Personal Finance App Development: Costs, Key Features and Factors to Consider

In the digital age, finance apps have become essential tools for managing personal and business finances. These apps have revolutionized the way people track their expenses, budget, save and invest their money. The convenience and accessibility offered by finance apps have made them indispensable for users who want to take control of their financial lives.

“ In the realm of finance, where numbers sway,

An innovative app can pave the way,

Unlocking freedom and a future bright,

Guiding users to financial light. ”

Overview

Considering the development of a FinTech product, not pursuing a personal finance app at this time could be a significant missed opportunity. In today’s world, users recognize the significance of effective personal finance management, resulting in an increasing demand for personal finance apps.

By 2021, the market value of mobile finance apps in the US had reached $573.1 million solely from downloads. This figure represents a 19% increase compared to 2020, which had a market value of $481.9 million.

Doubtful about our claim? Check out these data-backed statistics that further reinforce our argument:

- In the United Kingdom, 62% of individuals under 30 use an app to assist them in budgeting.

- The adoption rate of finance apps increased from 8% in 2015 to over 50% in 2021.

- More than 60% of U.S. citizens rely on money management apps more now than before the pandemic.

In addition to the high demand for budget apps, another reason to develop one is the massive influx of investment in FinTech:

- In Q1 of 2021, venture capital-backed fintech raised $22.8 billion.

- As of January 2021, there were over 79 VC-backed unicorn fintech companies.

- Studies conducted for the period 2018 to 2024 showcased positive growth for digital payments.

With your interest piqued to invest in a personal finance application, let’s dive into the specifics of the budgeting app development process. This article will help you to gain an understanding of how to develop finance app to empower your business.

Key benefits of finance apps include:

Finance apps provide users with up-to-date information on their accounts, expenses, and investments, making it easier for them to make informed decisions about their financial future.

A. Better financial management

Mobile application development enables you to commence better financial management of activities. It also empowers your business with diverse operations – such as: managing the budget in a systematic manner, consistent analytics of operations and many more.

B. Ease of use

The best personal finance app will not only help you with budgeting and accounting but also give you helpful insights about money management. It gives users various investment options, tax advice insurance inputs and above all, a proper security system.

C. Enhanced security

Most finance apps utilize robust security measures, including encryption and multi-factor authentication to protect users’ sensitive financial data.

Rising demand for personal finance app development

The popularity of finance apps has led to a surge in demand for personal finance app development. As more people turn to finance apps to manage their money, businesses and entrepreneurs are increasingly investing in app development to meet this growing need.

Factors driving the demand for personal finance app development include:

A. Increasing smartphone penetration

With the widespread adoption of smartphones and mobile devices, users are looking for apps that can help them manage their finances on the go.

B. Shift towards digital banking

As consumers become more comfortable with digital banking and online transactions, they are increasingly seeking finance apps that can help them manage their money more efficiently.

C. Growing financial literacy

As people become more financially literate, they seek tools that can help them better understand and manage their finances.

D. Demand for personalized financial solutions

Users are looking for finance apps that can provide tailored financial advice and recommendations based on their unique financial situations.

Read More: 15 Benefits of Having a Mobile App for Business in 2023

Overview of factors influencing app development costs

Developing a finance app can be a complex and costly process, with several factors influencing the overall development cost. Some of the key factors that impact the cost of banking and finance app development include:

A. App complexity and features

The more complex the app and the more features it includes, the higher the development cost will be.

B. Development team expertise and location

The cost of hiring a development team will vary depending on their expertise, experience, and location. Highly skilled developers in developed countries will typically charge more than those in developing countries.

C. Platform selection

Developing an app for multiple platforms (e.g., iOS, Android) will increase development costs, as it requires additional time and resources.

D. Customization and branding

Customizing the app’s appearance and branding can add to the development cost, especially if extensive design work is required.

E. Development timeline

A shorter development timeline may necessitate hiring more developers or working longer hours, which can increase the overall cost of the project.

F. Development team’s expertise

A development team’s level of expertise and experience influences the quality of the final product, the time required for development, and the app’s overall success.

At Amplework, our developers are profound into developing solutions related to the next-generational related technologies such as: artificial intelligence (AI), machine learning (ML), IoT app development and many more.

G. Development location

The geographical location of your development team plays a significant role in determining the cost of your project. Developers in different regions or countries have varying hourly rates, which can affect the overall cost of the project. For instance, developers in North America and Western Europe generally charge higher rates compared to those in Eastern Europe, Asia, or South America.

