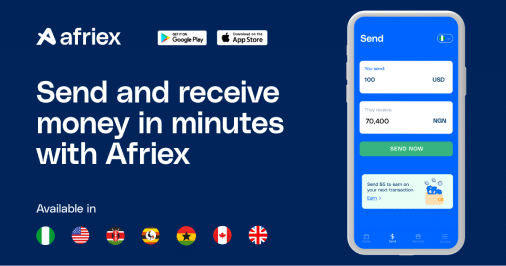

We worked closely with AfriexApp to build a compliance framework that adhered to international regulations, including AML and KYC laws. The framework was adaptable to the specific requirements of each country, ensuring that AfriexApp could expand its services without risking non-compliance.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228