Revolutionizing Finance: Complete Guide For Fintech App Development

Whether you run a startup or an enterprise – if you have a revolutionary fintech mobile development idea then it’s time to develop a cutting-edge business with it. So, embolden yourself because fintech app development will give wings to your aspirations! In a world where innovation reigns supreme, traditional finance methods are revolutionized by mobile applications’ power.

Gone are the days of complicated paperwork and lengthy processes. With fintech apps, you can soar towards success by streamlining your financial services, enhancing customer experiences and many more.

From seamless payment solutions to personalized investment platforms, these apps are your secret weapon in disrupting the financial landscape. So, if you’re ready to take your startup to new heights and leave your competitors in the dust, fasten your seatbelts and embark on a fintech app development journey.

As per the research conducted by Vantage Market Research, the Global Fintech Market was valued at $1334.84 billion in the year 2022. It is projected that it will reach a market valuation of $556.58 billion by the year 2030. As per the data, it is estimated that this industry will accomplish growth at a 19.50% CAGR from 2022 to 2030.

With the above-mentioned information, you can analyze that there is an ample amount of opportunity with fintech app development. So, in the blog, we have covered an in-depth analysis by covering points such as: types, must-have features that fintech app developers should include in your application, key requirements, monetization strategies, steps & technological transformations.

Types of Fintech Applications

We all live in an environment where we come across diverse financial products. Whether it can be an insurance product, banking product, credit card, etc. Similarly, you need to first evaluate which type of targeted audience you want to be satisfied with your fintech application?

To empower your knowledge and understanding level, we have outlined some types of fintech applications. Such as: banking apps, lending apps, consumer finance and many more.

1. Mobile Banking Apps

These types of apps allow users to effectively access and manage their bank accounts, perform transactions, transfer funds, pay bills and view transaction history.

Examples of Leading Banking Apps:

1. Chase Mobile

2. Citi Mobile

2. Payment Wallet Apps

Enable users to store their payment card information securely and make seamless online and offline transactions. In the payment apps, there are features available for peer-to-peer payments and merchant payments.

Examples of Leading Payment Wallet Apps:

1. Google Pay.

2. Samsung Pay.

3. Investment and Trading Apps

These apps incorporate the functions of providing users with access to investment opportunities, stock trading, portfolio management, real-time market data, financial analysis and many more.

Examples of Investment and Trading Apps:

1. Investing.com

2. Binance.

4. Personal Finance Management Apps

Here, it is important to understand that personal finance management apps help users to get insights and visualizations to better manage their finances. So, if you desire to provide a platform to your audiences with all the extensive features of personal finances then you can incorporate reliable mobile application development services.

Examples of Finance Management Apps

1. YNAB.

2. Wells Fargo Mobile.

5. Peer-to-Peer Lending Apps

These apps facilitate lending and borrowing directly between individuals, bypassing traditional financial institutions. They provide platforms for borrowers to seek loans and for lenders to invest their money & earn interest.

Examples of Peer-to-Peer Lending Apps

1. Chime – Mobile Banking

Read More: Fintech Business Model: How to Start a Successful Fintech Business

Must-Have Features for Fintech Mobile App Development

While opting for a specific fintech app development service, you can specifically opt for various key features that will enhance the probability of your application’s success. You can hire full-stack developers from Amplework for developing fintech applications as well as apps for other categories:

| Serial Number | Basic Features | Advance Features |

| 1. | User Registration & Authentication | Smart Spending Insights |

| 2. | Account Aggregation & Integration | AI-Powered Investments |

| 3. | Secure Payment Processing | Real-time Market Updates |

| 4. | Transaction History & Tracking | Personalized Recommendations |

| 5. | Budgeting & Expense Management | Goal-Based Savings |

| 6. | Personalized Recommendations | Integrated Budget Planner |

| 7. | Push Notifications & Alerts | Instant Fund Transfers |

| 8. | Biometric Authentication | Customizable Dashboards |

| 9. | Bill Payment & Reminders | Fraud Detection System |

| 10. | Investment & Portfolio Management | Multi-Currency Support |

| 11. | Real-time Market Data & Trading | Voice-Activated Commands |

| 12. | Customer Support & In-App Chat | Advanced Security Measures |

| 13. | Integration with Third-Party Services | Augmented Reality Analytics |

| 14. | Data Encryption & Privacy Measures | Real-time Expense Tracking |

| 15. | Payment Gateways | Intelligent Chatbot Assistance |

Avoid These 3 Mistakes To Make Your Fintech App Fascinating

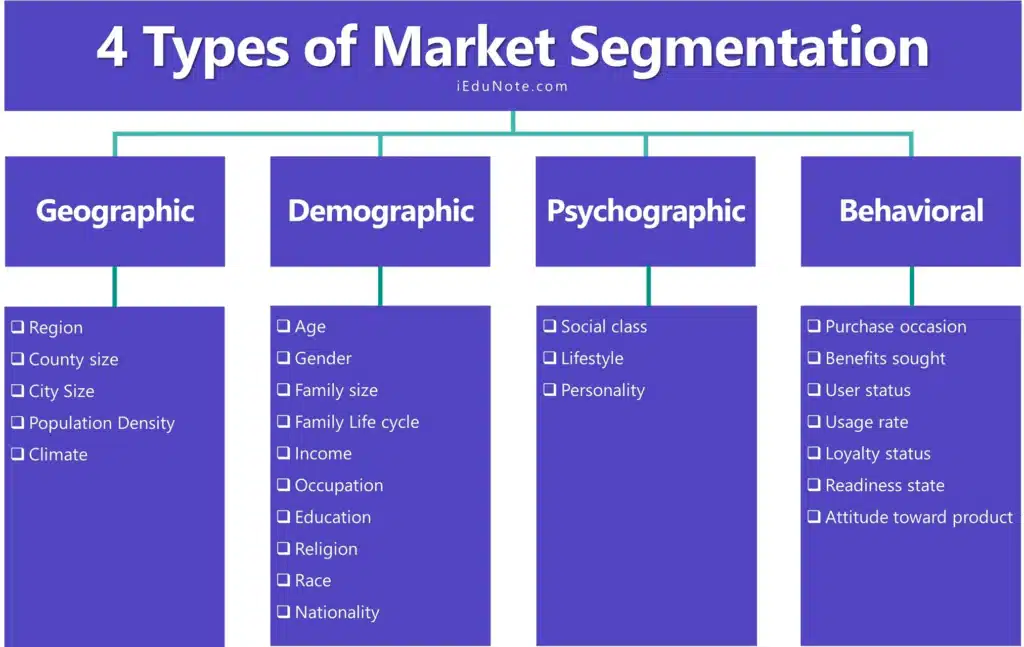

Mistake 1: Failure in Making Target Market Strategies

In management studies, all the students who pursue “Marketing Subject” as a specialization are extensively trained in “marketing segmentation” related concepts.

Similarly, if you fail to target your audiences then you can make use of the marketing segmentation concept. During marketing segmentation, you need to cover discussions about demographic segmentation, behavioral segmentation, psychological segmentation and many more.

Also read: Top 10 AI Content Detector Tools & Extension Free in 2025

Mistake 2: Adding Excessive Features

You want to provide the best experience to your audiences. However, it is important to make sure that adding excessive features to your application does not necessarily mean that your users will going to be fascinated.

It is also better to make sure that you should limit providing excessive features in your application. When your application is in the early stage then it is better to primarily focus on the core application features.

Following the above recommendation will also help you in reducing your mobile app maintenance and development costs.

Mistake 3: Ignoring Regulatory Compliance

Ignorance of regulatory compliance can result in adverse impacts. Thus, you should carefully follow and evaluate the latest government standards or changes into FinTech.

At Amplework, we always develop applications that are in accordance with the latest guidelines issued by “Financial Industry Regulatory Authorities – Fintech (USA)”.

Monetization Strategies For Fintech Applications

It’s worth noting that the optimal monetization strategy may vary depending on the specific nature of the fintech application. For example: to decide which monetization strategy will bring out maximum revenue generation for your business – you need to decide your target audience, their desires and the competitive landscape.

It’s essential to carefully evaluate the market, user preferences and the perceived value of your application’s offerings to determine the most suitable monetization approach. Although, for your convenience, we have outlined a few monetization strategies that you can utilize effectively.

A. Freemium Model

The freemium model offers a basic version of the fintech application for free while charging for additional features or premium services. Later on, your users will need to pay a certain amount in order to access premium-quality features or advanced tools.

B. Transaction Fees

One of the most straightforward monetization strategies can be to charge transaction fees for the services provided through the fintech application. It can incorporate charging a specific percentage or a fixed fee for each financial transaction conducted within the app – such as: money transfers, bill payments, investing into mutual funds and many more.

C. Advertising & Sponsorships

Another monetization strategy is to display targeted advertisements within the fintech application. Advertisers or sponsors can pay for ad placements or partnerships to reach the application’s user base. However, this monetization strategy works best when you are to get a huge community of users or subscribers.

D. Subscription Model

Although, implementing a subscription-based pricing model can be effective for fintech applications that offer premium features or advanced functionalities. Your users can pay a recurring fee, typically on a monthly or annual basis, to access enhanced services, personalized financial advice, or exclusive benefits.