Also read: Best Bike Rental Apps in 2025

Estimating Finance App Development Costs

Developing a finance app can be an intricate and expensive endeavor, with various components contributing to the overall cost. To help you understand the costs associated with finance app development, we’ll break down the key aspects involved:

A. App design and UX/UI

The design and user experience (UX) of your finance app are crucial to its success, as they directly impact user engagement and satisfaction. A visually appealing, intuitive, and easy-to-navigate app will likely attract more users and keep them engaged.

B. App development (backend and frontend)

The core of finance app development consists of both frontend (user-facing) and backend (server-side) development. Frontend development focuses on creating a visually appealing and responsive app interface, while backend development involves building the infrastructure that supports the app’s functionality, such as databases and APIs.

C. App testing and quality assurance

The cost of app testing and quality assurance can vary depending on the scope of the testing and the expertise of the testers, generally ranging from $5,000 to $15,000.

D. App maintenance and support

App maintenance and support costs can vary but generally fall within the range of $5,000 to $10,000 per year. Although, a reliable finance app development company incorporates effective measures to keep applicate free from bugs.

E. Third-party integrations and services

These integrations can add to the overall development cost, depending on the complexity of the integration and any associated licensing fees.

In summary, the total cost of developing a personal finance app can range from $40,000 to $100,000 or more, depending on the app’s complexity, the development team’s expertise and the features and integrations included.

Read More: 10 Essential Best Practices for Mobile App Development

Key Features of Finance Apps

Finance apps are designed to help users manage their finances more efficiently and effectively. Here is a breakdown of some essential features commonly found in finance apps:

A. Account integration

This feature allows users to connect and sync their various financial accounts (e.g., bank accounts, credit cards, loans) within the app, providing a consolidated view of their finances.

B. Expense tracking and categorization

Expense tracking helps users monitor their spending by recording and categorizing transactions automatically or manually. This feature enables users to understand their spending habits and make better financial decisions.

C. Budgeting and goal setting

Budgeting features help users create and manage budgets based on their income and expenses, while goal-setting features allow users to define specific financial objectives (e.g., saving for a vacation or paying off debt) and track their progress.

D. Bill reminders and payments

Finance apps can send notifications to remind users of upcoming bills and facilitate bill payments directly within the app, ensuring timely payments and avoiding late fees.

E. Savings and investment tools

These features assist users in building their savings and investment portfolios, providing recommendations, and tracking the performance of their assets. Some apps also offer automated savings or investment options based on the user’s financial goals and risk tolerance.

F. Financial reports and analysis

Finance apps often provide insightful reports and analyses, such as cash flow summaries, expense breakdowns, and net worth overviews. These reports help users better understand their financial situation and make informed decisions.

G. Security and privacy features

Ensuring the security and privacy of users’ financial data is of utmost importance in finance apps. Security features may include encryption, multi-factor authentication, biometric login options and strict privacy policies. Although, you should always focus on consistent software maintenance for keeping all the features running smoothly.

Choosing the Right Development Team

Selecting the right development team for your finance app is crucial to the project’s success. Here are some essential steps to follow when evaluating potential development teams:

A. Evaluating experience and expertise

Assess the team’s experience and expertise in finance app development, including their familiarity with industry regulations, security requirements, and specific features relevant to your app. A team with a strong background in finance app development is more likely to deliver a high-quality product that meets your expectations.

B. Assessing the team’s communication and project management skills

Effective communication and project management are vital for a smooth development process. Ensure that the development team is responsive, clear in their explanations, and can provide regular updates on the project’s progress. Additionally, they should be able to manage deadlines and handle any unforeseen challenges that may arise during development.

C. Reviewing the team’s portfolio and past work

Examine the team’s portfolio and past projects to gauge the quality of their work and their ability to develop finance apps with features and functionalities similar to your project requirements. This will give you a better understanding of their capabilities and whether they are a good fit for your project.

By carefully considering these factors, you can select the right development team to create a finance app that meets your expectations and has the potential to succeed in the market. Moreover, from Amplework you can hire full-stack developers for curtailing your personal finance app development cost.

