and server configuration. The following setup will help make sure the models are developed and integrated smoothly.

- Environment

- Operating System: Linux-based (Ubuntu, CentOS, or other distributions) is recommended for better compatibility and performance.

- Python: Essential for machine learning and data analysis. Popular frameworks for AI model development include TensorFlow, Keras, PyTorch, Scikit-learn, and XGBoost.

- Libraries: NumPy, pandas, and matplotlib for data manipulation, preprocessing, and visualization; Statsmodels for time series analysis; and SciPy for statistical operations.

- Server Configuration

- CPU: For smooth and speedy performance, go for multi-core processors like Intel Xeon or AMD EPYC. These let your system work on many tasks at once without slowing down.

- RAM: Having at least 32GB of RAM helps your system easily manage big chunks of data and run heavy processes without crashing or lagging.

- GPU: When training advanced models like LSTMs, having a powerful GPU (like NVIDIA Tesla or A100) can significantly speed up the process.

- Storage: Using a 1TB SSD ensures quick access to data and smoother model training.

- Cloud Services: Platforms like AWS (EC2, SageMaker), Google Cloud (AI Platform), or Azure (machine learning) offer flexible, scalable environments that help with model deployment and training.

Training Data Models for Financial Risk Analysis

To train these AI models, developers can rely on several existing datasets that are specifically curated for financial risk analysis. Here are some examples:

- The LendingClub Dataset: LendingClub’s dataset, filled with borrower data, loan performance records, and lending criteria, offers great potential for AI model training to predict defaults, store credit, and identify fraudulent activity.

- The Kaggle Credit Card Fraud Detection Dataset: The dataset containing transaction data marked as fraudulent or legitimate is ideal for training classification models for fraud detection.

- Yahoo Finance Data: A rich dataset for training time series models such as LSTM to forecast stock market movements. It includes historical stock prices, technical indicators, and other financial metrics.

- UCI Machine Learning Repository – Bank Marketing Dataset: This is customer data acquired from direct marketing campaigns, which can be useful for segmentation and classification tasks.

These datasets can be refined in combination with appropriate models to enhance the forecasting accuracy of several financial risk management tasks. The developers should also concentrate on continuous model evaluation and retraining, incorporating new data as market conditions evolve.

5. Deployment and Monitoring

Deployment is the last step where AI models move from being created to actually being used in real life. Here are a few easy ways to do it:

| Task | Tools |

| Containerization | Docker |

| Orchestration | Kubernetes |

| Monitoring | Prometheus, Grafana |

- Containerization: Using tools like Docker, we can wrap AI models with everything needed to run, making them easier to move and scale.

- Cloud Deployment: Services like AWS SageMaker, Google AI Platform, and Azure ML offer the power and flexibility needed to host and scale AI models in the cloud.

- Monitoring: Once the model is running, it’s important to keep an eye on its performance. Tools like Prometheus and Grafana help us spot any issues, such as when the model starts making mistakes or behaving unexpectedly.

For example, imagine an AI model predicting loan defaults. It can be easily connected to a bank’s system using a REST API, helping the bank make real-time, data-driven decisions.

Also Read : A Complete Guide for AI Agent Development in 2025

Tools and Frameworks for AI-Driven Financial Risk Analysis

The success of AI-powered financial risk analysis depends heavily on the right selection of tools and frameworks. These tools streamline tasks such as data preprocessing, model building, deployment, and monitoring, helping developers build robust, scalable solutions. Below are key categories of tools and their significance in the AI lifecycle.

| Category | Tools | Use Case |

| Machine Learning Frameworks | TensorFlow, Pytorch | Building and training AI models |

| Data Processing | Apache Spark, Pandas | Handling large datasets efficiently |

| Feature Engineering | Feature tools | Automating feature creation |

| Deployment | Flask, FastAPI | Hosting AI models via APIs |

| Monitoring | Prometheus, Grafana | Real-time tracking of model performance |

Each tool plays a vital role in the AI development lifecycle, helping developers create end-to-end solutions tailored to AI risk management frameworks and financial risk detection tool needs in financial risk management.

Addressing Technical Challenges in AI-Based Financial Risk Analysis

Applying AI to financial risk analysis poses major technical challenges, such as managing large datasets, ensuring model accuracy, and maintaining compliance with regulatory standards. Overcoming these challenges requires robust strategies, advanced tools, and a focus on explainability and security. Below, we explore the major barriers and solutions in detail.

| Challenge | Solution | Tools |

| DData Privacy | Differential privacy techniques | IBM Privacy Guard |

| Model Explainability | Explainable AI (XAI) | SHAP, LIME |

| Bias in Data | Regular dataset audits | Custom scripts |

- Data Privacy and Security: Financial data is highly sensitive. Implementing encryption protocols and compliance with regulations like GDPR ensures data security.

- Bias in Models: AI systems can unintentionally perpetuate biases present in training data. Regular audits and diverse datasets are essential to mitigate this issue.

- Explainability: Financial stakeholders often require transparent decision-making processes. Explainable AI (XAI) tools like SHAP or LIME help demystify model predictions.

For instance, AI-driven predictive modeling solutions for financial risk assessment, such as a SHAP-based dashboard, can visualize the impact of each feature (e.g., credit score, income) on loan approval decisions, fostering trust among stakeholders.