E. Partnership and Integration Fees

Fintech applications can collaborate with other financial services providers, such as banks, payment processors, or insurance companies, and charge integration fees or revenue-sharing arrangements. By offering seamless integration with established financial institutions, the application can provide added convenience and value to users.

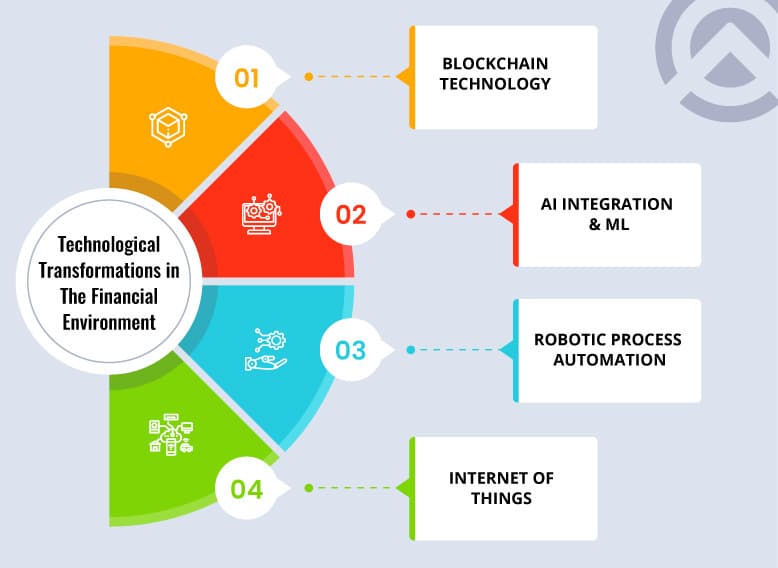

4 Technological Transformations in The Financial Environment

Business leaders speed up their digital transformation by putting in their extensive business efforts. Not only this, even customers also started moving from traditional financial measures to online financial services.

Now, there are various emerging technologies that incorporate huge growth potential for various business measures. As far as fintech applications are concerned then we’re outlining four technologies that can transform financial services:

1. Blockchain Technology

Since, the intervention of digitalization into financial technologies people are actively aiming to find innovative ways for securing their transactions. Now, experts believe that blockchain technology is the ultimate answer for securing transactions from almost every fraudulent transaction.

In blockchain technology, all the transactions are stored in peer-to-peer networks & a distributed database ledger is shared among the entire computer network’s nodes.

2. Artificial Intelligence (AI) and Machine Learning (ML)

The trend for AI & ML can be seen across all industries. You can also automate your business operations with the use of AI and ML processes. The fintech industry is also aiming toward the development of AI and ML-based algorithms for identifying customers’ buying patterns.

The use of AI & ML-based algorithms support fintech companies to provide personalized product recommendation to customers. For example: companies can decide which type of financial product will be beneficial for the customer on the bases of their spending habits, income or cash flow.

3. Robotic Process Automation (RPA)

Most of the fintech companies are already shifted towards the use of automated chatbots. The reason behind utilizing chatbots is that it helps them to emulate the actions of a human being’s interactions with digital systems.

Not only this, but with the use of RPA companies are shifting the need workload to automated systems from manual operations. Apart from this, the use of RPA in financial technology also ensures easy data access, higher data accuracy, data security and many more.

4. Internet of Things (IoT)

Over the past decade, IoT has become one of the most important technologies. Now, people can effectively connect everyday objects with the use of IoT systems. Here, it is important to understand that in the hyperconnected world, digital systems can record, maintain and adjust each interaction between connected things.

Read More: Personal Finance App Development: Costs, Key Features and Factors to Consider

7 Steps To Develop Fintech Applications

If your question is “How to develop a fintech app?” then we have outlined effective steps

1. Market Research

2. Define Objectives and Target Audience

3. Design User Interface and User Experience (UI/UX)

4. Develop and Implement Backend Functionality

5. Integrate Security Measures and Compliance Features

6. Test, Iterate and Refine

7. Launch and Continuous Improvement

Also read: Cost, Features & Technology Required to Build a Job Portal like Glassdoor?

The Final Words

There is huge potential for growth in the fintech application development market. If you have an idea then it’s time to turn your vision into reality. Although, if you are still confused about your business idea then you can take our fintech business consultation.

At Amplework, we offer best-in-class fintech application development services. We’re an ISO-certified organization and we incorporate cutting-edge tech products. So, to experience transparent and reliable business solutions – you need to connect with our dedicated team members.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228