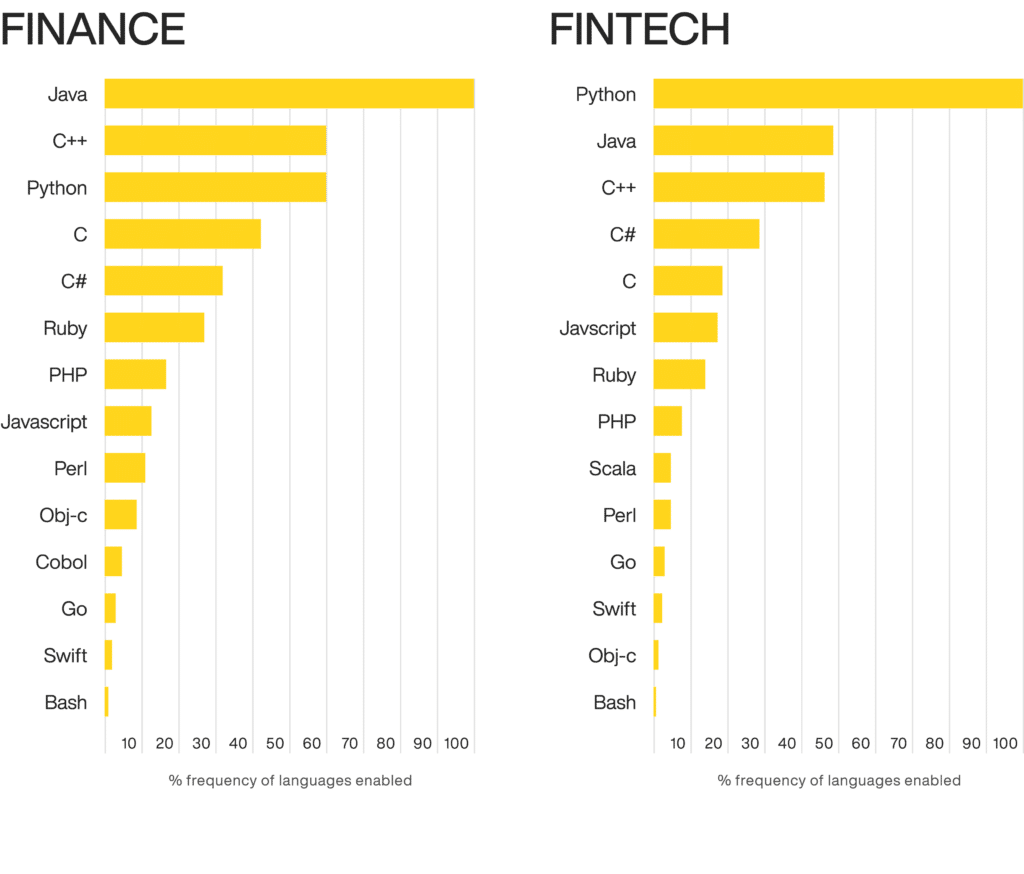

Apart from this, the technology aspect also plays an important role for the development team. The selection of appropriate technology ensures that all the projects should be deployed in a faster time to market.

Also read: Beyond the Download: Strategies for Effective Mobile App Monetization

Monetization Strategies for Finance Apps

To generate revenue from your finance app, it’s essential to choose the right monetization strategy. Here are some popular monetization methods and how to analyze which one is the best fit for your app:

A. In-app purchases

It allow users to buy additional features or services within the app. In the context of finance apps, this could include access to advanced financial tools, personalized financial advice, or specialized reports.

B. Premium features and subscriptions

Offering premium features or subscription plans can provide users with access to exclusive functionalities or content for a recurring fee. For example, you could offer a basic version of the app for free and provide advanced features, such as AI-driven financial analysis or personalized recommendations, to users who subscribe to a premium plan.

C. Advertising and sponsored content

Integrating ads or sponsored content into your app can generate revenue through ad views, clicks, or sponsored content partnerships. Be cautious when using this method in finance apps, as users may be sensitive about ads and promotions that could compromise their financial data’s privacy.

D. Affiliate partnerships and referral programs

Collaborating with other financial service providers or products can create additional revenue streams through affiliate partnerships or referral programs. For instance, you could partner with a credit card company, a loan provider, or an investment platform and earn commissions for referrals or successful conversions.

E. Analyzing the best monetization strategy for your app

To determine the most suitable monetization strategy for your finance app, consider your target audience, app’s primary purpose and value proposition. Analyze the market and your competitors to understand which monetization methods are most effective in your niche. It’s also crucial to strike a balance between generating revenue and ensuring a positive user experience, as aggressive monetization may deter users.

Read more: Fintech Business Model: How to Start a Successful Fintech Business

Conclusion

Gaining a clear understanding of the costs involved in developing a finance app is crucial for planning your project and ensuring its success. By being aware of the factors that influence development costs, you can make informed decisions and allocate your resources effectively.

By following this ultimate guide, which provides valuable insights into the key features, development costs, and strategies needed for a successful finance app, you can confidently navigate the development process, creating an app that meets your target audience’s needs while generating revenue.

As the demand for finance apps grows due to the increasing reliance on technology for managing personal finances, there is significant potential for growth in this market. Investing in a finance app allows you to tap into this lucrative opportunity and contribute to the growing FinTech industry.

Amplework Software is a fintech mobile development company with years of experience, offering a range of services to help you build finance apps. We understand the costs involved in hiring financial app developers and how to navigate risks and opportunities. Our collaboration models include complete project outsourcing or a dedicated development team tailored to your project needs.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228