Real-World Applications of AI in Financial Risk Analysis

AI has transformed financial risk analysis in various sectors, making more accurate forecasting, fraud detection, and credit risk assessment possible. From AI agents for investment risk assessment to AI agents in loan processes best practices, these applications demonstrate the tangible impact of AI on improving efficiency and decision-making in the financial sector. Below, we discuss specific use cases that demonstrate the capabilities of AI in real-world scenarios.

- Fraud Detection: PayPal uses ML algorithms to detect fraudulent transactions with a 98% accuracy rate.

- Credit Scoring: JPMorgan Chase has implemented AI to improve credit assessments, reducing loan processing times by 30%.

- Market Predictions: Goldman Sachs leverages AI to analyze market trends, enabling more accurate investment strategies.

These use cases demonstrate how AI, including specialized AI agents for investment risk assessment and loan processing, enhances decision-making, operational efficiency, and customer trust.

Key Takeaways for Developers:

- Invest time in understanding domain-specific challenges and opportunities.

- Choose the right tools and frameworks to streamline the AI development lifecycle.

- Prioritize transparency, security, and scalability when designing AI solutions.

- Focus on continuous model evaluation and refinement to improve performance.

- Leverage cloud services and distributed computing for efficient processing of large datasets.

Why Choose Amplework to Develop AI Agents for Financial Risk Analysis?

Amplework is a leading AI development company that has been offering innovative and cutting-edge AI solutions around the world across industries. And within a short period, they have become one of the prominent AI companies to get AI solutions. When you partner with Amplework to develop AI agents for financial risk analysis then you partner with a dedicated team of AI experts who have vast experience in delivering top-notch solutions tailored to business needs. They use advanced machine-learning algorithms with rich experience in the financial domain to build highly advanced AI agents that identify, assess, and mitigate risks in real life. They follow a step-by-step process to build AI agents for financial risk analysis so that you can get actionable insights for decision-making. At Amplework, our AI development team ensures AI agents evolve with changing market conditions. As one of the leading AI development companies in India, we specialize in building intelligent agents optimized for financial risk analysis. For all kinds of AI agent development, feel free to contact Amplework.

Final Words

AI agents have become an important part of the financial industry for effective risk management. By harnessing the power of machine learning, advanced algorithms, AI, and advanced analytics, financial institutions are revolutionizing the way they are used to identify, assess, and mitigate risks. AI agents enable real-time risk monitoring, predictive insights, and automated decision-making, and offer a level of accuracy and efficiency that cannot be achieved by using the traditional way. As AI is evolving continuously with time, it will play an important role in optimizing financial operations, ensuring regulatory compliance, and safeguarding against emerging risks. So we can say that shortly, we will experience more advancement in financial risk management because AI agents are automated, intelligent, dynamic, and have the ability to drive efficiency.

As technologies are being advanced with time, the financial landscape is also evolving, and that’s why, we should also upgrade our strategies and tools to manage financial risks. And, by using AI systems we will be able to navigate complex challenges with confidence and agility.

Also Read : What Are AI Agents and How Do They Work

Frequently Asked Questions (FAQs)

Which machine learning models are best suited for AI agents in financial risk analysis?

Logistic regression, decision tree, random forest, neural network, and support vector machine are counted as the most suitable machine learning models for AI agents in financial risk analysis.

Such models are the best for identifying complicated financial data and predicting risks at a very high accuracy. When you add such ML models to your AI agents to analyze financial data, you can do so much better.

How do AI agents handle unstructured financial data for risk analysis?

AI agents use natural language processing and deep learning to handle unstructured financial data for risk analysis, which allows them to extract important insights from text-based sources such as articles, reports, social media sentiment, etc. These advanced models extract valuable insights and integrate them into predictive models to enhance the quality of analysis.

What are the main challenges in training AI agents for financial risk prediction?

Here is the list of major challenges you may face while training AI agents for financial risk prediction:

- Data privacy and security

- Compliance and regulatory frameworks

- Legacy systems

- Required AI expertise

- High-quality data

- Noise and volatility issues

How do AI agents integrate with real-time financial systems for risk management?

AI agents that process real-time market data are integrated using APIs and message queues. Kafka and Apache Spark technologies power these systems. They help make faster, low-latency decisions in the financial environment.

What is the role of feature engineering in optimizing AI agents for financial risk analysis?

Feature engineering is an important part of financial risk analysis to provide meaningful inputs for AI models. To enhance the performance of AI agents in predicting risk factors, techniques such as technical indicator analysis, sentiment analysis, and time series feature extraction are used.

How much does it cost to develop AI agents for financial risk analysis?

The development cost of a financial risk analysis AI agent is determined by factors such as the scope, complexity, tools, technology, team, and timeline. To get an accurate cost, share your idea with Amplework.

How can reinforcement learning be applied in financial risk management?

Reinforcement learning helps manage financial risk. It trains AI on techniques to optimize optimal choice under changing market conditions. Real-time adjustments in portfolios and trading strategies make an AI system adjust them accordingly. A healthy way to minimize the risk and maximize return. It’s a smart risk manager adapting according to feedback.

Which tools and platforms are most effective for developing AI agents in financial risk analysis?

Platforms such as TensorFlow, PyTorch, and Scikit-learn are used to build and train machine learning models. For real-time data processing, tools such as Apache Kafka, Apache Flink, and cloud-based solutions (e.g., AWS SageMaker, Google AI) are essential for the seamless integration of AI agents into the financial ecosystem.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228